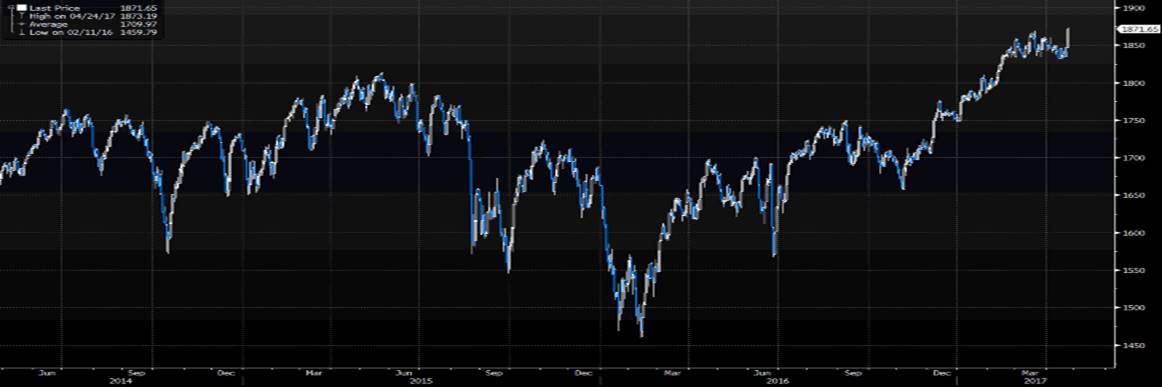

A market at an all-time high is positive, in fact, it is as bullish conditions as you can get and should be traded as such – this means being long or neutral, but shorting a market at an all-time high is ill advised. In fact, despite concerns of elevated valuation, macroeconomic and geopolitical risks, the fact the MSCI World index is at an all-time high is remarkable, especially when we think that we haven’t seen a 2% pullback for 120 trading sessions.

The bulls are in firm control here and momentum and trend are firmly dominating the market and the question many are facing is whether to chase the move higher or buy any impending pullback?

This is still one of the most a hated rallies in history and money managers are buying equity but hating themselves for doing so, but that is life when there is a genuine fear of missing out (FOMO) trade underway. If we think purely in probabilities, then the index is more likely than not to build on the 13% gain we have seen since November, where the market capitalisation of the index has increased by $6.4 trillion to $71.486 trillion. It would not be a huge surprise to see this global benchmark 5% higher in the coming weeks, but while optimistic I would always be assessing and reacting to risk, as there are real headwinds still potentially ready to hit traders and investors.

Developed markets are leading the charge, with the Nasdaq 100 breaking to new all-time highs and the S&P 500 looking like it wants to follow suit – that happens on a break of the 5 April high of 2378. US corporate earnings have helped, although they have largely been overshadowed by the political and geopolitical news flow. It’s still worth of note that while we have only seen just over 20% of the S&P 500 report quarterly earnings, 81.3% have beaten on the earnings line (by an average of 5.3%), while 71% have beaten on sales and this is firmly above the levels of beats we have seen (relative to consensus) over the last five quarters. The 13.2% aggregate earnings and 4.4% sales growth should not be taken for granted either, and upholds the belief that if earnings are going up, equities, at least on a relative basis, remain attractive. Where else do you park your money?

Small caps are also perfuming strongly, a sign of real confidence to hold equity and it wouldn’t be a surprise to see new highs in the Russell 2000 in the near-term too.

European equities have found solid buyers of late, which is hardly a surprise as we have seen Emmanuel Macron polling admirably in France – his chances of becoming president seem highly likely now. In turn, we have seen French credit-default swaps (CDS) collapse, as has the French OAT-German bund yield spread and we have even seen the implied probability of a June rate hike from the Federal Reserve increase 26 percentage points to stand at 62% in a number of days. Who would have thought the election risk accounted for so much of the variability in the fall in Fed rate hike expectations?

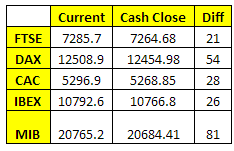

IG’s Euro equity calls for today’s cash open – another lively open.

It also seems that even though the French equity market (CAC 40) had been outperforming both the German and US equity markets going into the election, the index continues to lead the way as relief and trend bring out new money to work, with banks literally on fire. The Nikkei 225 is also looking moderately more attractive, although the threat of sharp JPY inflows is ever present given the situation on the Korean peninsula is fluid. We are seeing a good performance from emerging markets like Turkey, Brazil and South Korea.

The view is to stay long until proven wrong, and we must remember that a market at an all-time high is bullish and despite it feeling terrible to do so, money managers could have no choice but to chase this rally here.