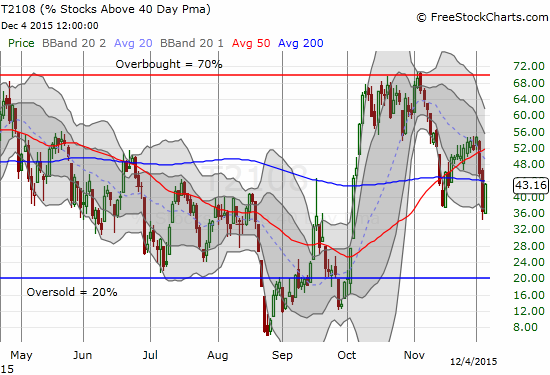

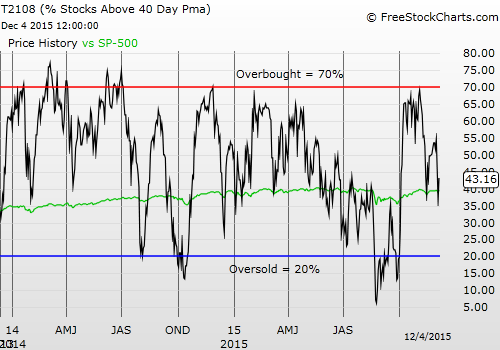

T2108 Status: 43.2%

T2107 Status: 33.3%

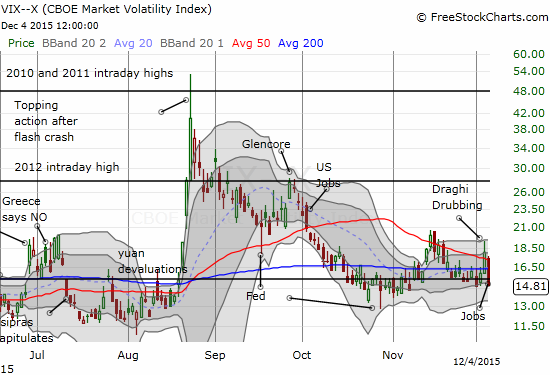

VIX Status: 14.8

General (Short-term) Trading Call: neutral

Active T2108 periods: Day #44 over 20%, Day #43 over 30%, Day #1 over 40% (ending 11 day under 40%) (overperiod), Day #3 below 50% (underperiod), Day #17 und8r 60%, Day #358 under 70%

Commentary

Once again, T2108 dropping below 40%, particularly in rapid fashion, was enough to generate a quick rebound. This rebound was apparently catalyzed by a strong U.S. jobs report on Friday. However, I think it may be more appropriate to just say this rebound represents a simple reversal of the angst going into the jobs number – angst that was suddenly starved of further fuel.

I said the following in the last T2108 Update in preparation for Friday’s trading action:

“The next catalyst for the market is the U.S. jobs report for November. Just as the market was primed to react poorly to bad news the previous day, it is now primed to react very well to good news. I honestly have no idea anymore whether a strong jobs report will be interpreted as good or bad by the market at this juncture where a rate hike seems like a done deal. I will be in reaction mode, not prediction mode.”

As planned, my reaction was to fade volatility. I waited a few minutes after the open to be relatively confident that the market was more than likely to react positively. I bought shares in ProShares Short VIX Short-Term Futures (N:SVXY). In hindsight, I should have loaded up. I sold my position at the close: I did not want to stay exposed to volatility over the weekend.

T2108 jumps from under 40% to over 40%, BUT it does not recover all of the previous day’s losses like the S&P 500…

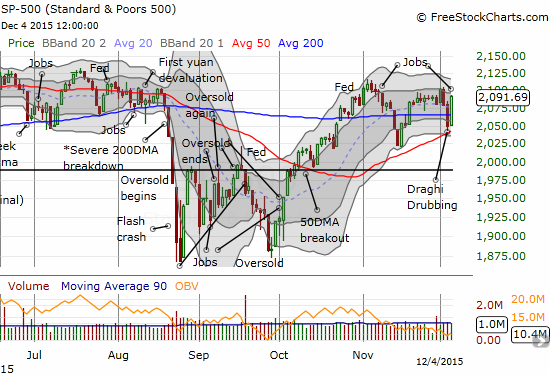

The S&P 500 (SPDR S&P 500 (N:SPY)) soars on the day. Not only did it recover the losses from the previous day but also it ate into about half of Wednesday’s loss as well.

