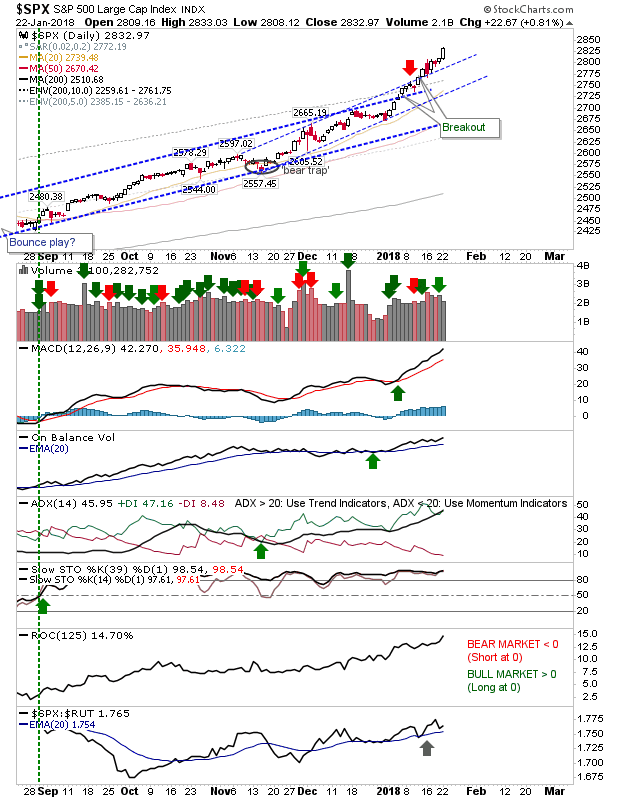

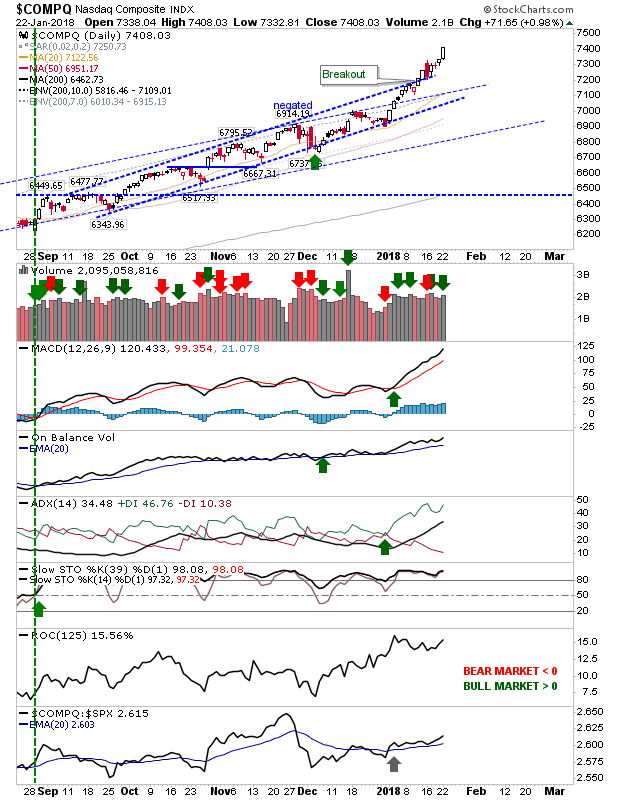

The NASDAQ joined the S&P at historic highs as it hit the 15% zone of historic price extremes (relative to its 200-day MA). The S&P went a step higher as it touched the 10% zone of historic highs; i.e. it trades at levels above 90% of historic price action dating back to 1950 - a sign there isn't much left to this rally. If it makes it to 2,874 it will be in the 5% zone, a zone last seen in February 2011.

The NASDAQ continued to accelerate past its most recent upside channel on higher volume accumulation. Technicals continued to move higher in support of rising price action. While the index trades at historic price extremes it hasn't yet signaled a technical top.

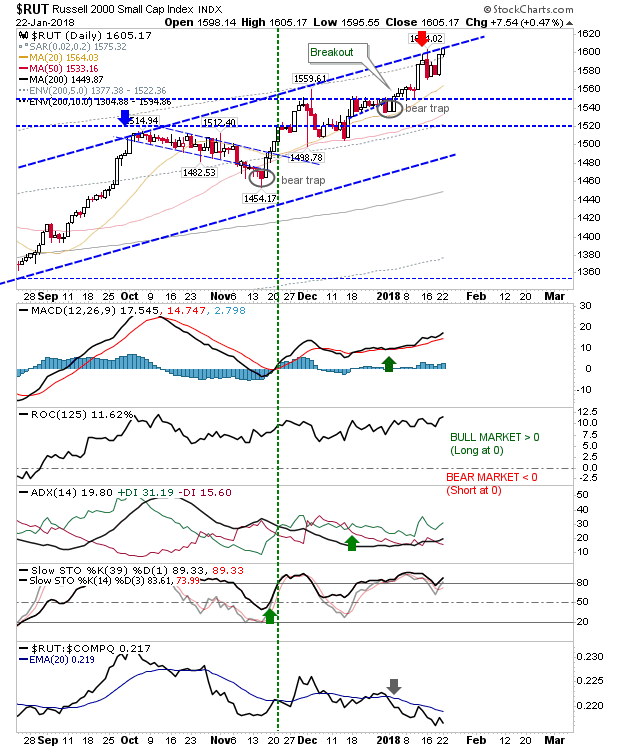

The Russell 2000 made a tag of upper channel resistance in what was likely a continuation of any short covering generated by the original channel tag last week. The technical picture is not as favorable given the continued, sharp relative underperformance against its peer indices. However, this can also be viewed as a positive as it also represents a more sustainable rally.

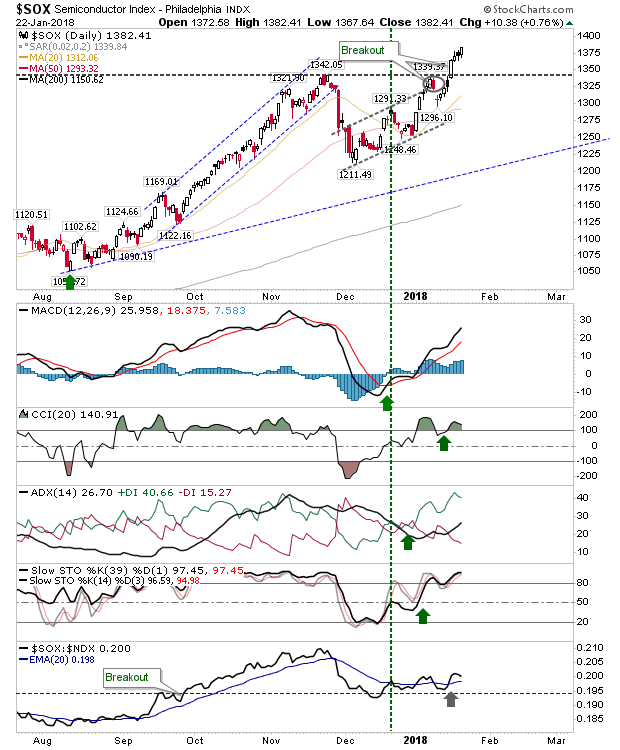

The Semiconductor Index added a little extra to its earlier breakout as it continues to tempt sideline buyers.

For today, it's about seeing how far the S&P and NASDAQ can continue to push into the zone of historic price extremes. Profit taking remains the order of the day.