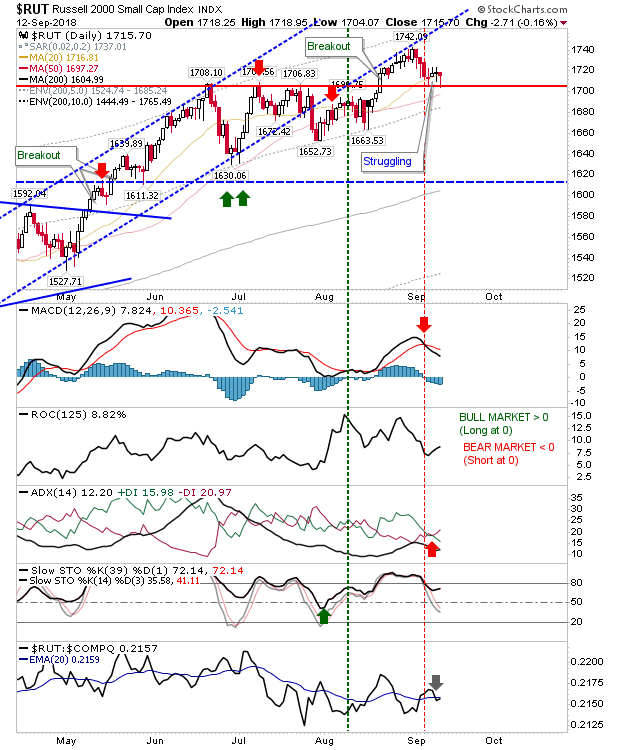

The last few days have been tricky. The bounce in the Russell 2000 off the 20-day MA and key support of 1,705 has struggled to follow through on what should have been a strong support test. Technicals are a bit of a mixed bag with 'sell' triggers in +DI/-DI and MACD.

Yesterday's 'doji/hammer' is perhaps the last chance saloon to see something happen here. A lower close later today, Thursday, will likely see a break of 1,705.

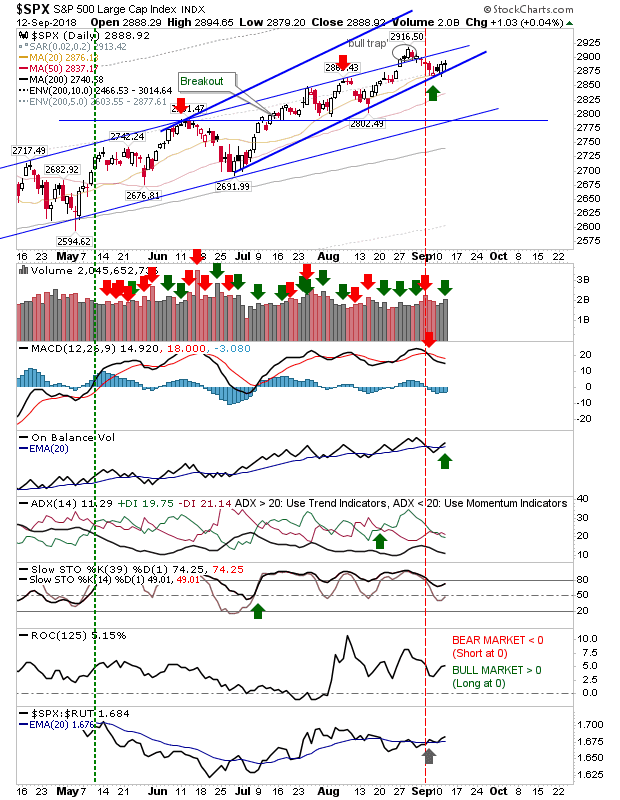

The S&P is running along accelerated channel support but the sequence of doji despite higher volume accumulation suggests a lack of interest on the part of buyers. Until support breaks, bulls have it but it's not a convincing 'buy' at this point.

