Yesterday's action ranked as bearish cloud cover after last week's bearish reversal. However, as these reversals came in beneath last week's highs the significance of this selling is less. Volume was also lighter.

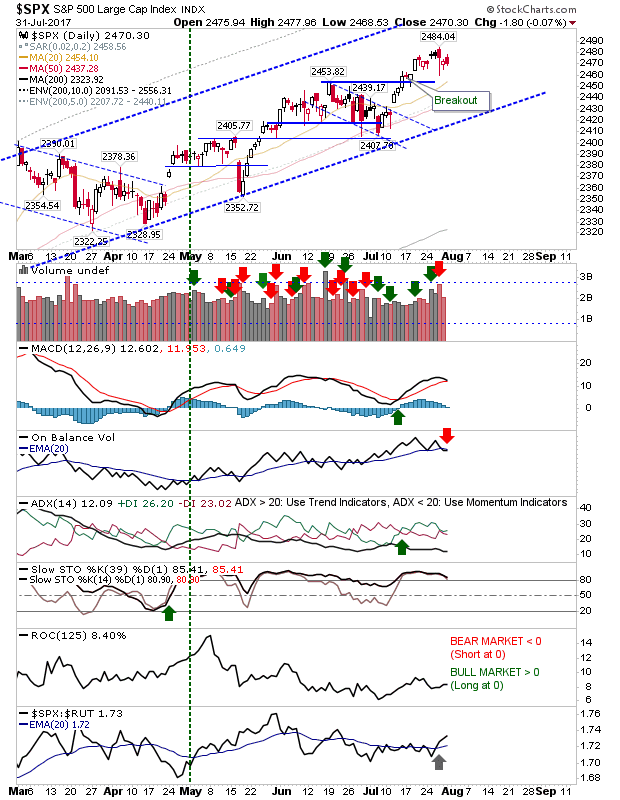

The S&P triggered a 'sell' in its On-Balance-Volume but it's well above breakout support.

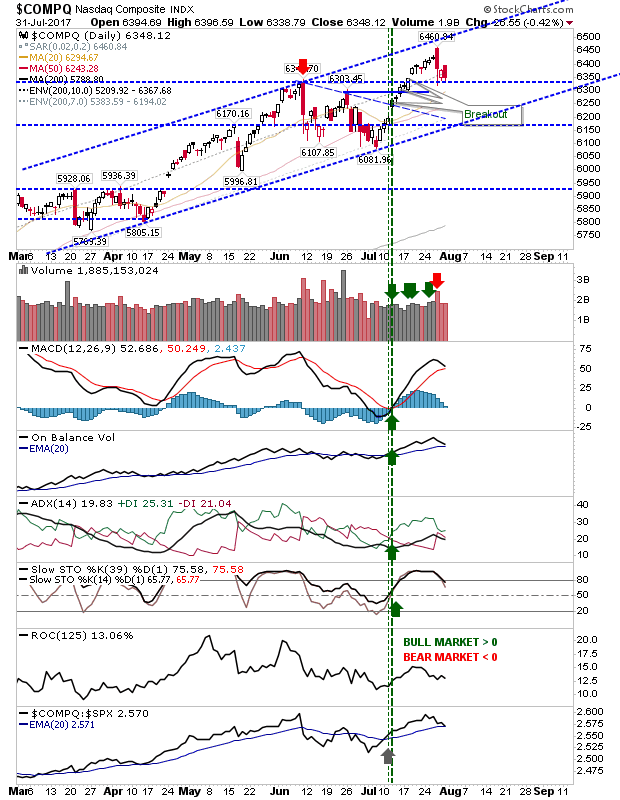

The NASDAQ just about claimed a bearish engulfing pattern but held 6,345 support. More worryingly, there is a shift in relative trend strength against Large Caps. Today is a chance for aggressive long players to take a punt but yesterday's action suggests 6,345 support won't hold.

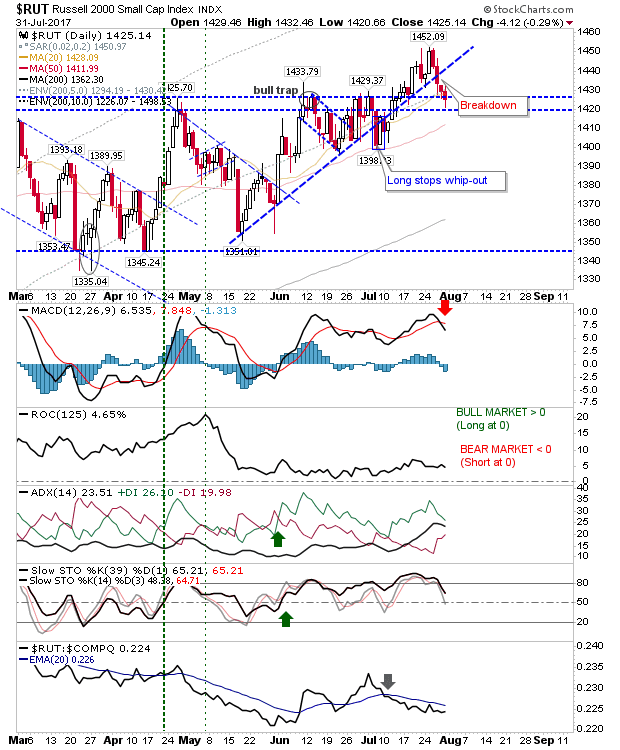

The Russell 2000 didn't stop at its 20-day MA as it may have done after recent selling. Instead, it continues its path towards its 50-day MA but has at least 1,420 support to work with. As with the NASDAQ there is an opportunity for aggressive longs to take a position here; although stop placement is more tricky with 1,400 next support beyond the 50-day MA.

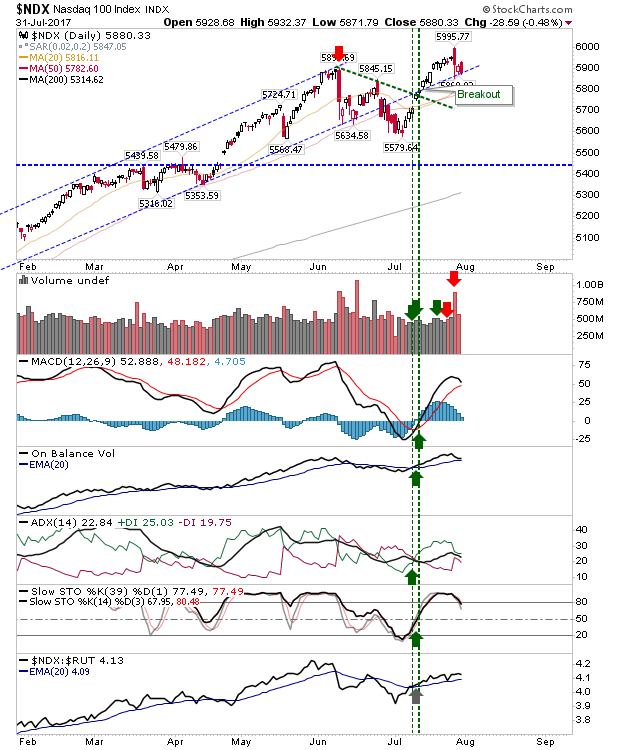

As with the NASDAQ, the NASDAQ 100 is resting on (what was) channel support. Technicals are all still net bullish and relative performance against Small Caps is still positive.

For today, bulls may have to hold their nose but there is a support opportunity in play which may give day traders - if not swing traders - a chance to profit.