Investing.com’s stocks of the week

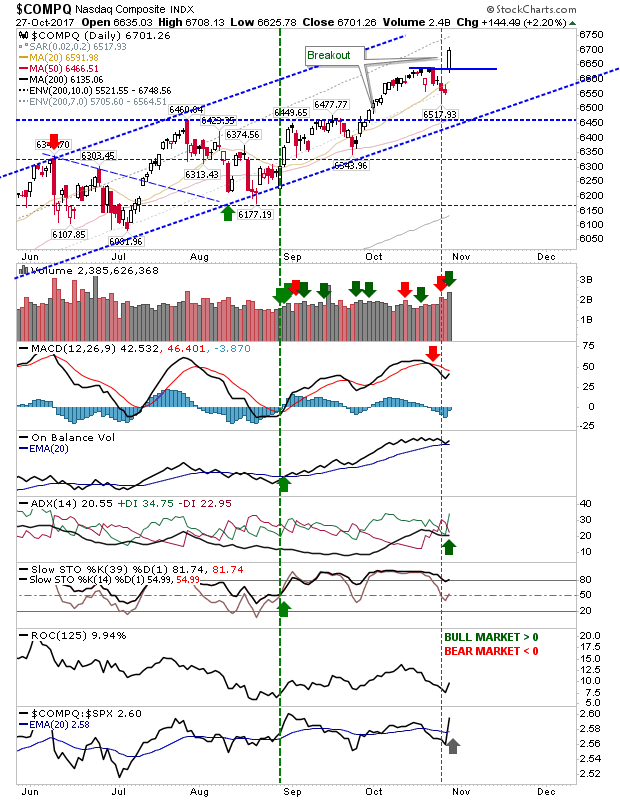

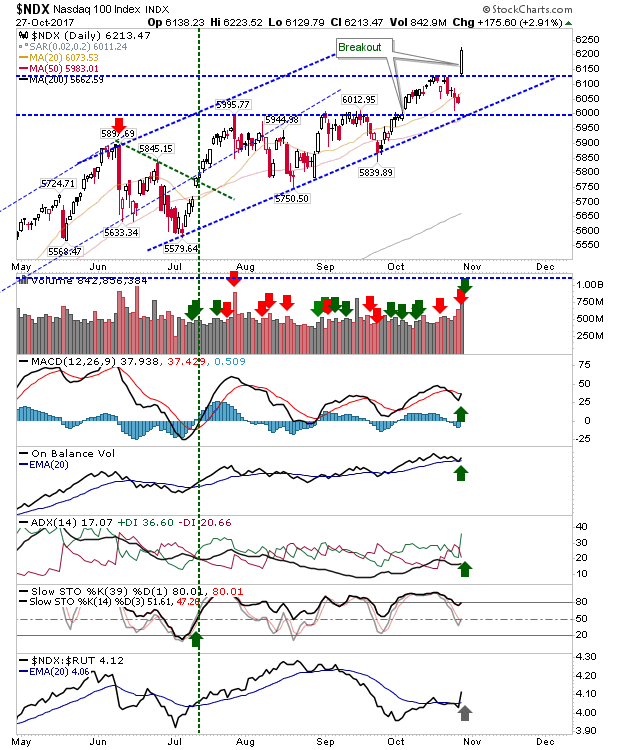

On Friday, tech markets, helped by Amazon (NASDAQ:AMZN), Apple (NASDAQ:AAPL) and Alphabet (NASDAQ:GOOGL), surged into fresh breakouts. The NASDAQ and NASDAQ 100 enjoyed strong volume with renewed 'buy' signals for the MACD in the NASDAQ 100 and +DI/-DI in the ADX for the NASDAQ.

