The Nasdaq had looked primed for a breakout but there was a trend breakdown last week. The index has returned to its base with a break in its 20-day MA; the 50-day MA is its next port of call.

Technicals are mixed; On-Balance-Volume is still moving strongly in bulls favor, and I thought this would be the driver for the breakout.

Momentum is solid and short term is at a pullback 'buy'. However, it's the trend break on the back of a (weak) MACD 'sell' trigger that is of greater concern.

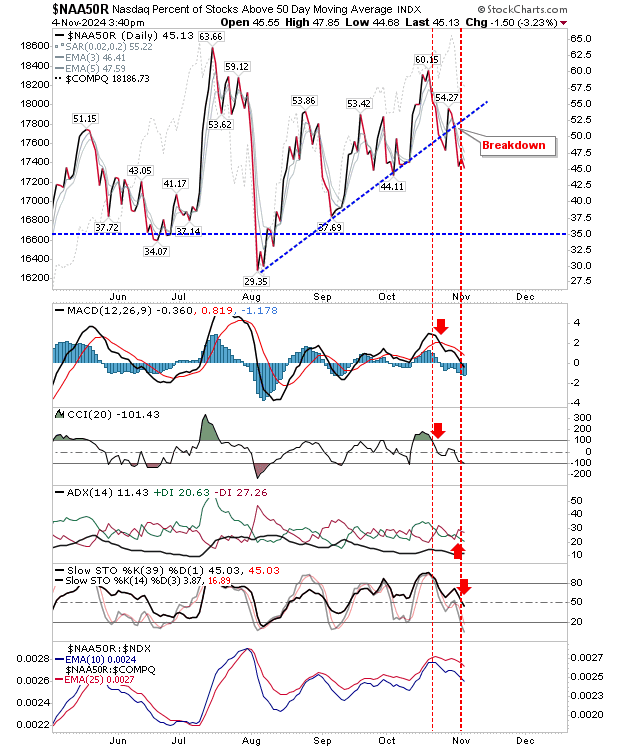

But its Nasdaq breadth metrics that are pointing to bigger troubles ahead. The Percentage of Nasdaq Stocks Above the 50-day MA have breached trend support and dropped below the mid-50% point. Supporting technicals are net bearish, but not oversold.

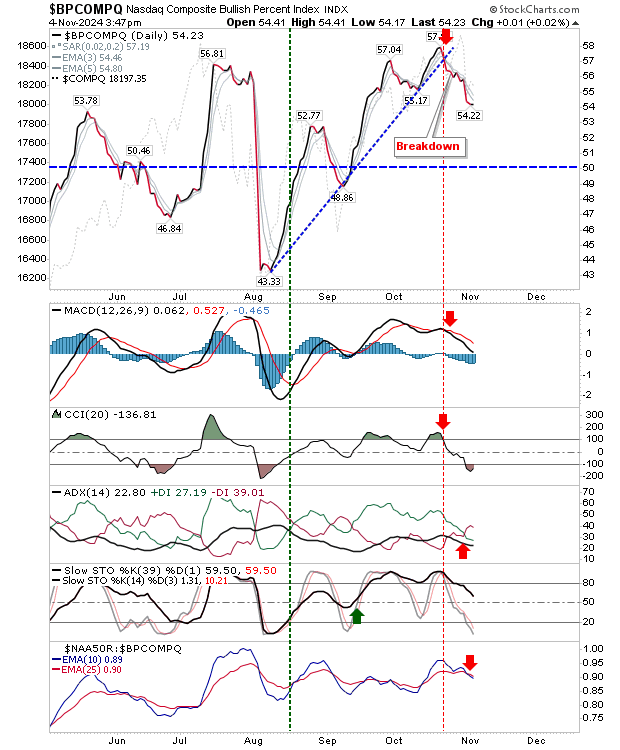

It was a similar story for the Nasdaq Bullish Percents (percentage of stocks on point-n-figure 'buy' signals); a trend break, although no drop below the 50% line.

