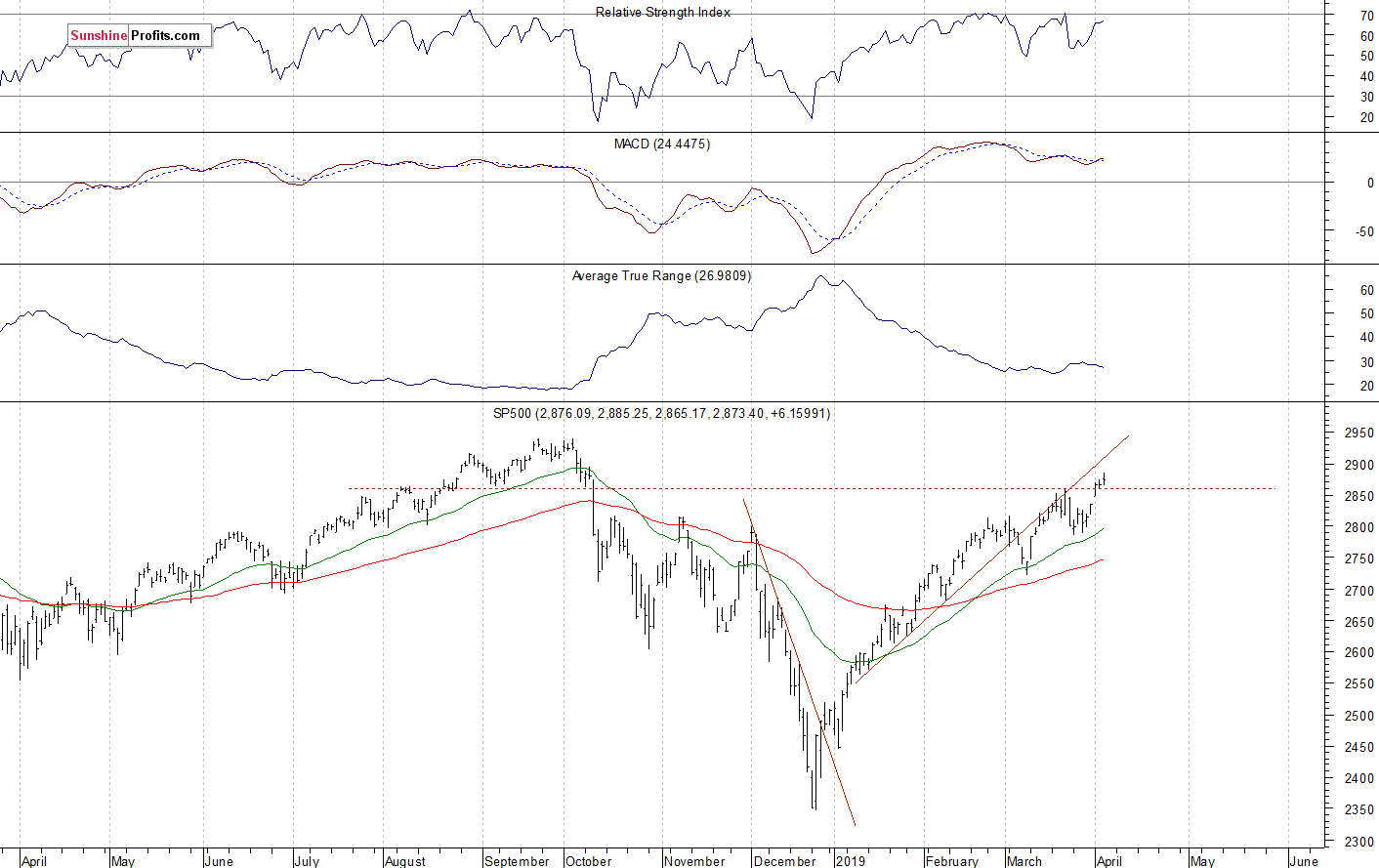

The U.S. stock market indexes gained 0.2-0.6% on Wednesday, slightly extending their short-term uptrend once again, as investors’ sentiment remained bullish following the recent rally. The S&P 500 index retraced more of its October-December downward correction of 20.2%. The broad stock market's gauge is now just 2.3% below September the 21st record high of 2,940.91. The Dow Jones Industrial Average gained 0.2% and the Nasdaq Composite gained 0.6% on Wednesday.

