Tuesday featured a modest but significant gain for the leading indexes, helping push the rallies into spike highs from Monday. Volume was lighter, so there was no accumulation, but there was some technical improvement.

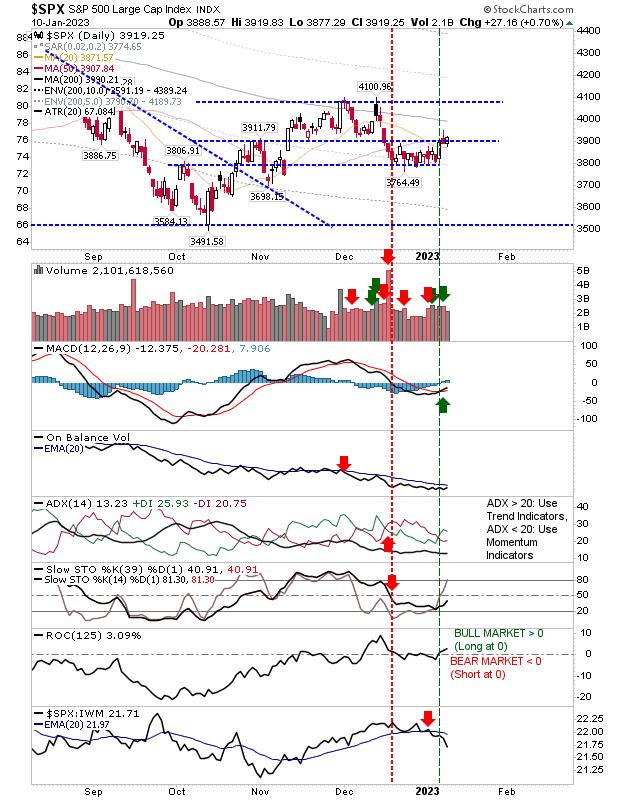

For the S&P 500, there was the MACD trigger 'buy,' as relative performance against the Russell 2000 took a nose dive. The index holds 50-day MA support and is well-placed to challenge the 200-day MA.

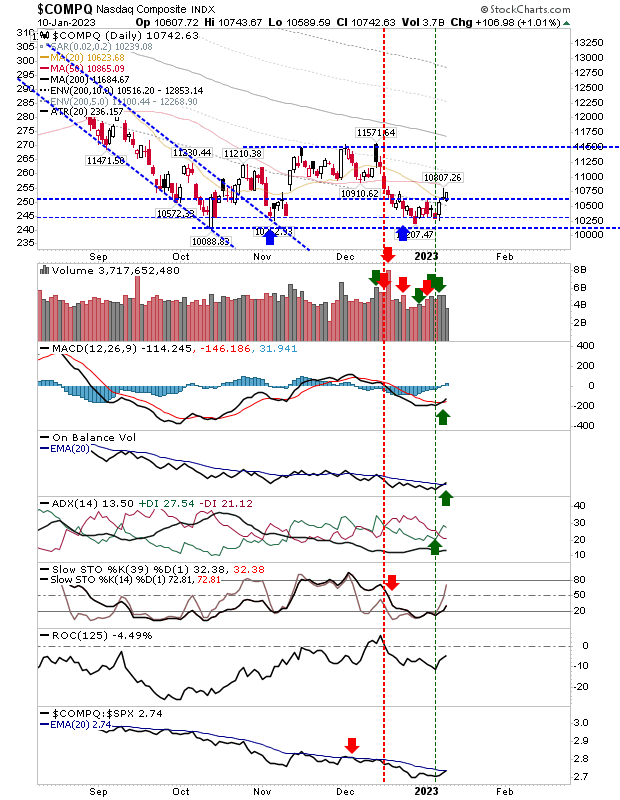

The Nasdaq 100 is forming more of a rounding bottom, challenged by 50-day MA resistance. Technicals are more bullish with 'buy' triggers in the MACD, On-Balance-Volume, and ADX. Momentum underperformance continues but getting out of oversold territory hasn't helped.

