- European shares rally after no-deal Brexit is rejected; U.S. futures give up early gains

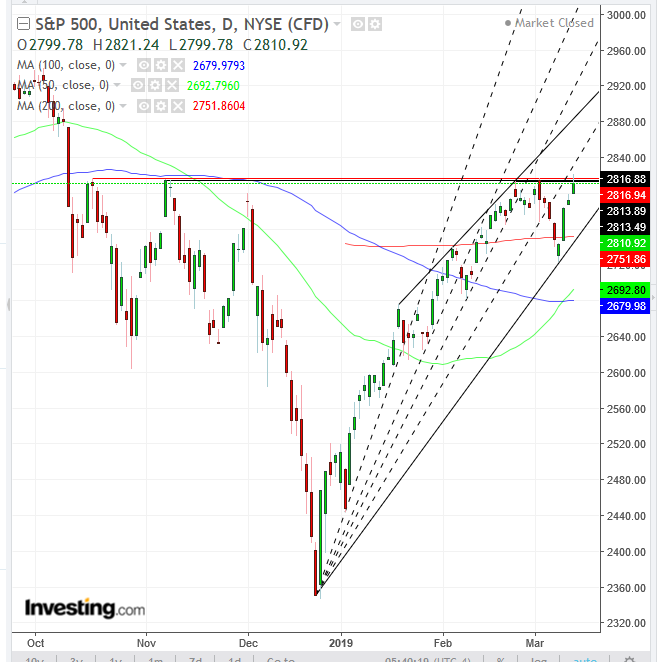

- S&P 500 reaches four-month high, but remains unable to close higher

- WTI breaks bullish pattern

- Bonds continue to signal stock fall

Key Events

European shares climbed while futures on the S&P 500, Dow and NASDAQ 100 reversed early gains this morning, following a mixed opening, as traders weighed conflicting signals on global economic growth.

The STOXX Europe 600 rallied over 2% by mid morning session, posting a new high in the short-term uptrend since December after a no-deal Brexit was rejected by the U.K. Parliament late on Wednesday, lowering chances of a disorderly separation from the EU. The latest Brexit vote also helped London's FTSE 100 rebound from a lower open, registering a fourth straight advance. The index has been consolidating since early February, in a potentially bullish pattern, reflecting investor indecision over an ongoing struggle between parliament and government. The pound pared gains, projecting similar indecisiveness over Brexit developments.

During the earlier Asian session, traders wavered back and forth between buy and sell orders. China’s Shanghai Composite gave up intraday gains to end 1.2% lower after industrial output numbers dropped to a 17-year low, reinforcing the outlook of a slowdown in the world’s second largest economy. The number of firms defaulting on their bonds reached a record high. Sentiment was also hit, as most companies expected lower growth already this year, up from just a third of firms surveyed last year.

Global Financial Affairs

In yesterday’s U.S. session, stocks jumped to a four-month high, after PPI data confirmed a contained inflation trend, easing pressure on the economy and strengthening expectations that the Federal Reserve will steer clear of interest rates hikes for the foreseeable future.

The S&P 500 gained 0.69%, with all eleven sectors well in the green. Healthcare (+1.08%) outperformed for a second day on President Donald Trump’s substantial budget cuts on Medicare. Energy (+1.01%) followed closely amid an upside breakout of oil prices, as we had forecast. Communication Services (+0.3%) also posted some upbeat gains. Overall, the index sealed a three-day climb of 2.47%.

Strictly speaking, from a technical perspective, yesterday’s 2,821.24 intraday high posted another peak in the short-term uptrend since the pre-Christmas bottom. However, its inability to close above the March 4 high—which started last week’s rout and was overwhelmed by a supply ambush by the resistance of the October-November highs—diminishes yesterday’s bullish signal of the new high in the short-term uptrend. Therefore, we are still bearish in the medium-term.

The Dow Jones Industrial Average edged 0.58% higher after Boeing (NYSE:BA) (+0.46%) pared some losses, thereby alleviating pressure on the benchmark. Technically, the Dow might be forming a falling flag, bullish in its short-term uptrend since the Christmas bottom. The pattern must complete an upside breakout for the trend to resume, and it should be accompanied by significant volumes to be more reliable. The pattern’s formation beneath the November high demonstrates the importance of this technical level, and why there would be a bull-bear spat over it.

The NASDAQ Composite matched the S&P 500’s 0.69% advance. Technically, the tech-heavy index registered a new high in the short-term uptrend, like the SPX, and like the SPX it failed to close at the height of its session, forming a shooting star.

The Russell 2000 sealed a 0.52% gain, resuming its lag for the week, as risk-on pushed traders into larger-cap stocks.

Meanwhile, the yield on 10-year Treasurys climbed for a second day, as investor risk appetite increased. However, yields have yet to overcome the resistance of the lows since late-January, as well as the resistance of a symmetrical triangle, bearish in a downtrend, that they broke to the downside on Tuesday.

The dollar bounced back from a four-day selloff, despite weakening yields, as it neared the bottom of an ascending channel, which is supported by the 200 DMA. However, rates found resistance by the 100 DMA.

Oil prices surged on Venezuela’s power blackout, compounded by OPEC+ supply cuts and by a U.S. economy that seems to be chugging along despite recurring pessimism. However, the commodity slipped into negative territory by late European morning. Technically, the price completed a bullish pennant, with the 200 DMA looming above the $60 mark. Some analysts are pointing out that, geopolitics and supply glitches aside, corporate strategies will also be something to watch closely for the next price movements.

Up Ahead

- The U.K. Parliament holds a third round of votes on an extension of the Brexit March 29 deadline on Thursday.

- China’s National People’s Congress is set to wrap up on Friday.

- Also on Friday, Bank of Japan Governor Haruhiko Kuroda will speak after a monetary policy decision.

Market Moves

Stocks

- The MSCI Asia Pacific Index declined 0.3 percent

- The MSCI Emerging Market Index dropped 0.1 percent.

Currencies

- The Dollar Index advanced 0.08 percent, giving up a 0.18 percent gain but still sealing the first advance in a week.

- The euro was unchanged at $1.1327, the strongest in more than a week.

- The Japanese yen fell 0.5 percent to 111.70 per dollar, the weakest in more than a week on the largest decrease in a month.

- The MSCI Emerging Markets Currency Index slid 0.1 percent.

- The British pound slipped 0.1 percent to $1.3319.

Bonds

- The yield on 10-year Treasurys gained one basis point to 2.64 percent.

- Germany’s 10-year yield climbed two basis points to 0.09 percent, the largest surge in two weeks.

- Britain’s 10-year yield ticked five basis points higher to 1.246 percent, the highest in more than a week.

- The spread of Italy’s 10-year bonds over Germany’s declined four basis points to 2.4486 percentage points.

Commodities

- The Bloomberg Commodity Index climbed 0.1 percent to the highest in more than two weeks.

- Brent crude advanced 0.8 percent to $68.06 a barrel, the highest in four months.

- LME copper fell 0.5 percent to $6,440.00 per metric ton, the biggest fall in a week.

- Gold dropped 0.5 percent to $1,302.25 an ounce, the largest dip in almost two weeks.