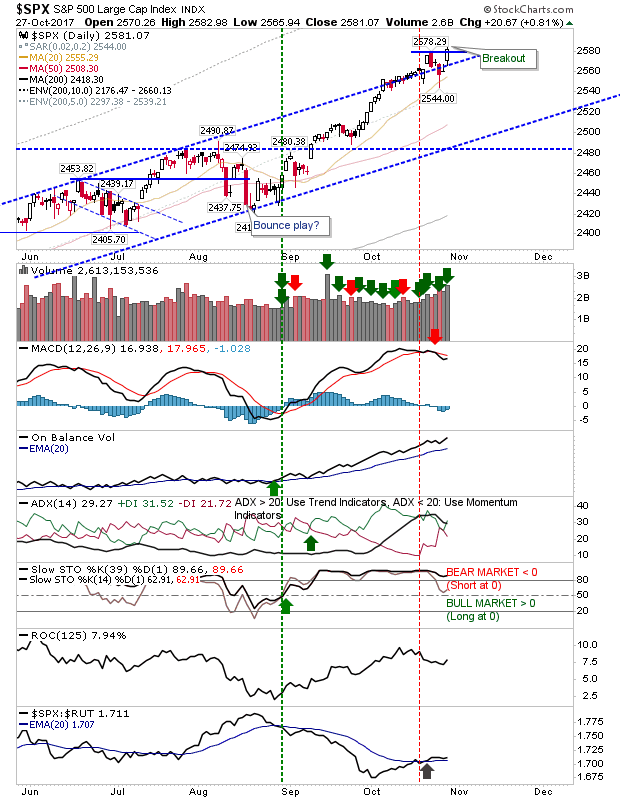

Not surprisingly, there were gains for the S&P. Better still, the higher volume accumulation in this index negated the prior week's 'bull trap'. The breakout didn't change the technical picture and the index is still edging a relative advantage over Small Caps.

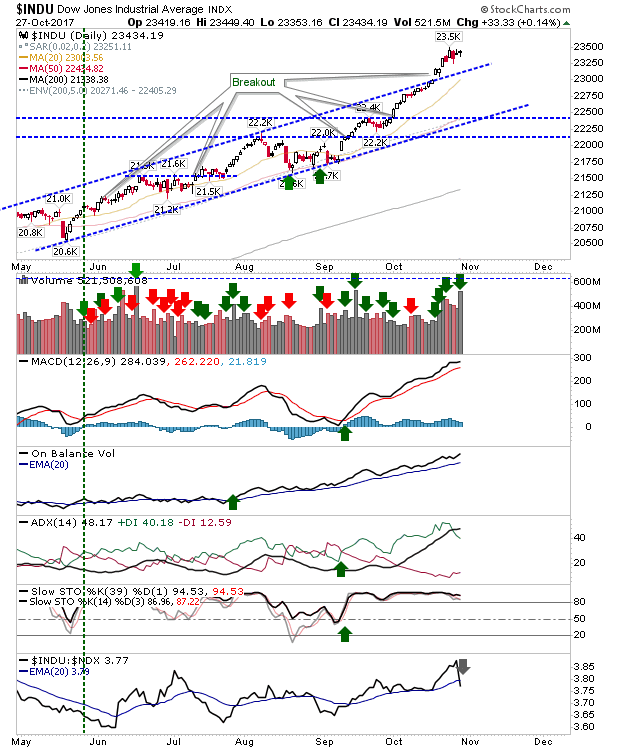

The Dow was a disappointment. It enjoyed the volume but not the relative gain.

