It was a good week and an exceptionally good month in the markets.

The S&P 500 was up 9.1%. This was the best July since 1939. Conversely, it came on the heels of the 3rd worst June ever, down 8.4%.

We have continually illuminated for you that the market is made up of three important inputs. A change, positive or negative in any of these inputs, can result in the market rallying or taking a nosedive. These inputs are inflation, interest rates, and earnings. Let’s see what might have fueled this recent relief rally:

- Inflation: Negative and remains elevated.

Inflation is not coming down anytime soon. On Friday, the Personal Consumption Expenditure Index (PCE) came out with a much higher than expected annualized increase of 6.8. This is the highest PCE since 1982.

Ending in June, energy costs rose 43% for the past 12 months.

Food costs in June showed a rise of 10% for the past 12 months.

Grocery store costs in June showed a rise of 12% for the past 12 months.

However, energy and some commodities have come down, which served as a near-term positive for the stock market. Certainly, Friday’s market action was not disturbed by these very high numbers.

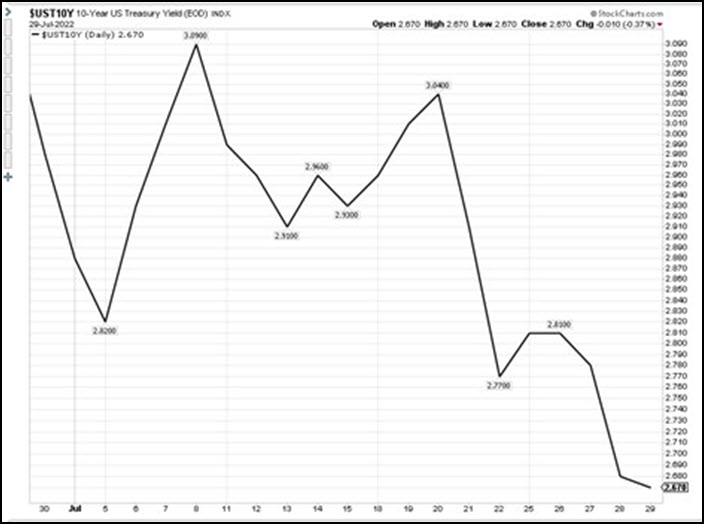

- Interest Rates: Positive and trending down.

This has clearly been the surprise recently especially given the Federal Reserve raising their key lending rate this past week by 75 basis points. After hitting 3.09% in early July, the US 10-year Treasury rate came down to 2.67% this week. iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) (20-year bond funds MarketGauge frequently uses) have rallied from 112 to 117 at the end of the month.

The rise in long-term rates reflects increased concern over future economic weakness, which was verified by the contraction of quarterly GDP numbers announced this past week. Many economists are forecasting a recession on the horizon (if not already… which is currently being debated).

