Investing.com’s stocks of the week

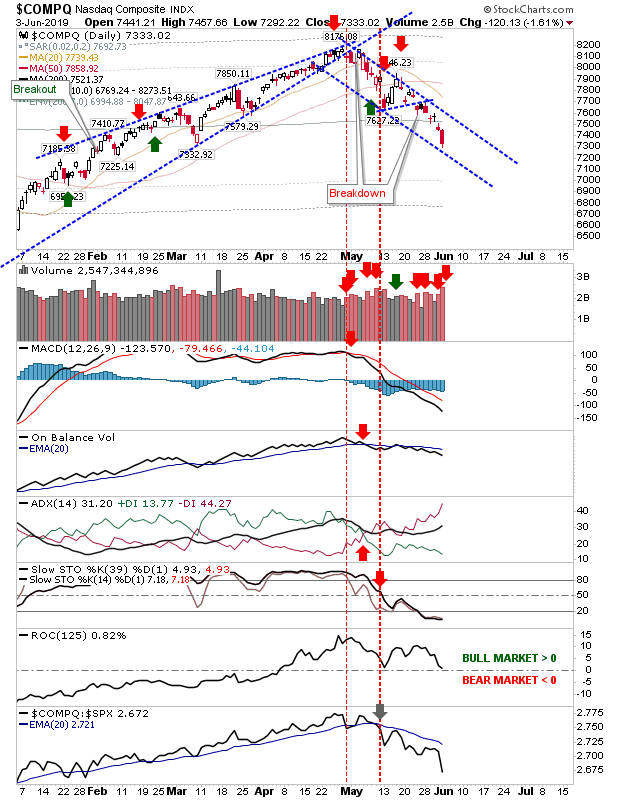

Rumors of antitrust probes for Facebook (NASDAQ:FB) and Google (NASDAQ:GOOGL) put a weak market under further pressure yesterday. The NASDAQ took the brunt of the selling on confirmed distribution. In the case of the NASDAQ I have redrawn the downward channel line which will place yesterday's lows at support of this channel line.

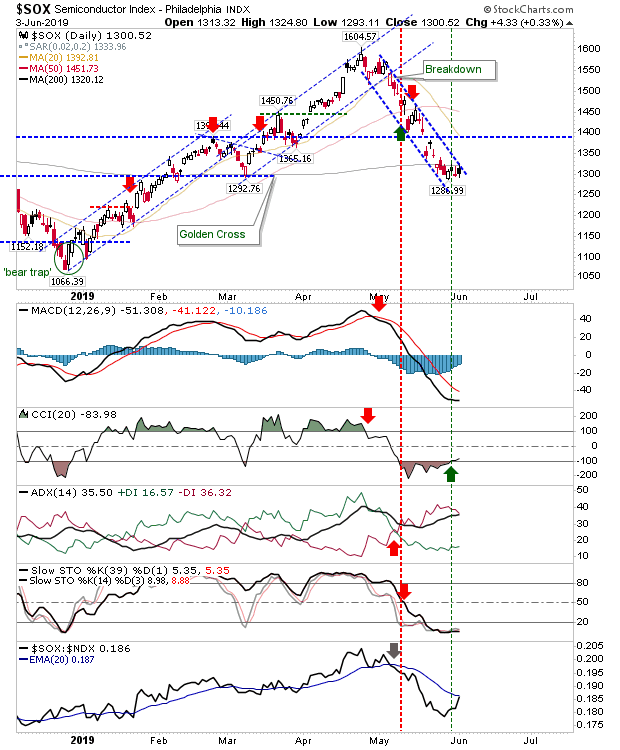

The Semiconductor Index wasn't impacted by the selling but there was also a lack of confidence on the part of buyers to return the index above the 200-day MA. The possibility of reversing a 'bear trap' remains a reasonable play to watch for (which would also go with an upside channel break).