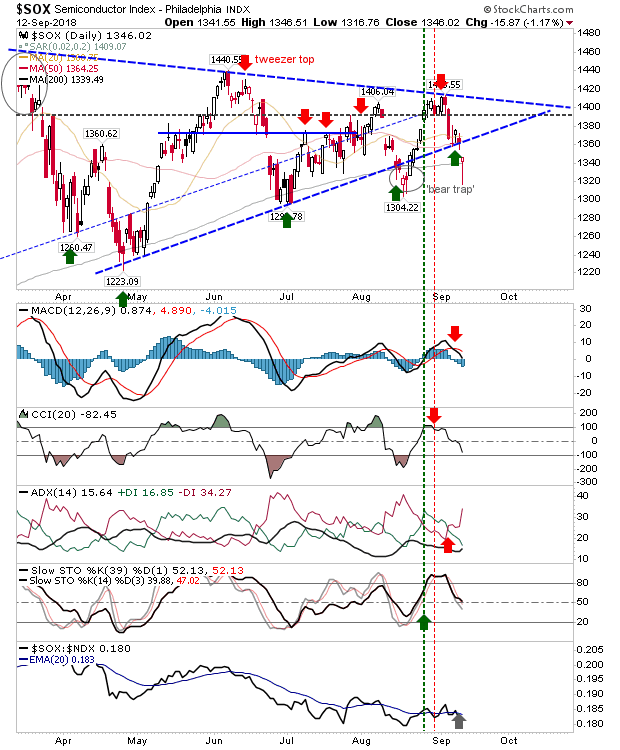

The Semiconductor Index enjoyed a big bullish 'hammer' on the 200-day MA but in doing so it gapped below the consolidation. It needs a rally today - one which would create a bullish morning star. Any losses during today's session and a breakdown would be confirmed.

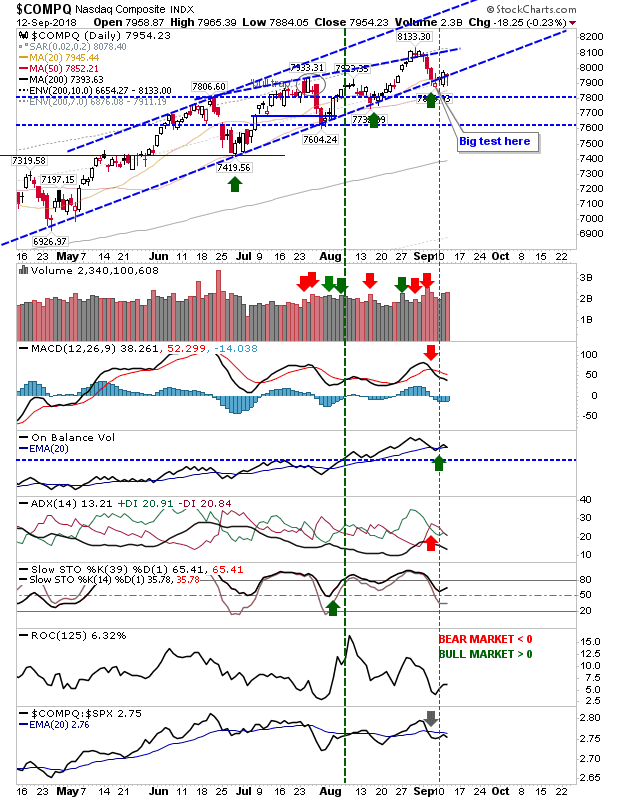

The NASDAQ did a little better than the Semiconductor Index yesterday at holding channel support. The bounce hasn't yet emerged but it's not too late for this to happen.

For today, look for a day of gains, one which would confirm the swing lows and act as a meaningful start point for a rally. Losses on the other hand would open up the possibility of larger declines as summer rallies would be confined to history. From a trade perspective, it's a hold, but if you insist on buying then use a loss of Friday's lows as a stop as markets may struggle with a drop into prior price action.