ProShares Short VIX Short-Term Futures (SVXY) gained 9.6% on the day and became a great way to trade the day’s bounce even starting with a gap up.

The volatility index, the VIX, plunged right back to the lower part of the previous churn and below the important 15.35 pivot.

Note well that for the second time during the week last week, a rally left T2108 and the S&P 500 notably out of sync. While the S&P 500 made an impressive gain reversing the previous day’s loss and then some, T2108 fell well short.

This was not just another rebound for the S&P 500. This unbalanced bounce provides yet more evidence that the market’s breadth is poor. The upside is not shared by nearly as many stocks as the downside (relative to the 40-day moving average). So, once again, I am very wary of the sustainability of the sudden bounce in the market. The last mismatch occurred on the big rally that started December and preceded a 2-day pullback.

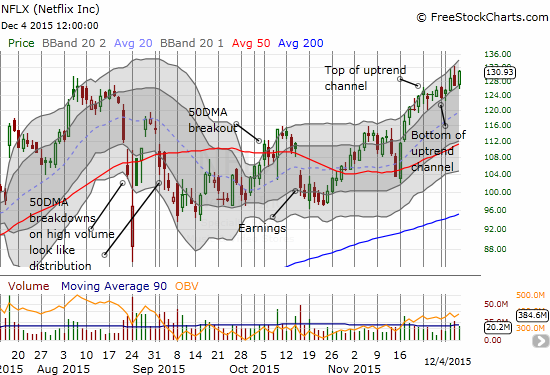

The good side of a market with thin participation is that I know immediately where to look for ripe buying opportunities on a bullish day. Second to fading volatility was going long Netflix (O:NFLX).

NFLX had a great setup sitting right at the bottom of an uptrend channel well defined by the two upper-Bollinger® Bands (BB). Like SVXY, I was looking for a one day trade. For NFLX, this meant loading up on weekly call options expiring the same day. I made two purchases, one at the open and another on NFLX’s pullback.

Despite the relative underperformance at the time, I stuck to the thesis. NFLX ended the day with a nice 3.25% gain. I did not hold my position into the close given the risks involved with expiration occurring on the same day. The fresh all-time high combined with the uptrend promises to make NFLX a popular trade as momentum players swarm into position…

Netflix (NFLX) has found fresh favor with traders after initially disappointing after October earnings.

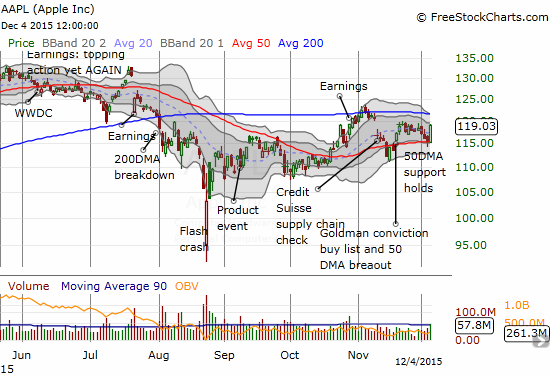

Apple (O:AAPL) has not been as reliable a play on bullish days but on THIS day, it was as much a champ as Netflix. I was well-positioned to play AAPL’s near picture-perfect bounce off support at its 50DMA. AAPL delivered a 3.3% gain. Once again, I did not hold my call options into the close, but I cannot complain.

Apple (AAPL) bounces in near picture-perfect form off support at its 50DMA.

After it was all said and done, the S&P 500 ended the week pretty much where it ended the previous week. The valuable trades occurred from day-to-day and not overplaying any one move. I expect more of the same in the coming week as the market gets more and more antsy in anticipation of a Fed rate hike on December 16th.

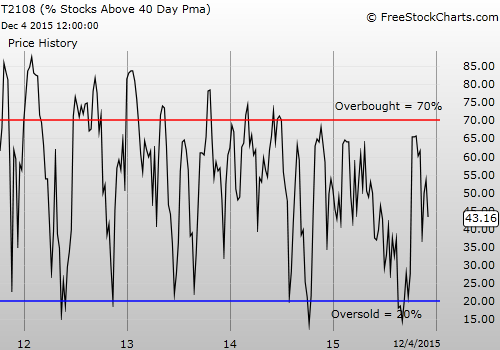

Daily T2108 vs the S&P 500

Black line: T2108 (measured on the right); Green line: S&P 500 (for comparative purposes)

Red line: T2108 Overbought (70%); Blue line: T2108 Oversold (20%)

Be careful out there!

Full disclosure: no positions