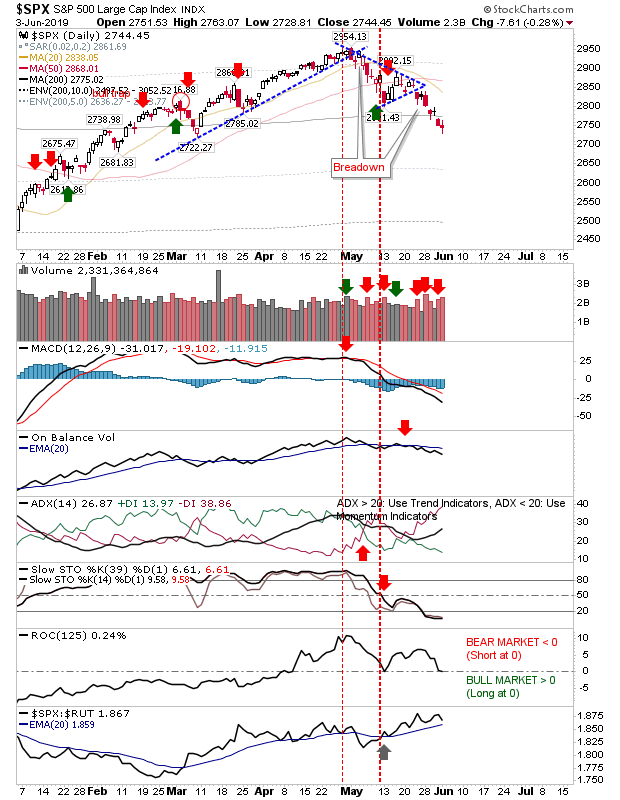

The S&P closed with a neutral doji, suggesting yesterday's selling in Facebook and Google wasn't reflective of broader market conditions. As with the Semiconductor Index, watch for a possible 'bear trap' reversal return above the 200-day MA.

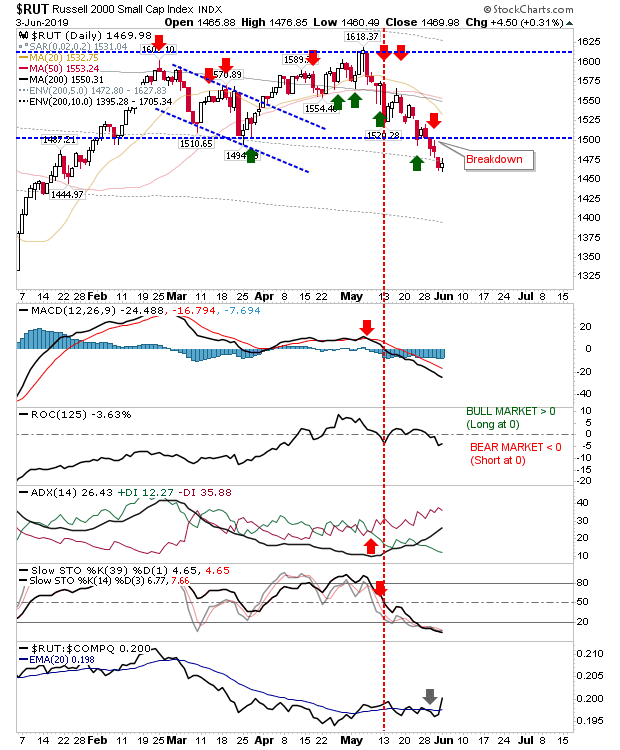

The Russell 2000 was the only index to close higher. It does trade well below key moving averages (20-day, 50-day, 200-day MAs) but in the absence of concerted selling (distracted by the NASDAQ and SPX) there is a chance for a nascent recovery above trading range support.

For Tuesday, look for 'bear traps' in the Semiconductor Index and S&P given their respective proximity to their 200-day MAs. The NASDAQ is likely to see some follow-through lower based on Google and Facebook action, but both stocks will prove attractive for those looking to buy-in at a discount.