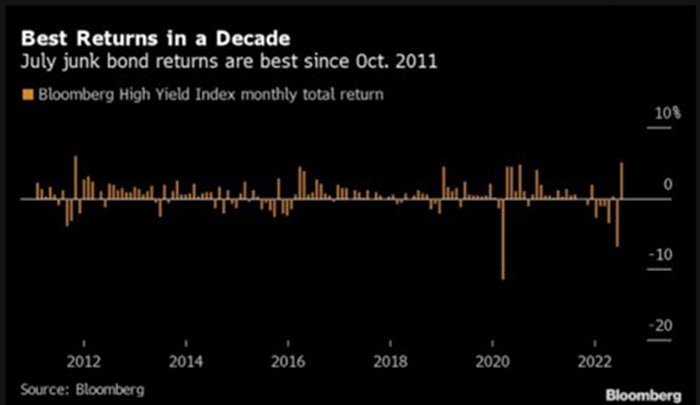

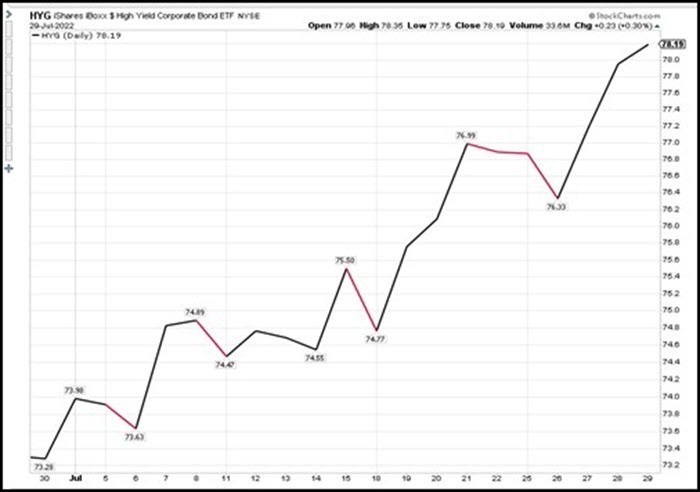

High Yield bonds (junk), an often-used proxy for risk on assets, had the best month (up 5.1%) since October 2011. See charts below:

- Earnings: Good and trending higher.

175 companies released their earnings this past week. Some good (Apple (NASDAQ:AAPL) & Amazon (NASDAQ:AMZN) beat estimates) and some not so good (Meta Platforms (NASDAQ:META), Microsoft (NASDAQ:MSFT), and Alphabet (NASDAQ:GOOG) all missed). As we have mentioned in most of our recent commentary, earnings are expected to grow by 4% or greater during 2022. According to FactSet, 56% of S&P 500 companies have reported their Q2 2022 results with 73% beating their earnings and 66% beating their revenues estimates.

Until we see a decline/contraction in earnings across the board, the economic weakness caused by rising Fed borrowing costs and higher inflation may be muted.

Last week (and throughout July), we told you our indicators were improving and that we had entered Risk On in several of our algo based investment strategies. In our coaching and certainly Mish’s recent appearances on National TV, we pointed to our indicators suggesting we were in for a mean reversion trade.

We were, at worst neutral on certain sectors and, at best, urging your attention to areas such as Consumer Discretionary and Technology. Here are a few of Mish’s recent TV appearances which echo the more positive sentiment. (Remember that we told you she had suggested purchasing ARKK a few weeks back - a bold forecast that the market could and would go into a Risk On rally mode).

A Tale of Different Cities

Due to a family situation, I found myself in Phoenix this past week. Here is a city that is being overrun with new residents. Today they announced occupancy of commercial buildings at just 2.6%; basically “full up.” They cite the migration of new residents pouring into the city and that there are 80,000+ new workers in the area over the past 12 months. Inflation in Pheonix is running the hottest in the US at 20%+ year-over-year. Rentals of apartments on average, went from $1500 a month to $2,300 a month. Housing prices increased by 23% YoY. Sales of resale homes are still taking less than a week, but there are no longer 5 bids over asking price. Still, this is quite different than Cleveland, where I live.

Cleveland, like much of the Midwest is seeing an abrupt slowdown. Apartment occupancies are starting to rise, and there is not much of a rate increase for the moment. Home sales have basically stopped as Cleveland and much of the area is much more dependent on mortgages which have risen from 3% (on a 30 year) to over 6%, a 100% increase in 8 months. Moreover, we are starting to see retail establishments and restaurants slow as people have to decide if they get gas or go out to dinner.

Interestingly, both cities share one distinct problem. Small businesses and restaurants are closing their doors as their landlords are raising rents putting them in a no-win situation of moving or closing down. In Cleveland, we see the latter.

News this past week in Phoenix also reported several long-standing businesses that have had to close their doors (after many decades in business). We suspect there will be more. It will be interesting to see how tourism in Arizona fares this coming winter. While the Super Bowl is being held there (yet again), there are rumors that some of the business conferences are canceling.

