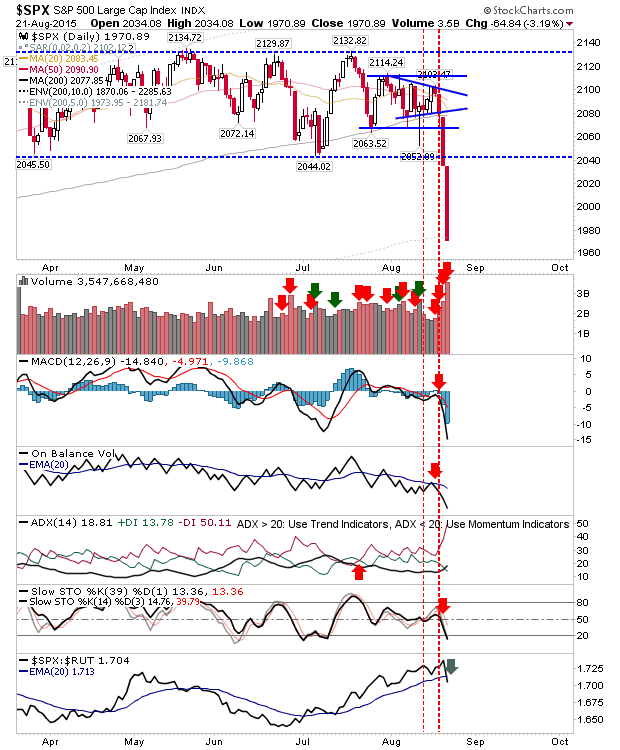

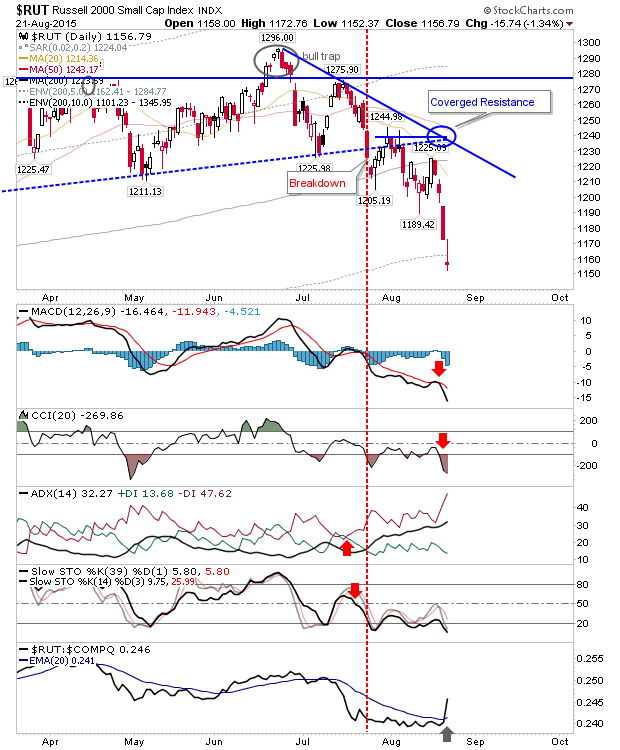

Friday's action washed out bulls and likely scared off any buy-the-dip players. Longstanding trading ranges from 2015 were decisively breached on heavy volume. However, selling has reached a point where there is good chance of a rebound on Monday. Both the Russell 2000 and S&P 500 reached the "Accumulate" marker, where long-term buyers can chase value in the market. The last time this scenario played for the S&P was November 2011, although it was October 2014 for the Russell 2000.

The S&P tagged the 5% envelope band of 200-day MA, an area which will give bulls a chance to mount a snap back rally to the 200-day MA, and a place where long term buyers can look to buy value in the market.

The Russell 2000 was one of the better indices on Friday. There was a sharp jump in relative performance against Large Caps and Tech indices., which combined with the "Accumulate" trigger, could offer a longer term (bull) trade. Of the indices, it finished Friday with a 'doji'; one of the few able to finish the day near where it started.

