Investing.com’s stocks of the week

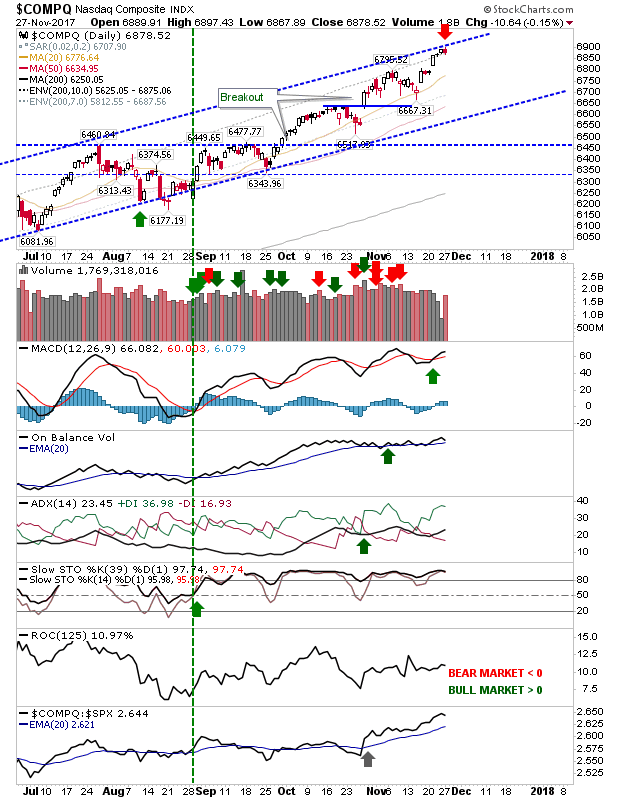

The post-Thanksgiving recovery offered some modest profit-taking yesterday, with Semiconductors experiencing the worst of the selling but the NASDAQ tagged resistance before reversing. It offered the clearest 'sell'/profit take trigger after the August support 'buy' signal.

Given action in other indices it could break above resistance, accelerating gains, but taking some profits here would be prudent.

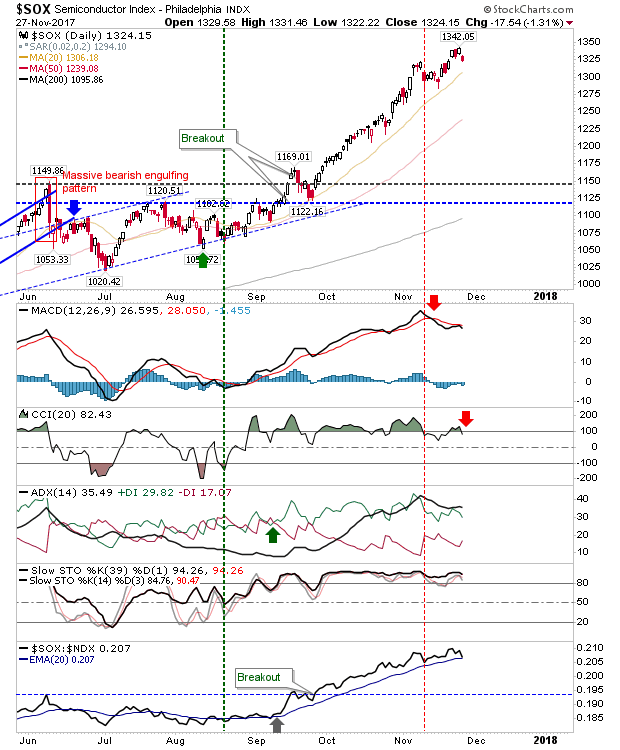

The Semiconductor Index is in need of a more orderly pullback. Since the September breakout it has more or less risen without respite - hogging the 20-day MA - it could do so again but I would look for a test of the 50-day MA, with a loss of the 20-day MA perhaps a shorting opportunity.

