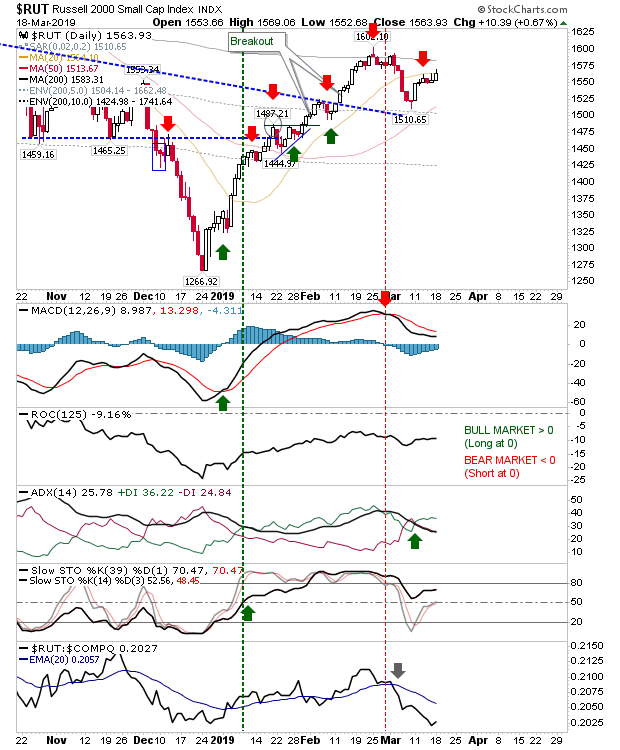

Another day of small gains yesterday, kept the rally moving for another day. The Russell 2000 probably got the most out of yesterday as the index closed at its 20-day MA.

It is now in a position to negate prior spike high tags of the latter moving average. If there was a short play on the initial tag of the 20-day MA it looks done now. The MACD is in recovery mode but is on course to trigger a 'buy.'

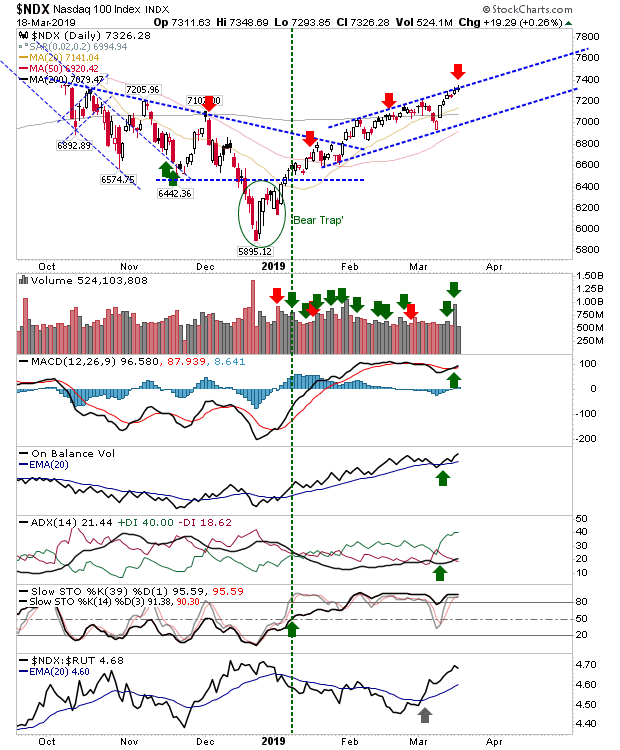

For the NASDAQ 100 I redrew the channel to account for the slower ascent. With that redraw there is a potential short play / swing trade with the small doji at resistance. However, technicals are all bullish so aside from the possibility of channel resistance there is no clear support for a short trade—so if opting for one, keep the stop tight (or alternatively, buy a break of the channel).

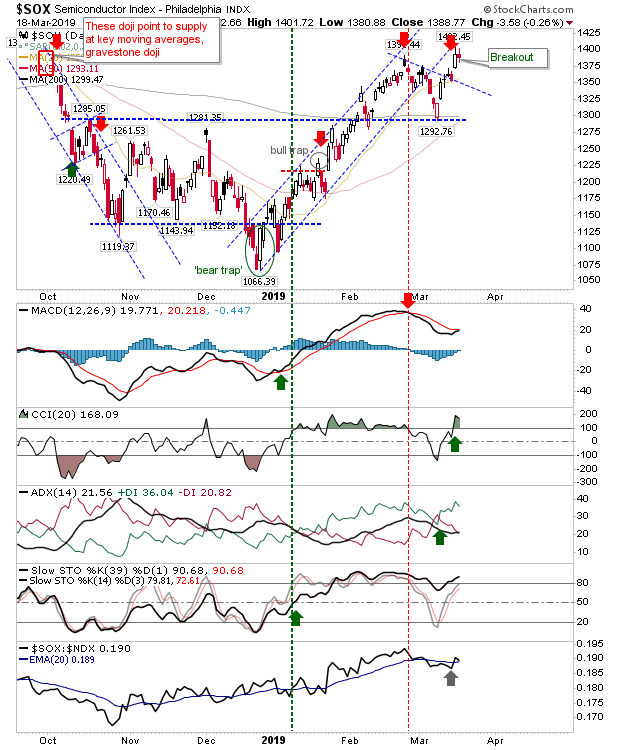

The Semiconductor Index consolidated its breakout with a small candlestick at the upper end of yesterday's candle. A MACD trigger 'buy' looks to be just a day away—if this comes through then I would expect the NASDAQ 100 to break upside beyond its channel.

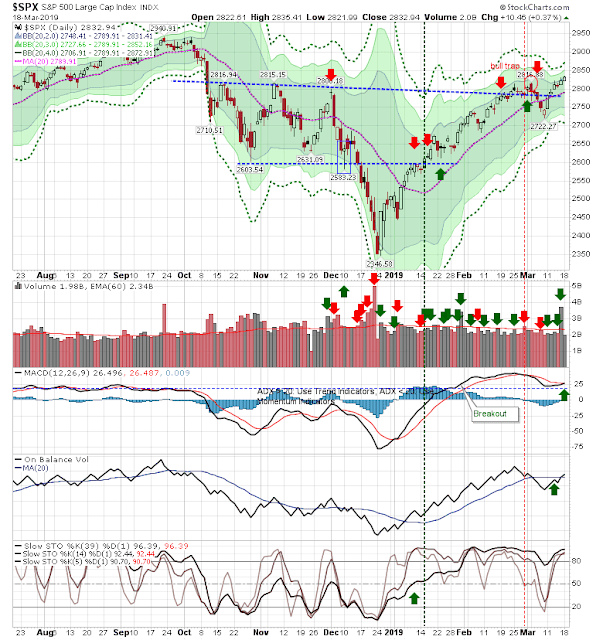

The S&P posted a new closing high as it moves into a challenge of October all-time highs. You can see on a weekly chart how important this break of resistance is.

For today, watch the NASDAQ 100 and Russell 2000 for leads; bears will be looking for a push down from the channel in the NASDAQ 100; bulls will want a strong move through the 20-day MA of the Russell 2000.