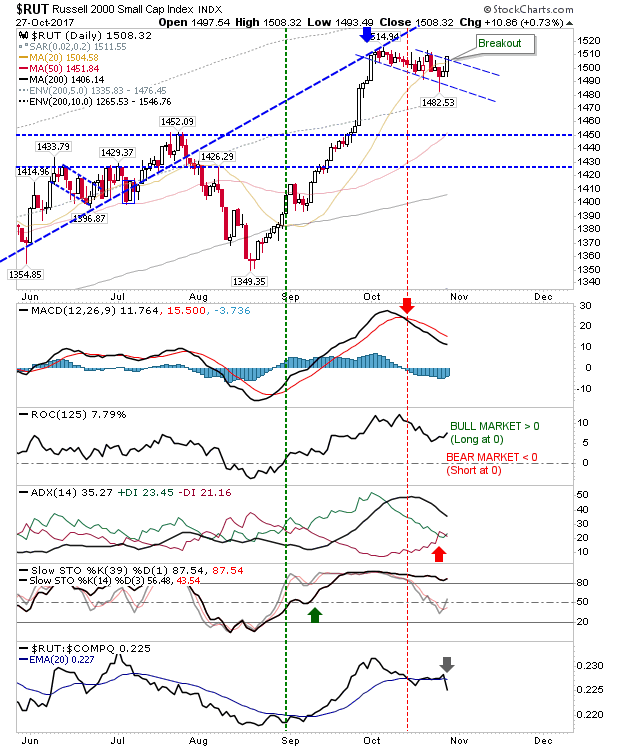

Small Caps continued to map out a broader 'bull flag'. An argument could be made for a break out from the 'flag' but Monday will tell. If there is a downside, because of bigger gains in other indices, the Russell has suffered a relative loss - reflecting a rotation of funding out of Small Caps - a potentially bearish scenario.

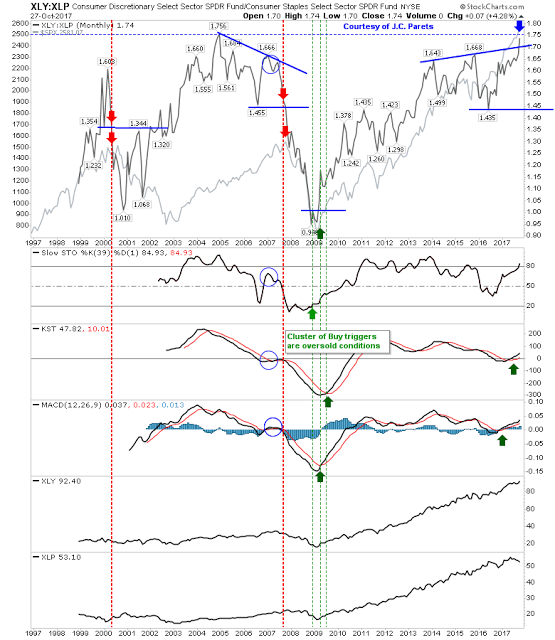

On longer time intervals the relationship between Discretionary and Staples has seen a marked acceleration. This has pushed past resistance and effectively reset the bear count. There is no immediate concern for bulls as a peak high here often leads a market top by a few months to a couple of years.

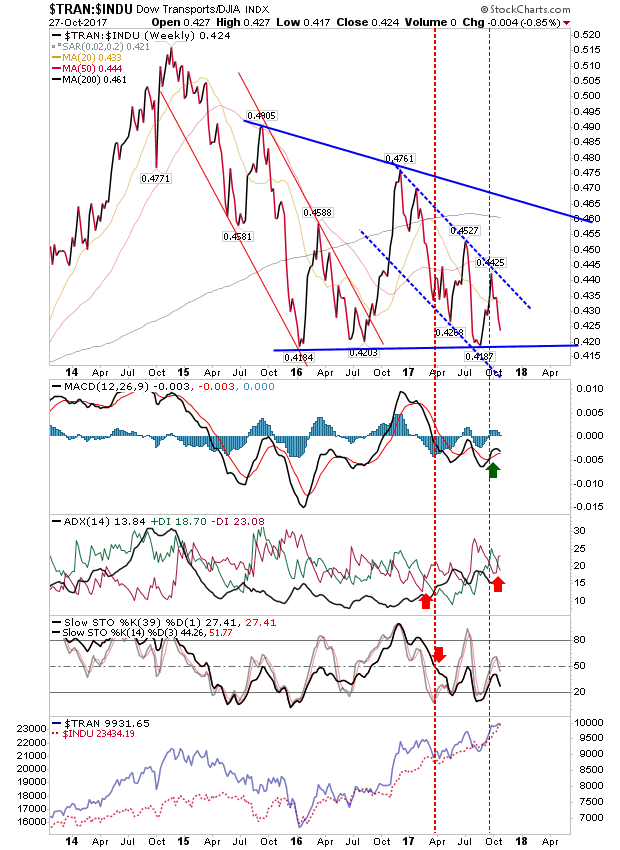

The more worrying set-up for bulls is the relationship between Dow Transports and Dow Industrials. This is fast approaching support and a potential breakdown.

Big gains on opening gaps could kick-start a new run much like breakouts in late September were followed by 4-5 days of gains. Better still, Friday's breakouts were bigger than September breakouts.