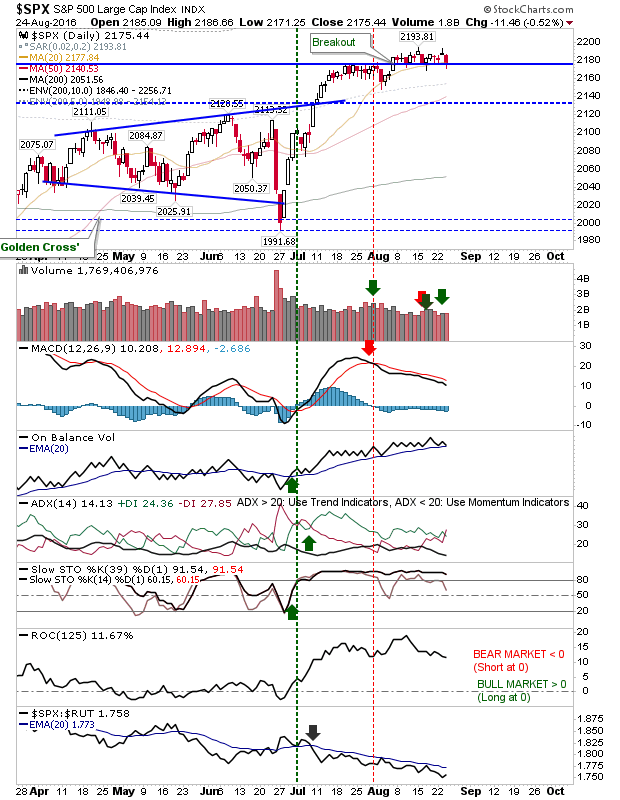

Tuesday's buying likely caught shorts out, but later weakness may have encouraged profit taking on Wednesday. The damage was relatively light and only served as a warning.

For example, the S&P didn't lose breakout support and selling volume was light

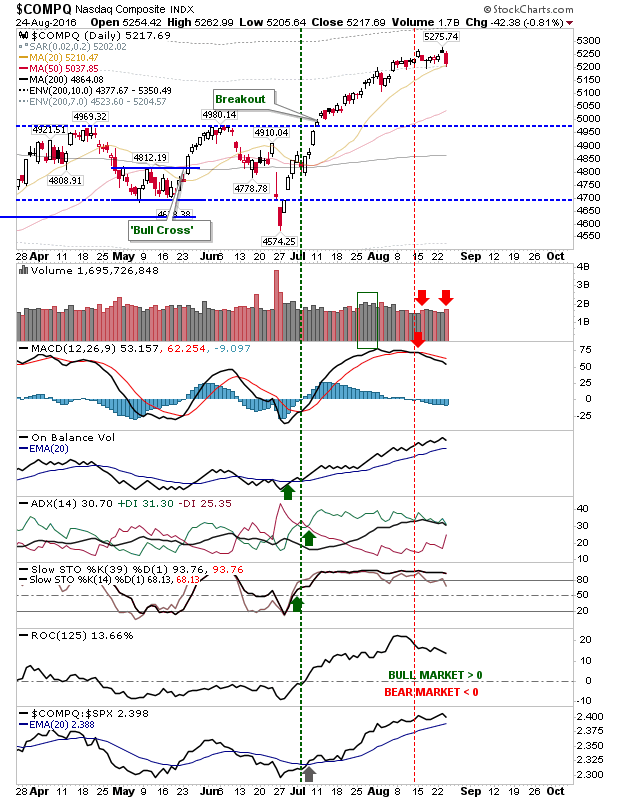

The Nasdaq did see more selling to finish with a distribution day. The index finished on its 20-day MA, which it last saw in a convergence in June and was followed by a successful bounce.

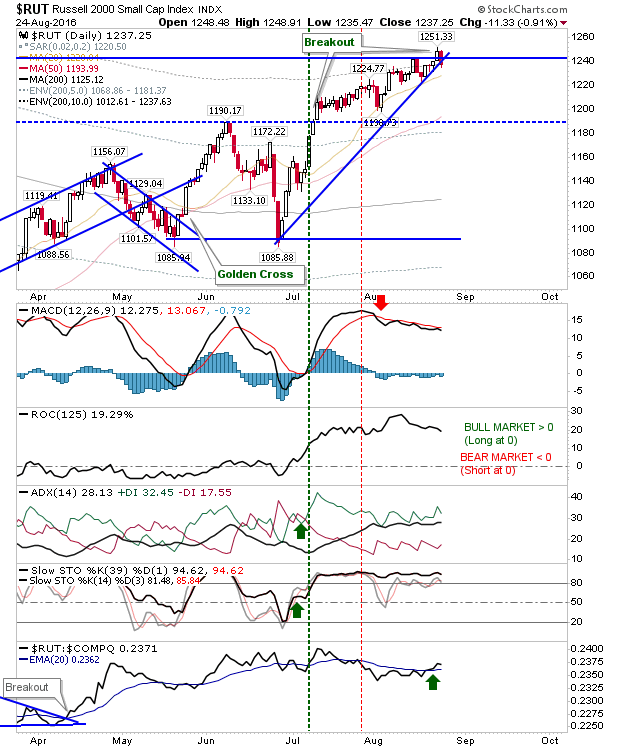

The Russell 2000 lost its breakout, but it didn't give up rising support. It hasn't yet tested its 20-day MA but it could do so on Thursday. Note, relative performance against the Nasdaq (and S&P) continued to improve.