Looking Under The Surface

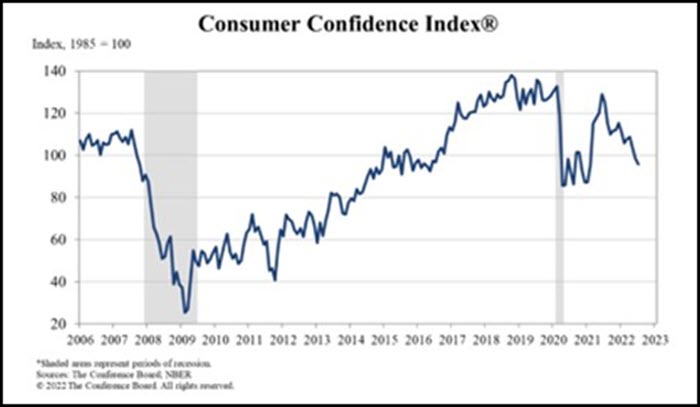

Here are a few more important economic indicators that convey to us that we should expect more volatility and a retest of the lower range on the markets in the next few months:

17% of consumers said business conditions were “good,” down from 19.5%

24% of consumers said business conditions were “bad,” up from 22.8%

50.1% of consumers said jobs were “plentiful,” down from 51.5%

12.3% of consumers said jobs were “hard to get,” up from 11.6%

Leading Economic Index (LEI)

The LEI is a weighted average of 10 indicators designed to show whether the economy is getting better or worse.

The leading economic index fell 0.8% in June, the US Conference Board said Thursday. Economists polled by The Wall Street Journal expected a 0.6% decline. This is the fourth straight monthly decline. Consumer pessimism about the outlook drove the index down along with falling stock prices (thru June), moderating labor market conditions, and weak orders for manufacturers.

Other Economic Signals

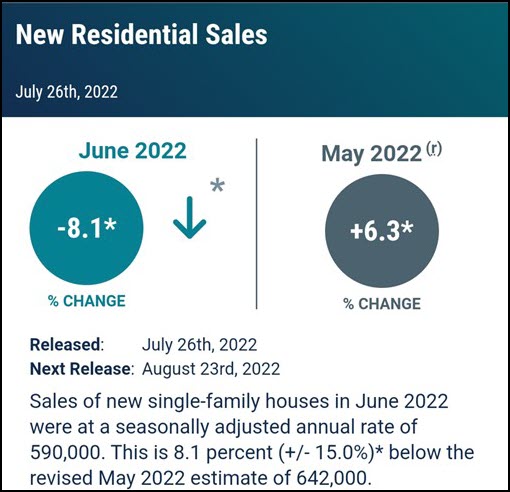

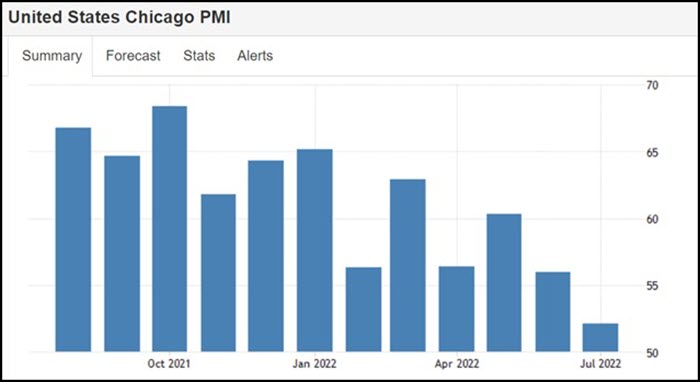

Fortunately, and certainly reflective of the market’s newfound momentum this past month, have been several important economic indicators with little change. These include Advanced Durable Goods Orders, Semiconductor Chip orders, and Advance International Trade Orders, all mostly flat to slight increases. However, two other areas are worrisome for economists and show significant weakness midway through 2022. See charts below:

Bad Is Good, Good Is Bad

As we have pointed out here (many times), bad news is now being construed as “good” for the markets. Weakness in economic numbers this soon in the Fed tightening cycle (and clearly because of much higher consumer prices) implies that the economy is slowing down. To an economist, this means that: 1) Fed action is already working; 2) higher prices are causing a natural demand destruction cycle, and most importantly; 3) The Fed may not have to remain hawkish, and this could lead to a “pause” in the hiking cycle. We have seen this as interest rates have come down quickly in the past few weeks.

