- US benchmarks post back-to-back records

- Europe's STOXX 600 hits new high

- Bitcoin continues to slide

Key Events

S&P, NASDAQ and Russell 2000 futures were higher in trading ahead of the US open on Thursday while futures on the Dow were marginally lower. European shares also surged to new records as global markets digested Wednesday's comments from the Chair of the Federal Reserve Chair. Jerome Powell said that the bank will maintain its accommodative monetary policy, although it is starting to reduce its stimulus program.

Both the dollar and gold rallied.

Global Financial Affairs

NASDAQ futures outperformed with contracts on the Russell 2000 the second-best performers this morning.

In Europe, the STOXX 600 Index surged to a new all-time high extending the index's rally into its fifth straight week. Investor eagerness to add risk comes on the back of a solid earnings season.

Energy and real estate firms led the gains. Alstria Office Reit (DE:AOXG) leaped as much as 20% after Brookfield Asset Management made a bid to take it private, assigning the real estate investment trust a value of about 3.47 billion euros.

Asian benchmarks accelerated in unison, with Japan's Nikkei 225 rising 0.93%, outperforming the region. However, concerns over another wave of the coronavirus pandemic are dampening positive sentiment.

Yesterday, Fed Chair Powell clarified the difference between the central bank’s stimulus program and future interest rates hikes a distinction that made investors happy—all four major US benchmarks, the S&P 500, the Dow Jones Industrial Average, NASDAQ 100 and the Russell 2000, reached all-time highs in the aftermath, for the second day in a row. This kind of back-to-back record has not occurred since January 2018.

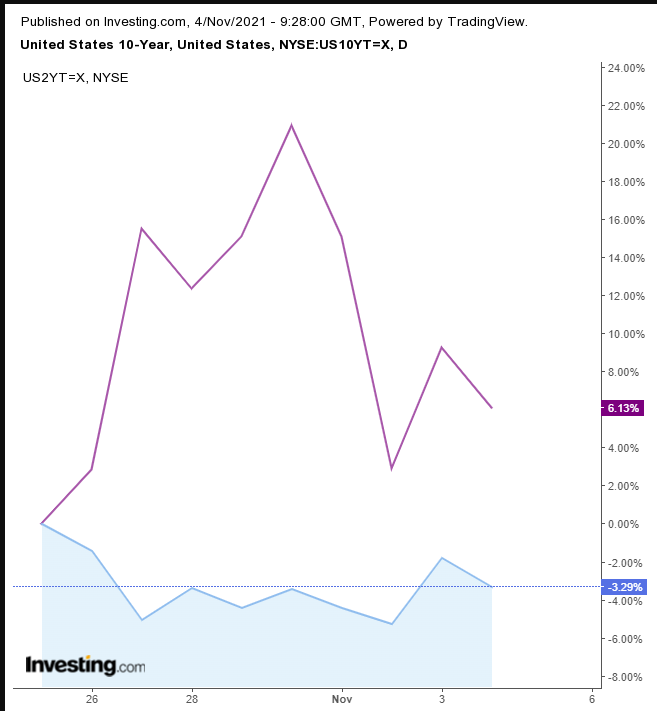

Treasuries climbed on the news.

Even as the Treasury yield curve steepened, 10-year yields slid by four basis points.

The dollar erased yesterday's losses, hitting its highest level since Oct. 12, which was the highest level since Sept. 28, 2020.

Gold proved its mettle, surging despite dollar strength. In a somewhat similar vein the yellow metal slid yesterday, despite dollar weakness. It seems that yesterday's rally in yields made the bonds more attractive than the non-yielding precious metal.

The gold price fell below its short-term uptrend, confirming the weekly H&S continuation pattern's bearishness.

Bitcoin fell for the second day.

Oil rebounded from an extended decline ahead of today's OPEC+ meeting to review production schedules. Market analysts expect OPEC+ to continue with the status quo of adding just 400,000 barrels per day in December which will continue to drive the oil price.

Meanwhile oil bulls are fighting a H&S top.

Up Ahead

- US nonfarm payrolls are printed on Friday.

- On Friday the US unemployment rate is published as well.

- Canadian employment figures are also released on Friday.

Market Moves

Stocks

- The STOXX 600 rose 0.5%

- Futures on the S&P 500 were little changed

- Futures on the NASDAQ 100 rose 0.4%

- Futures on the Dow Jones Industrial Average were little changed

- The MSCI Asia Pacific Index rose 0.7%

- The MSCI Emerging Markets Index rose 0.5%

Currencies

- The Dollar Index rose 0.2%

- The euro fell 0.5% to $1.1555

- The Japanese yen was little changed at 113.94 per dollar

- The offshore yuan was little changed at 6.3966 per dollar

- The British pound fell 0.3% to $1.3647

Bonds

- The yield on 10-year Treasuries declined four basis points to 1.57%

- Germany's 10-year yield fell two basis points to -0.19%

- Britain's 10-year yield fell four basis points to 1.03%

Commodities

- Brent crude rose 2% to $83.65 a barrel

- Spot gold rose 0.4% to $1,776.43 an ounce