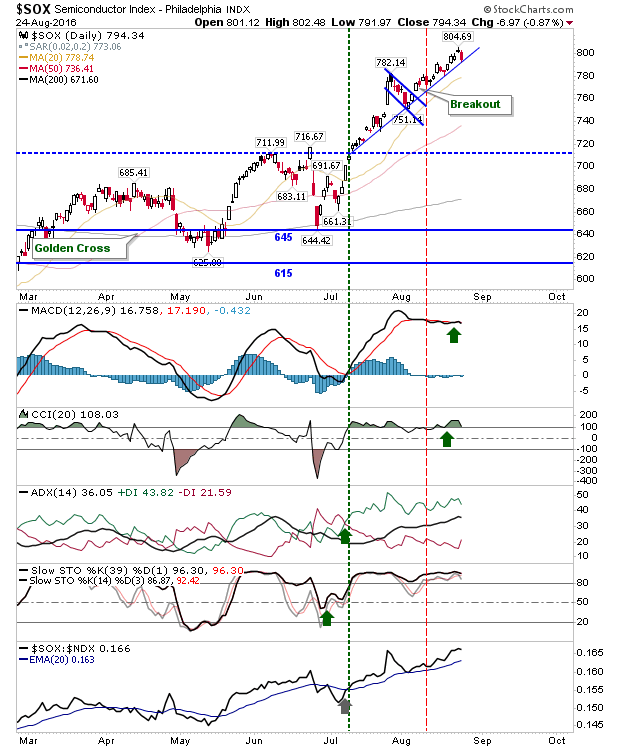

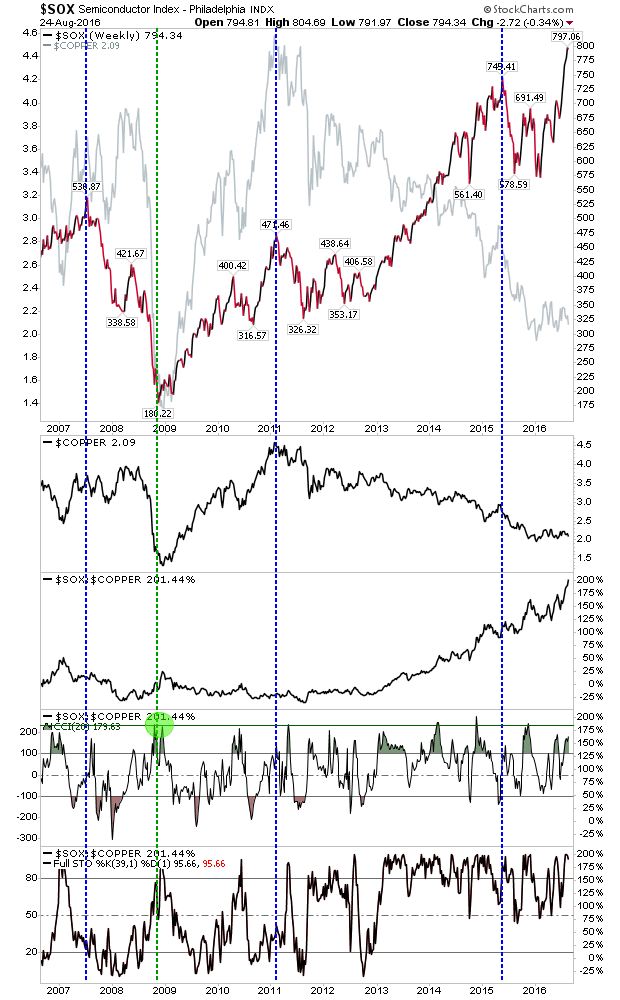

The Semiconductor Index is also feeling the pressure, but it hasn't given up support.

I have been fishing around copper for a play on the hourly chart. I thought I had a chance today, but it was stopped out. There is very little love for commodities, but copper is cheap and Semiconductors are performing well which should see demand for the metal improve. A swing low should emerge soon, but it may do so without me.

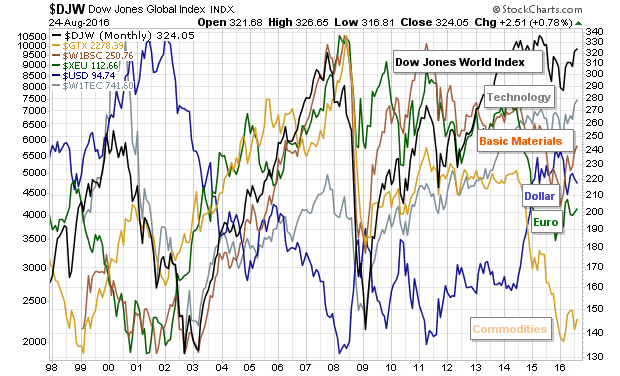

Commodities are at a deep discount to other global assets. If you can avoid the leverage, accumulating commodities could reap rewards in the years ahead.

Will Thursday offer something more?