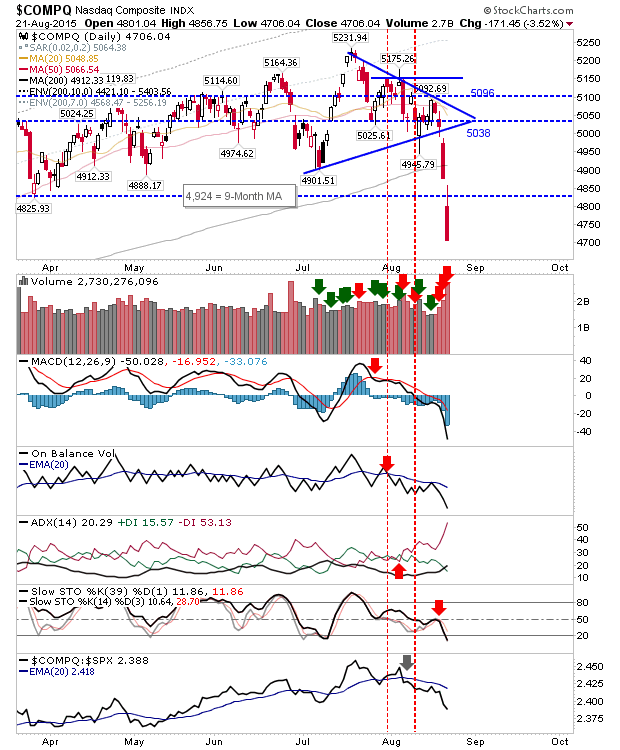

There was no such respite for the NASDAQ Composite. And having only recently breached the 200-day MA it's not in an "Accumulate" zone either. While it will likely benefit from any spill over buying (should this happen on Monday), there may be another leg of selling still to be had here.

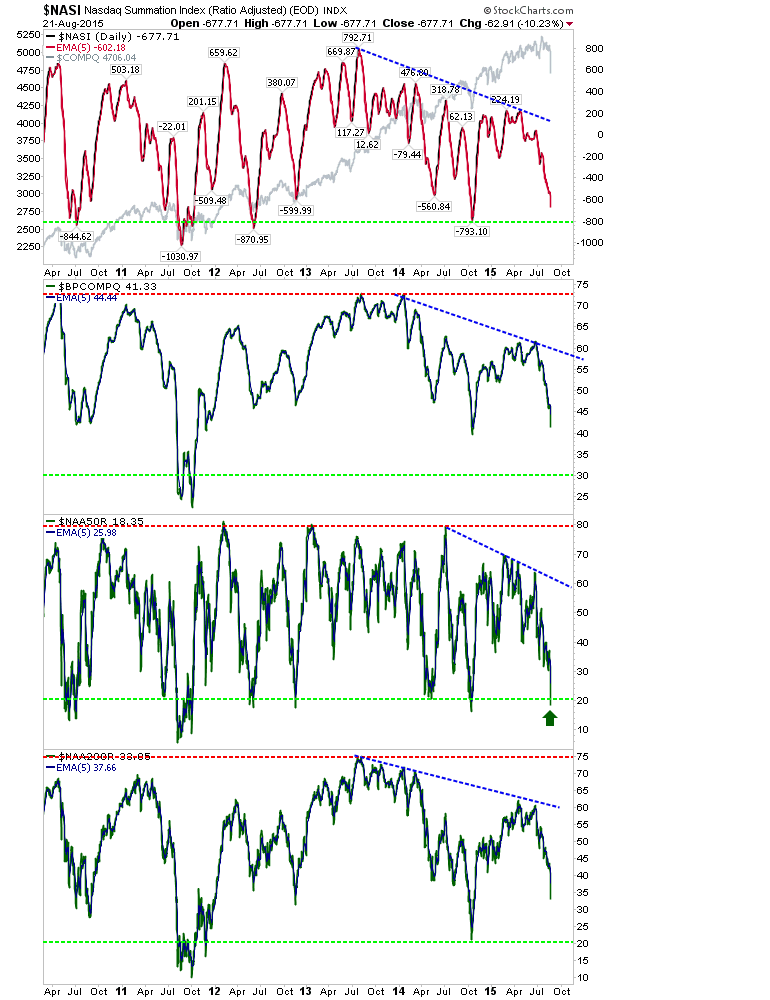

Nasdaq breadth metrics haven't entirely reached a bottom zone. The Percentage of Nasdaq Stocks above the 50-day MA finally reached a zone often associated with a trade-worthy bottom, but the Percentage of Nasdaq Stocks above the 200-day MA, Summation Index, and Bullish Percents still have room to run before they get there.