Chicago PMI

More bad news. Given how negative the PCE and LEI numbers were (see above), Friday morning, the Chicago Purchasing Manager index came out weak, adding to data demonstrating how bad the economic numbers continue to be. Production hit a 2-year low and new orders hit a 25-month low. These indicators are clearly showing that we are headed for a recession if we are not already in one!

August Seasonality and Midterm Years:

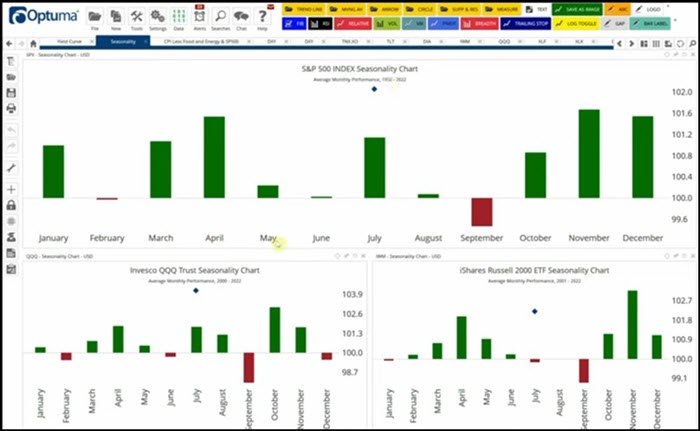

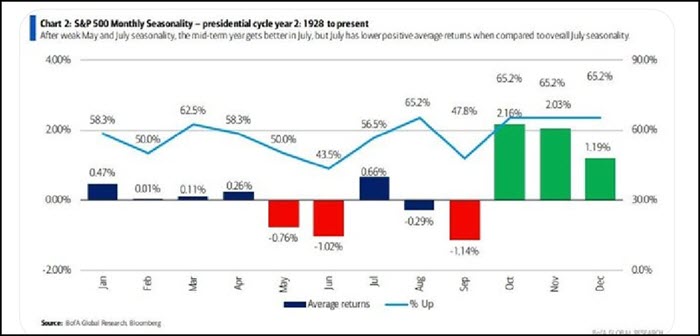

As you will see on the charts below, July typically is one of the better investing months in the stock market. This past month was no exception. However, August can be a different story.

Investors taking a vacation, portfolio managers getting away, lighter volume, and not as many earnings reports all contribute to August’s muted historical gains. As you will see, the NASDAQ (Tech heavier index) does a bit better.

Factor in additional influence from midterm election years, and August does not typically do well (nor does the next few months until the election is over). The confusion of who will be in charge in Congress, the heated rhetoric of one party telling you how poorly the other party is doing to attract votes, and confusion on the state of the economy all contribute to this period’s poor performance. Add high inflation, uncertain interest rates, and disappointing earnings, and you can have a recipe for enhanced volatility. It appears that much of the historical midterm market behavior is playing out closely. See the midterm chart below:

What Now?

We highly recommend that you put these suggestions into your financial game plan for the immediate future:

- Do not get overzealous about putting all your investment $ to work. This may be a bear market rally. These rallies can and do resemble a new starting point but rarely are a new bull market.

- Make sure you implement STOPS and TARGETS, especially if you are following MarketGauge strategies where they are already laid out for you.

- Watch the risk indicators. This market can (and probably will) turn in a very short time (days, not weeks). The underlying economic scenario does not yet paint a perfectly bullish scenario (see above). Therefore, it is important to be disciplined.

- Stay unemotional if possible.