The nearest important resistance level of the S&P 500 index remains at 2,890-2,900, marked by some early October local highs. The next resistance level is at 2,920-2,940, marked by the mentioned record high, among others. On the other hand, the support level is now at 2,860-2,865, marked by some recent local lows. The next support level remains at 2,835-2,845, marked by the Monday’s daily gap up of 2,836.03-2,848.63.

The broad stock market retraced all of its December sell-off and it broke above the medium-term resistance level of around 2,800-2,820, marked by the October-November local highs recently. So is it still just a correction or a new medium-term uptrend? The market broke above the 61.8% Fibonacci retracement of the 20% decline. And we may see an attempt at getting back to the record high. There have been no confirmed negative medium-term signals so far. The index gets closer to its last October all-time high, as we can see on the daily chart:

Mixed Expectations Following Recent Rally

Expectations before the opening of today's trading session are virtually flat because the index futures contracts trade between -0.1% and 0.0% vs. their yesterday’s closing prices. The European stock market indexes have been mixed so far. Investors will wait for the Unemployment Claims number announcement at 8:30 a.m. They will also wait for tomorrow’s monthly jobs data release. The broad stock market will likely fluctuate following its recent rally. We may see some profit-taking action at some point. But there have been no confirmed negative signals so far.

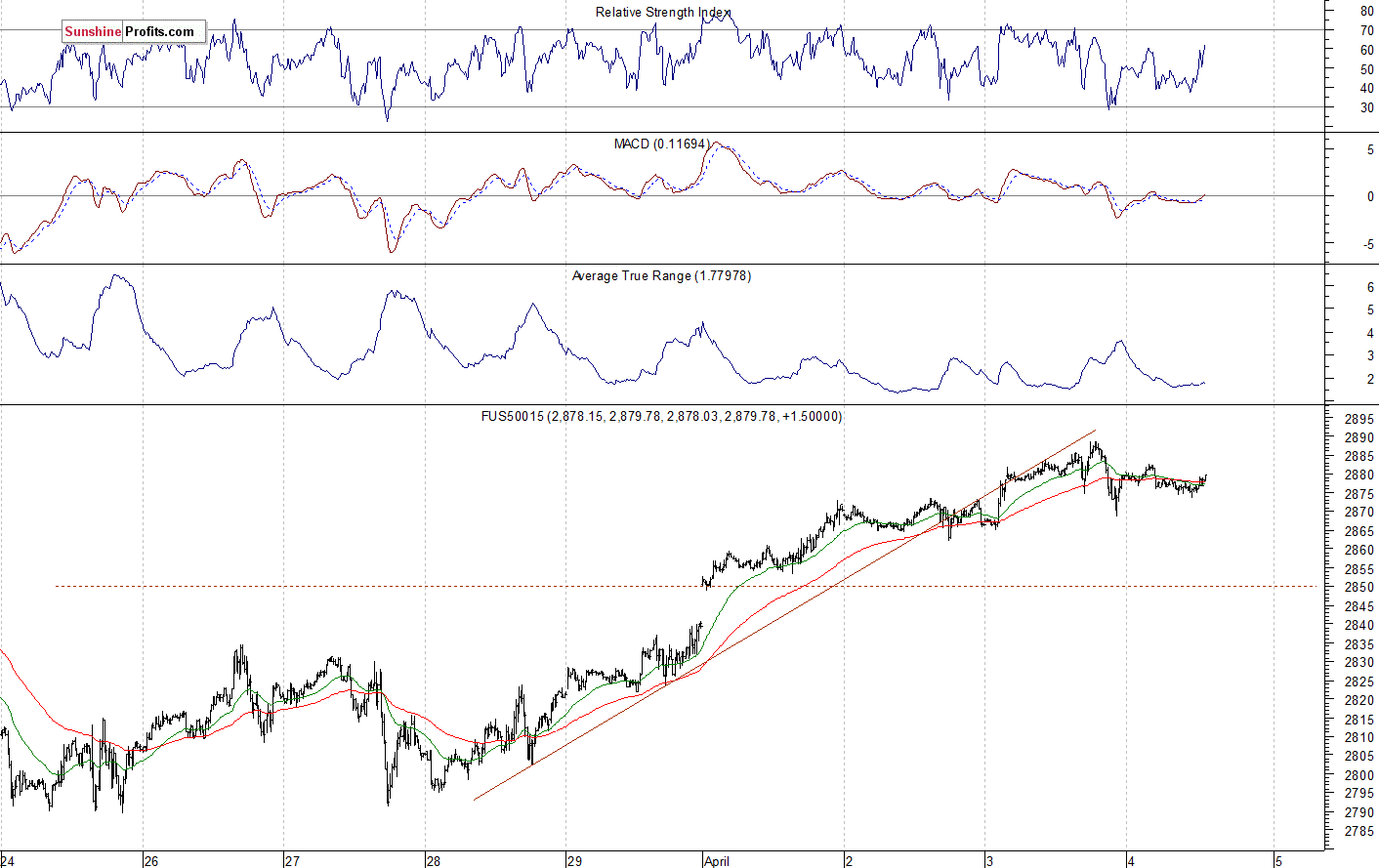

The S&P 500 futures contract trades within an intraday consolidation, as it fluctuates following its yesterday’s intraday decline. The nearest important resistance level is at around 2,885-2,890. On the other hand, the support level is at 2,870-2,875, marked by the recent resistance level. The futures contract goes sideways following breaking below the recent upward trend line, as the 15-minute chart shows:

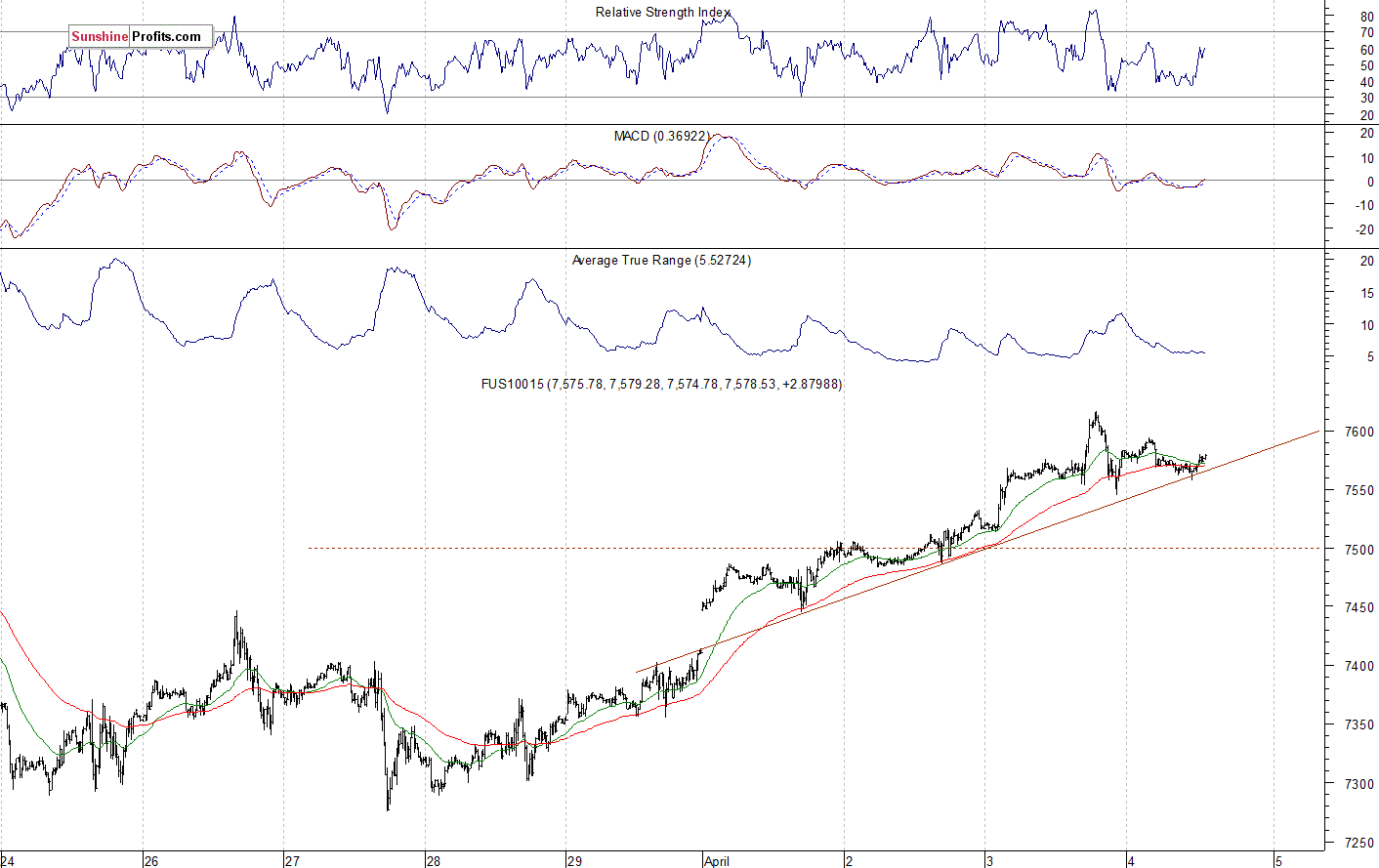

Nasdaq Slightly Below 7,600 Mark

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday consolidation. The market extended its medium-term uptrend yesterday, as it broke above the 7,600 level. It has retraced most of the late last year’s sell-off. The nearest important resistance level is at 7,600-7,650. On the other hand, the support level is now at 7,500-7,500. The Nasdaq futures contract continues to trade above its upward trend line, as we can see on the 15-minute chart:

Big Cap Tech Stocks – Apple (AAPL) Still Below $200

Let's take a look at the Apple (NASDAQ:AAPL daily chart (chart courtesy of http://stockcharts.com). The market broke above its recent local highs more than a week ago and then it continued above the $180 level. The stock accelerated the uptrend and it traded within a resistance level of $190-200. It is back at the resistance level again:

Now let's take a look at the daily chart of Amazon.com, Inc. (NASDAQ:AMZN). The price broke above its previous local high yesterday. So will it accelerate higher? We may see some short-term uncertainty, but overall the picture remains quite bullish:

Dow Jones – Short-Term Consolidation

The Dow Jones Industrial Average continues to trade at its February local high following breaking above the 26,000 mark. The blue-chip stocks’ gauge is close to resuming its medium-term uptrend. The next resistance level is at around 26,800-27,000, marked by the last year’s topping pattern and the record high of 26,951.8:

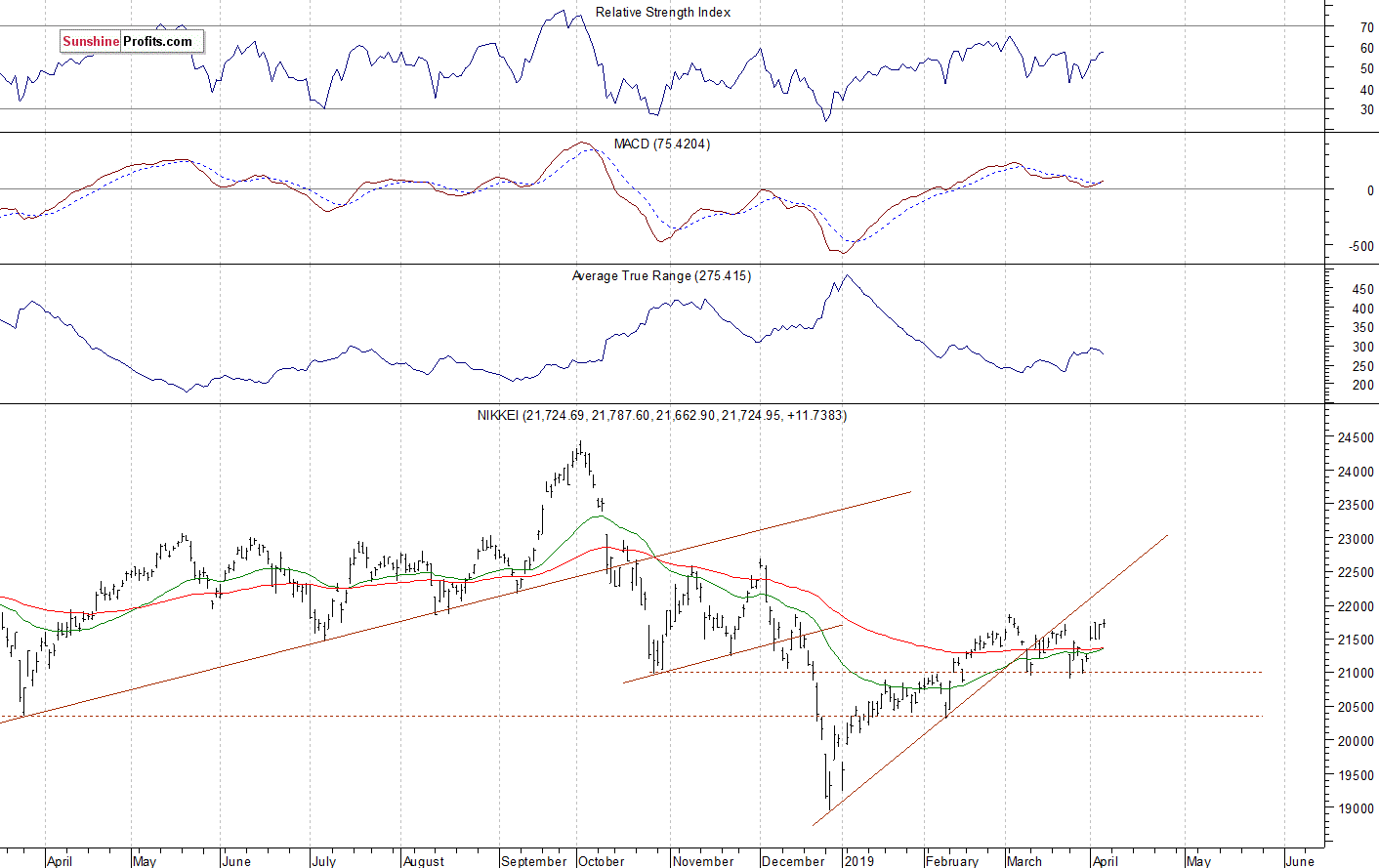

Nikkei Fluctuating Along the Recent Highs

Let's take a look at the Japanese Nikkei 225 index. It accelerated the downtrend in late December, as it fell slightly below the 19,000 level. Then it was retracing the downtrend for two months. In March the market went sideways. Recently the index got close to 21,500-22,000 again. It still looks like a flat correction following the January-February advance:

The S&P 500 index slightly extended its short-term uptrend yesterday, as it got the highest since early October. We wrote that the recent consolidation looked like a relatively flat correction within a three-month-long uptrend. And we were right. But will the market reach its last year’s record high? There may be some uncertainty, as the S&P 500 gets closer to the 2,900 resistance level.

Concluding, the S&P 500 index will likely open virtually flat today. There have been no confirmed negative signals so far. Investors will now wait for tomorrow’s monthly jobs data release.