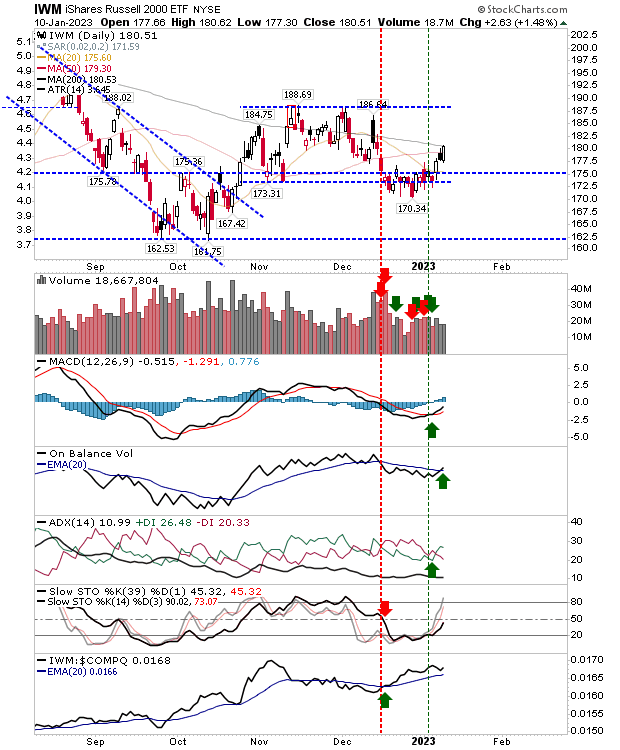

The Russell 2000 (IWM) enjoyed the best of the gains as it challenged its 200-day MA. It couldn't close above it, but it built on 'buy' triggers in the MACD, On-Balance-Volume, and ADX, along with outperforming the Nasdaq.

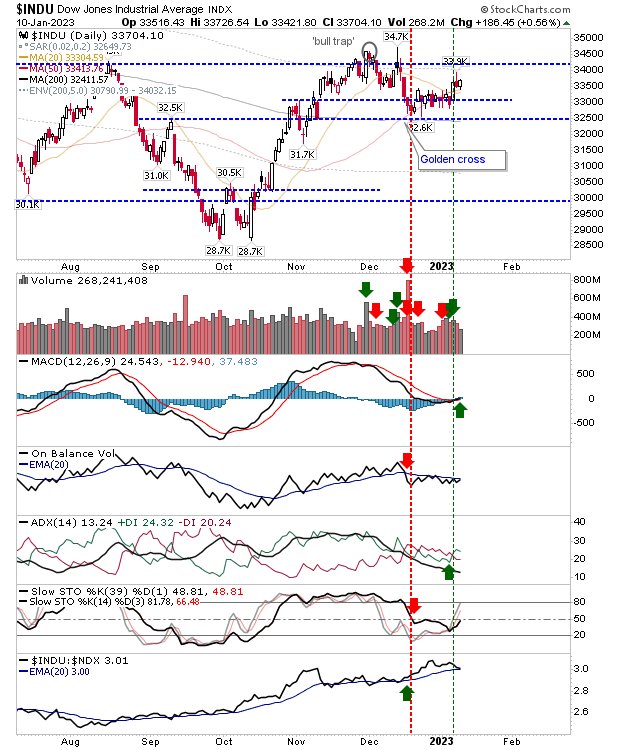

The Dow is also building a solid 'handle' in a cup-and-handle pattern. Interestingly, it's not as technically bullish as the Russell 2000, but it outperforms Tech averages and is the closest index to making new all-time highs.

For tomorrow, we want to see indices build on the challenge of yesterday's spike highs and negate the bearish implications of these candlesticks.

As a starter, I want to see closes above leading moving averages before knocking out November resistances. Early action for 2023 is positive, but there is much work to do.