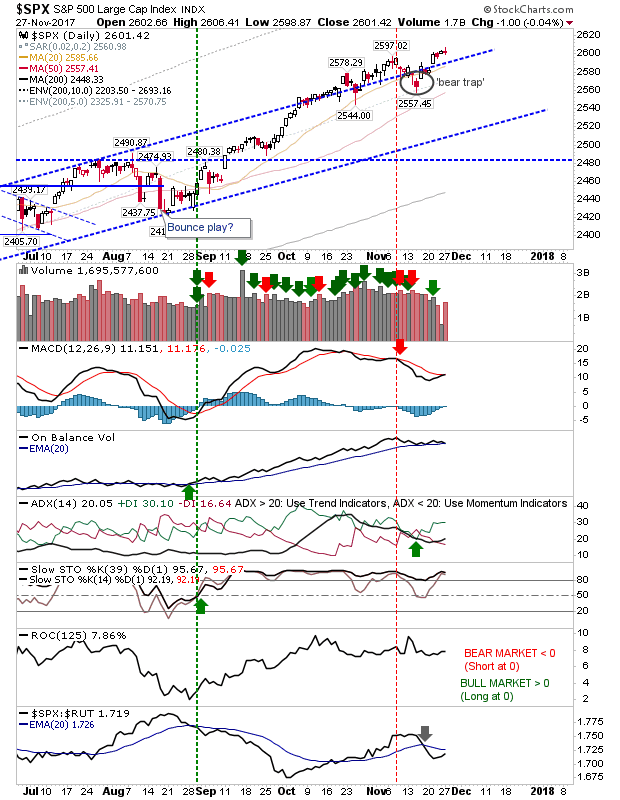

The S&P experienced a flat day with minimal intraday spread. Technicals are mixed with a pending MACD 'buy' offset by a soon-to-be 'sell' in On-Balance-Volume. The 'bear trap' remains dominant which means bulls have the edge.

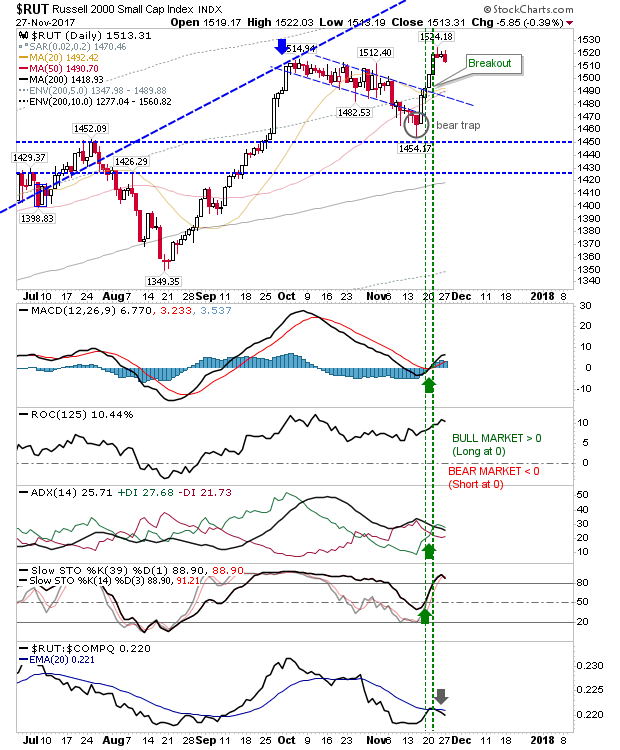

The Russell 2000 suffered slightly more selling but in a manner which suggests more may follow. It too has a 'bear trap' in play but this will be negated on a loss of 1,455. Technicals are positive with the exception of relative performance which has been losing ground to Tech averages since October and looks to be entering a second phase of loses.

For today, keep an eye out for a further expansion of yesterday's selling. However, the NASDAQ is ready to surprise and is well placed to clear channel resistance; such a break would also come with short covering, further fueling gains.