By Pinchas Cohen

Key Events

Political risk continues to dominate markets, with a decline in equities in Asia and the South Korean won, as the potential of war between the US and North Korea continues to worry investors.

Global Affairs

Yesterday, US shares remained flat after the S&P 500 erased most of its losses in the last hour of trading, while the VIX, as well as Treasuries, pared gains after Secretary of State Rex Tillerson—along with other government officials—calmed investors by suggesting there are no imminent threats of war with North Korea.

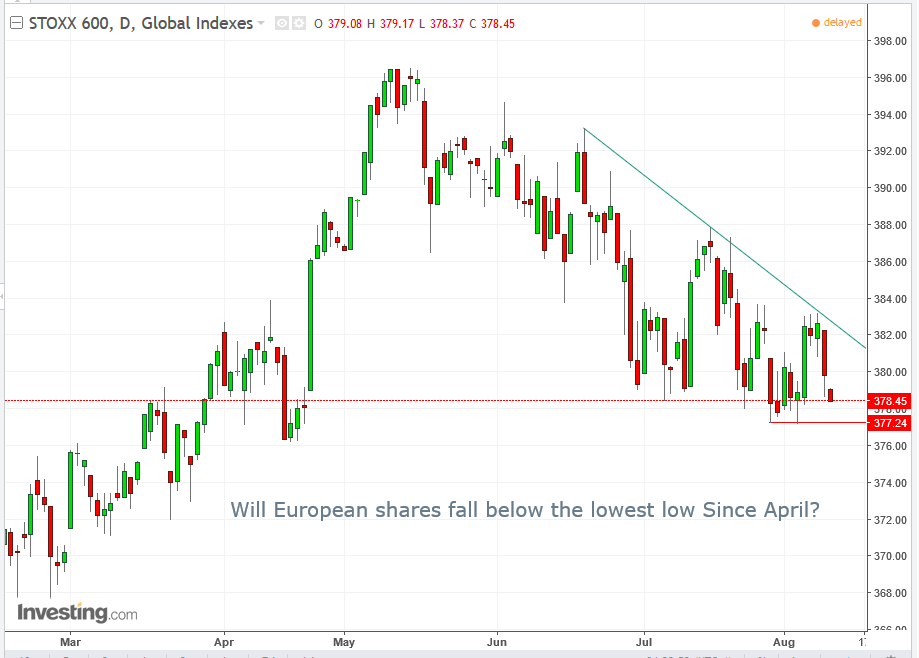

Today, the Stoxx Europe 600 is on course for a second day of declines, after Asian markets fell at least 1 percent while the yen slid. US futures also sank, as the won dragged down emerging market currencies.

After falling yesterday on increased gasoline inventories, West Texas Intermediary crude is holding its gains above $49 a barrel—after opening its highest since August 1st—as US production eases and crude inventories extends declines.

The recent bout of geopolitical risk with North Korea comes at an inopportune time as global shares are trading at record highs and premiums on high-yield debt creep up. This combination of rising tension and market extremes has prompted some of the most well-known asset managers to evoke a warning that it’s time to turn risk off.

If investors can overlook political tension, Fed Bank of New York President William Dudley’s speech may provide them with more clues on implications for monetary policy and US economic growth ahead of Friday's inflation data.

Investor sentiment is mixed after Chicago Fed President Charles Evans said it would be “reasonable” to announce the beginning of a reduction to the Fed balance sheet next month. He also warned that weak inflation may postpone interest-rate increases, as technological disruption will reduce price pressures.

Up Ahead

- 8:30 EDT: US - Continuing Jobless Claims are expected to decline from 1,968K to 1,960K.

- 8:30 EDT: US - Initial Jobless Claims are expected to remain flat at 240K.

- These two gauges are among the key metrics used by the Fed to determine its path toward interest rate hikes, therefore, traders follow them closely.

- 8:30 EDT: US - PPI will be released. The previous read was 0.1 percent growth for the month of July over the previous month.

- Forecasts range between Barclays and Bloomberg's 0.1 percent, to Bank of America Merrill Lynch's 0.2 percent.

- There is a consensus that the Core PPI, which excludes food, energy and trade, will increase to 0.2 percent.

Market Moves

Stocks

- The Stoxx Europe 600 fell 0.2 percent as of 8:50 a.m. in London.

- The UK’s FTSE 100 slid 0.6 percent.

- Germany’s DAX declined 0.2 percent.

- Japan’s TOPIX ended less than 0.1 percent lower.

- South Korea’s KOSPI fell 0.4 percent, adding to a 1.1 percent drop on Wednesday.

- Hong Kong’s Hang Seng declined 1.1 percent.

- Australia’s S&P/ASX 200 Index lost 0.1 percent.

- The MSCI Asia Pacific Index fell 0.5 percent.

Currencies

- The yen rose 0.1 percent to 110.

- The Dollar Index rose 0.25 percent, keeping its gains, as it trades above the 0.76 percent move from last Friday.

- The euro and British pound both weakened 0.3 percent.

- The won dropped to a four-week low and was trading 0.6 percent down at 1,141.55.

Bonds

- The yield on 10-year Treasuries declined less than one basis point to 2.24 percent.

- Germany’s 10-year yield climbed one basis point to 0.44 percent.

- France’s 10-year yield rose one basis point to 0.723 percent.

Commodities

- West Texas Intermediate crude climbed 0.4 percent to $49.74 a barrel, its highest in more than a week.

- Gold gained 0.1 percent to $1,278.57 an ounce, its strongest in two months.