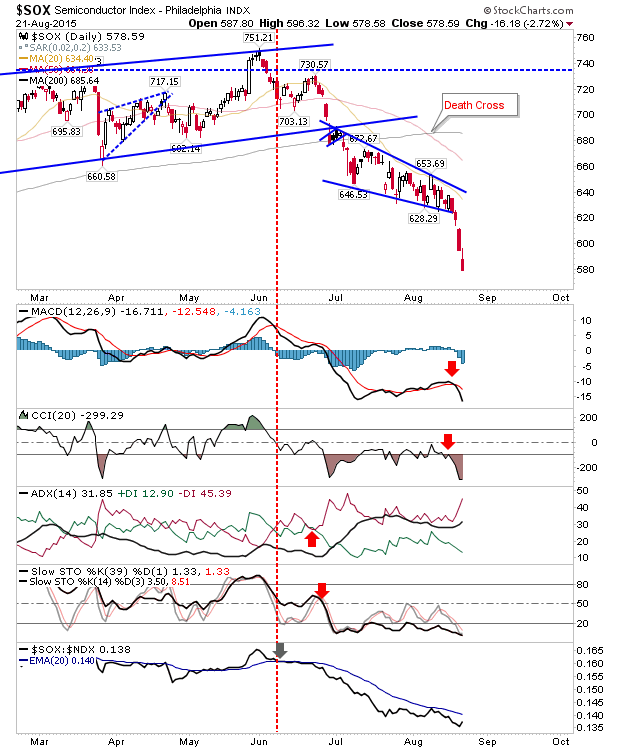

And the Philadelphia Semiconductor Index remains in free-fall.

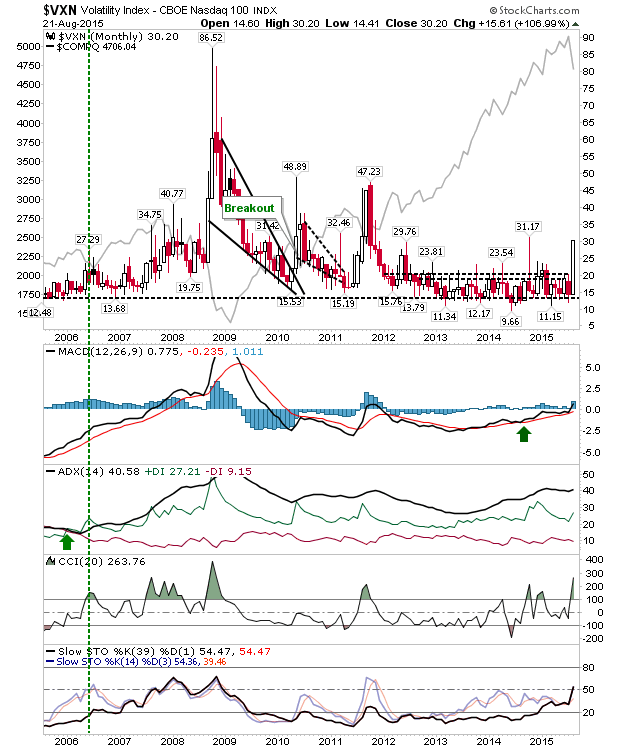

Volatility traders finally have something to celebrate. This Monthly chart suggests this only the start of the selling.

While there is a good chance for a bounce on Monday, few will expect this rally to last. Those with patience may be rewarded, but watching the day-to-day changes will probably strike fear into many!