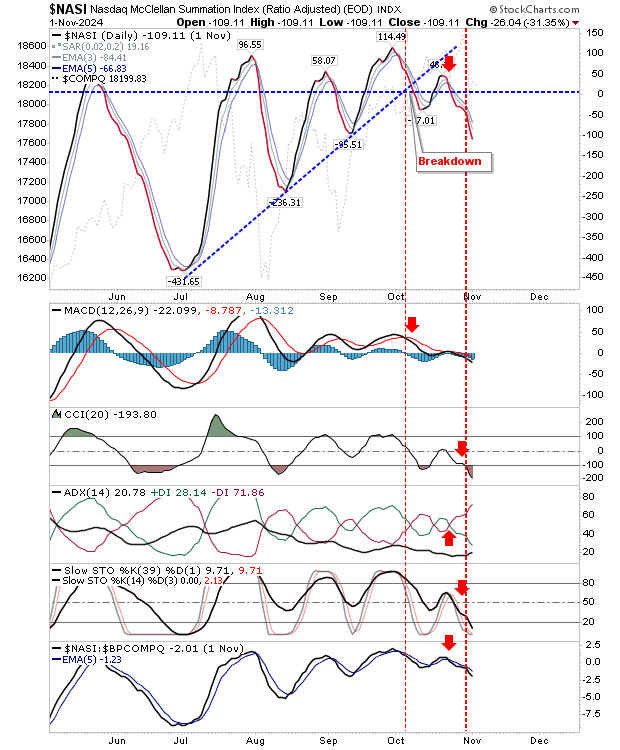

The early warning sign was the Nasdaq Summation Index. It took an accelerated move lower with an expansion in technical net weakness. A swing low will be confirmed when the 3-day EMA crosses above the 5-day EMA.

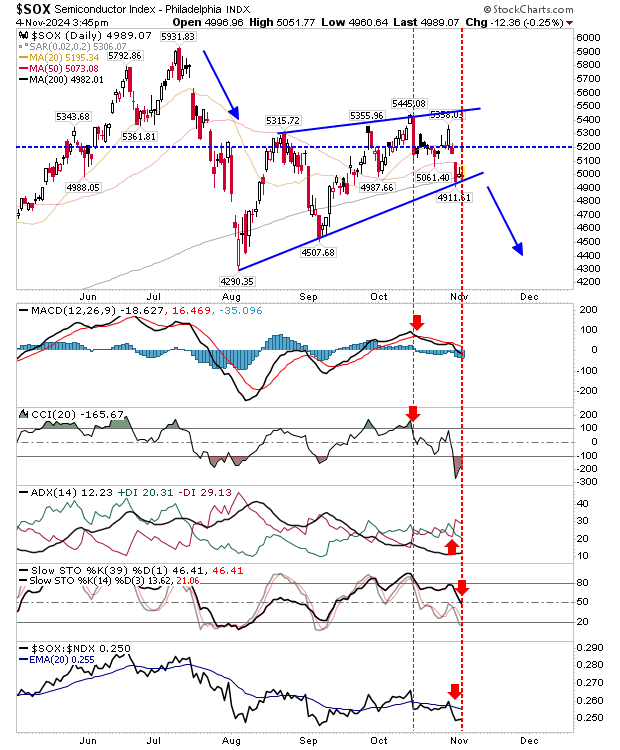

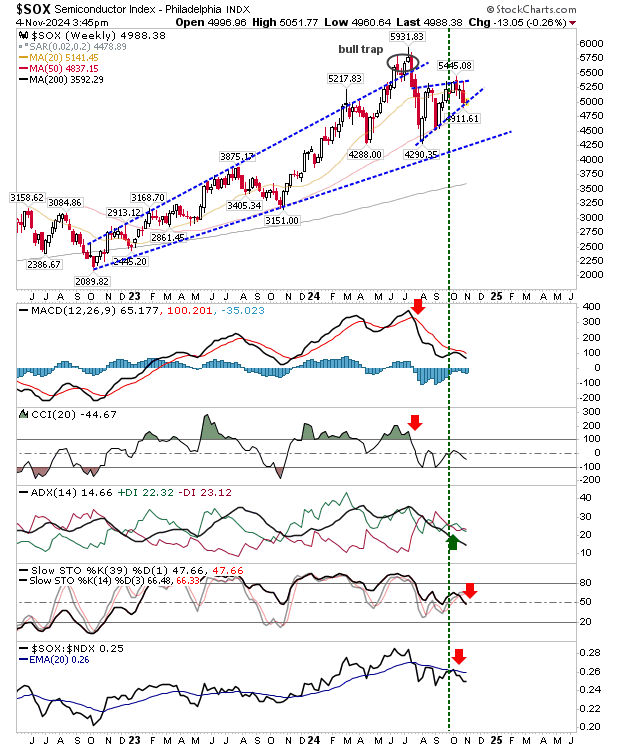

Finally, the Semiconductor Index is flirting with a major breakdown. Not just its 200-day MA but also the bearish wedge. Technicals are net bearish, but not oversold. This index is looking very vulnerable to further losses.

And if it breaks, there is a clear target to aim for; the rising trendline from 2022.

For the remainder of the week, keep an eye on the Nasdaq. This index is the canary in the coalmine for broader losses across indices. Election day is a natural catalyst for a reaction, independent of who wins the presidency. Sell the news.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.