- Sell losers, put no-loss stops on winners and be less concerned about paying taxes.

- Develop a trader’s mentality. Follow Mish.

- If you are not already, incorporate other MarketGauge strategies. You may not be aware that we have 6 current investment strategies (including Mish’s Premium and CryptoPulse) that are positive on the year (some in double digits).

Here are this week’s Big View summary points taken from our all-important Friday afternoon Investment Committee (IC) meeting.

Risk On

- The Key Indexes managed to surge higher despite a potentially risky week dominated by mega-cap tech results and the Fed’s rate hike of 75 basis points to combat inflation. (+)

- All major indexes had a positive week, ending the week and month with big gains. All key Indexes closed above their 50-day moving averages, a considerable technical bullish improvement this week, and the Invesco QQQ Trust (NASDAQ:QQQ) has a positive slope. (+)

- For July, iShares Russell 2000 ETF (NYSE:IWM) ended up 9.7%, the NASDAQ 100 up 11.2%, and the S&P 500 was up 9.1%. (+)

- Regarding sector leadership, the only sector down for the week was Granny retail -0.2%. However, consumer discretionary 5.2%, semiconductors 4.6%, technology 4.1%, utilities 6.5%, and energy led with 10.2% gains. Energy leading indicates continued inflationary pressure. Overall seeing the broad participation as bullish (+)

- 13 of the 14 sectors we follow closely were positive for the week. Considering only one sector was marginally down, this is primarily bullish. (+)

- The global macro picture was led by alternative energy and oil sector, with solar (TAN) up 18.8% for the week, oil services (OIH) up 14.5%, and clean energy (PBW) up just under 14% for the week. This bullish action occurred despite two-quarters of negative GDP growth confirmed earlier in the week, which is widely regarded as a recession, and with a further 75 bp rise. (+)

- In terms of volume analysis, more accumulation days are showing across the board in all the key indices. (+)

- The S&P 500 moved sideways and then up, and the number of stocks above their 10 and 50-day moving averages improved. The S&P 500 new high/new low ratio has improved. The S&P 500 cumulative advance/decline line improved and has broken out of a base. (+)

- Interest rates stabilized across several areas of the yield curve. The takeaway from the bond market is that the Federal Reserve might not have to be as aggressive with future rate hikes as initially thought. (+)

- Growth stocks (VUG) outperform value stocks in all time frames (VTV). (+)

- The Dollar (UUP) is in the process of mean reverting daily and weekly to the downside from overbought levels but could initially find support 2% to 3% lower from the current price. The US dollar mean reverting will be a positive catalyst for equities and commodities. (+)

Risk Off

- The IWM, the S&P 500, and the QQQs are all overbought based on price and real motion on their daily charts and subject to mean reverting. (-)

- The McClellan Oscillator for the S&P 500 is extremely high. The McClellan Oscillator for the NASDAQ 100 is also extremely high (-).

- The NASDAQ 100 market internals, the up-down vol ratio for NASDAQ 100, and the cumulative advance/decline line point to a potential weakening in the uptrend. (-)

- The number of stocks within Grandpa IWM trading above their 10 and 50-day moving averages decreased. (-)

- The yield curve inverted even more with the 75 bp hike by the Fed. Investors bought bonds again, lowering the 10-year Treasury yield by 5 basis points to 2.63%. (-)

- Foreign equities were choppy and down; emerging markets led to the downside, with China leading the way. EM is in a bear phase, including EFA, pointing to overall global stock market weakness and could be a drag on US stock indices. (-)

Neutral

- Risk gauges remain 100% positive on a short-term basis, while longer-term, they have more of a neutral reading. (=)

- All six of Mish’s Modern Family index members improved this week and are in a recovery phase, with semiconductors leading with 4.6% and Grandma retail lagging by -0.2% for the week. (=)

- The prices of most commodities rose this week, including energy, metals, and agricultural products. Many of the supply uncertainties that drove prices higher earlier this year remain, indicating higher inflation. (=)