It has been more than two months since I last provided an Elliott Wave-based update on the NASDAQ 100. I was then looking for $16K, while it was trading at $14.6K. Voilà, as the French say, the NDX now sits at $15.6K – a 7% gain over that period. My upside target zone has been reached. With the new price data at hand, I can now adjust my forecast. Because, as I say "Please remember, my work is ~70% reliable and ~90% accurate. Thus, be realistic and do not expect perfection, nor zero bad calls in a dynamic, stochastic, probabilistic environment."

At the end of June, "my preferred Elliott Wave Principle (EWP) count suggest[ed] the index is completing its 3rd of a 3rd wave: grey minute wave-iii of green minor-3."

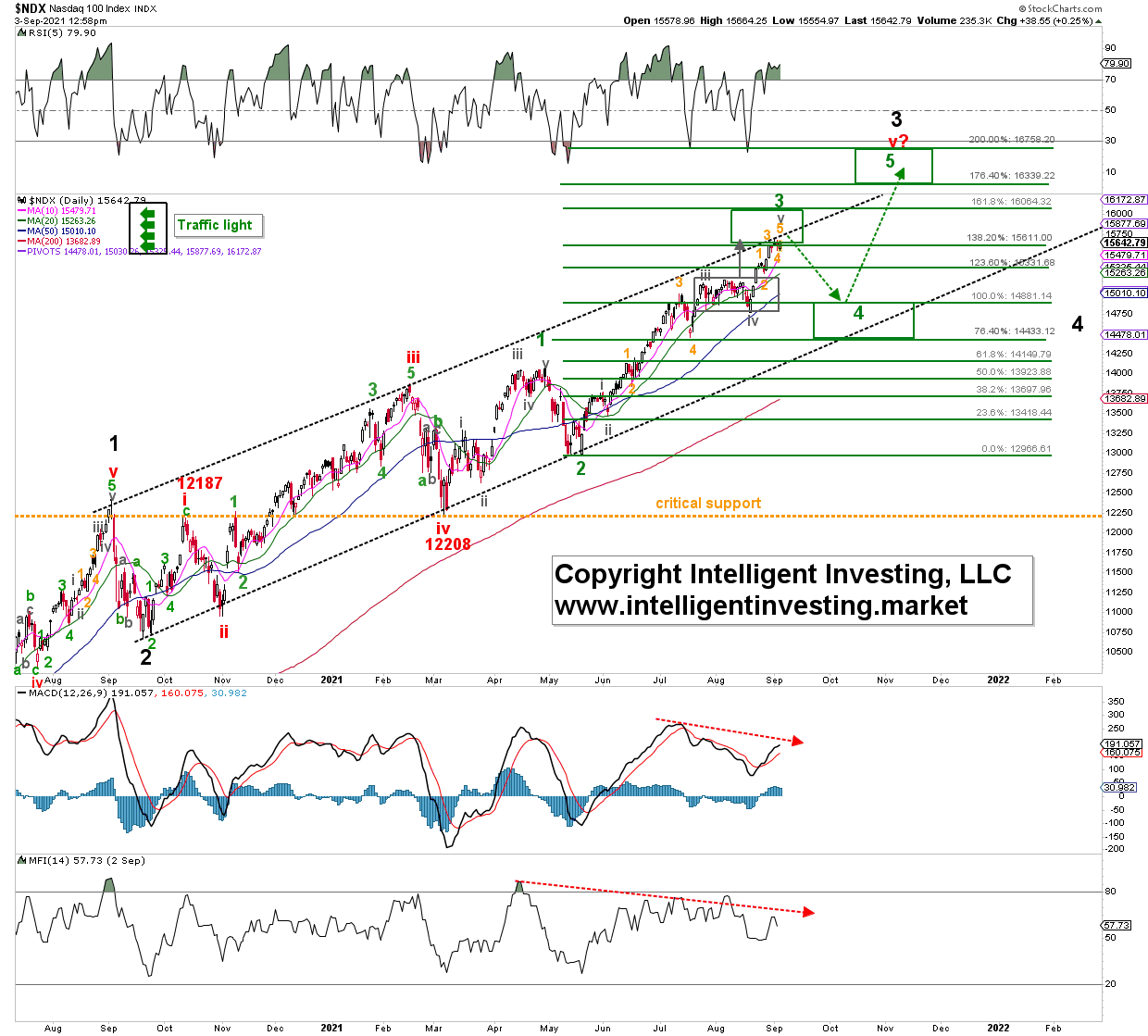

That was the correct call as the NDX essentially moved sideways until Aug.19: (grey) minute wave-iv. See figure 1 below.

Now minute wave-v is under way to complete (green) minor wave-3 right in the ideal Fibonacci-based extension target zone.

Figure 1: NDX100 daily candlestick chart with EWP count and technical indicators.

Namely, based on historical evidence, we know 3rd waves typically reach the 1.382 to 1.618x Fibonacci-extension of the 1st wave, measured from the 2nd waves low. This target zone is reached, and some caution is advised for shorter-term traders because, after wave three comes wave-4 and wave-5. The negatively diverging technical indicators (red dotted arrows) suggest this 5-7% pullback as well.

So far, all is rather "textbook," but the market does not owe us anything. It can decide to extend, correct more in time (sideways) than in price, etc. Thus, we only have an anticipated road map, which needs to be tracked to see if the index makes a detour, short-cut or takes the scenic route. Thus ,all we can do is "anticipate, monitor, and adjust if necessary." My initial and prior anticipation was proven wrong, I adjusted it in late June, and that was the correct call. That is the beauty of the EWP: it helps identify new if/then scenarios, and if one then has an objective, open-minded, fault-admitting approach, it is easier to get back on track and be profitable.

Regardless, I anticipate the index to top out in the target zone soon, put in a multi-week correction back down to the ideal wave-4 target zone $14,430-$14,880 before rallying for wave-5 to ideally $16,340-$16,760. That last rally then completes an even more significant 3rd wave (black, major wave-3), and a multi-month major 4th wave should then rattle the markets, and a revisit of $14,750+/-250 should then be in the cards. Let's not try to look around too many corners simultaneously as uncertainty increases and stick with this game plan for now.