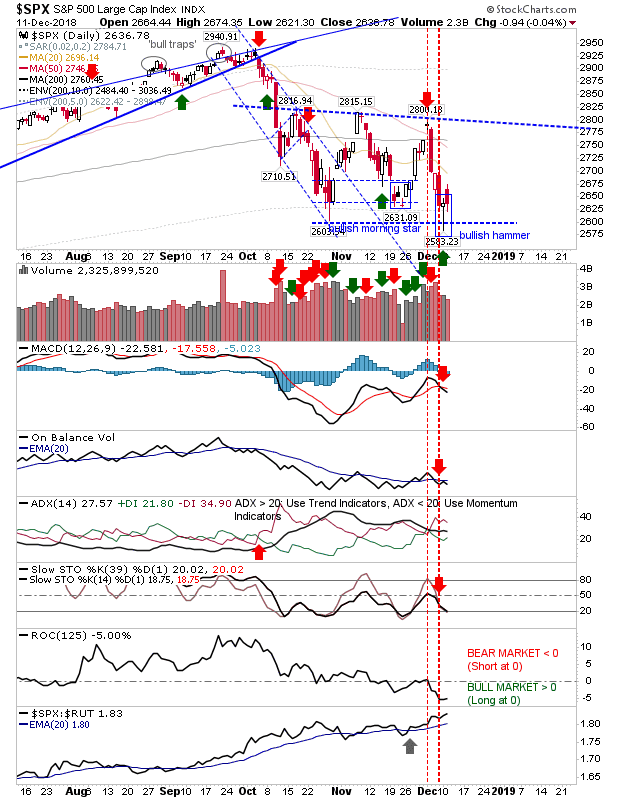

It was a good finish for bulls on Monday but yesterday there was a lack of follow-through on what should have been a good day for buyers. However, damage was still relatively light. Technicals for the S&P reverted to a net bearish state as other indices lost ground.

The S&P cut into Monday's spike low but not enough to negate the bullish hammer. I would look for another spike low and would measure risk on a break of 2,580.

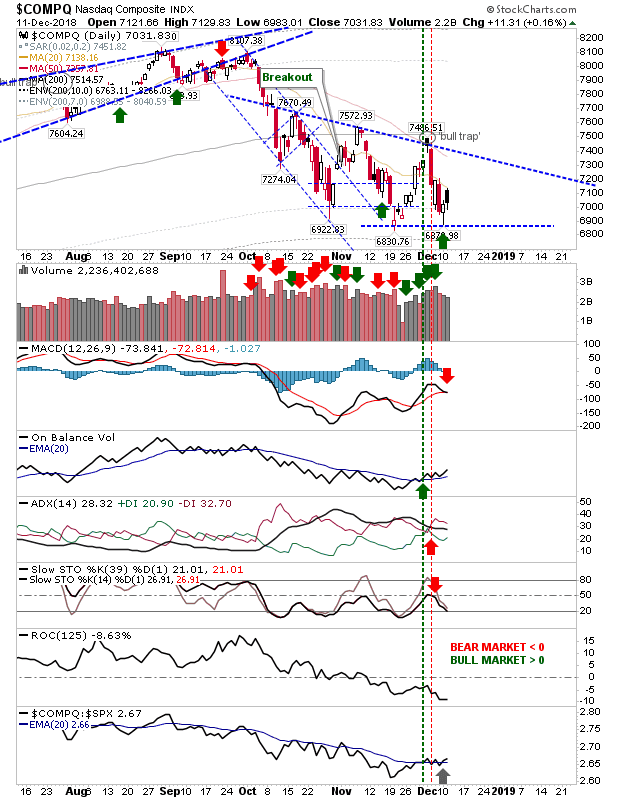

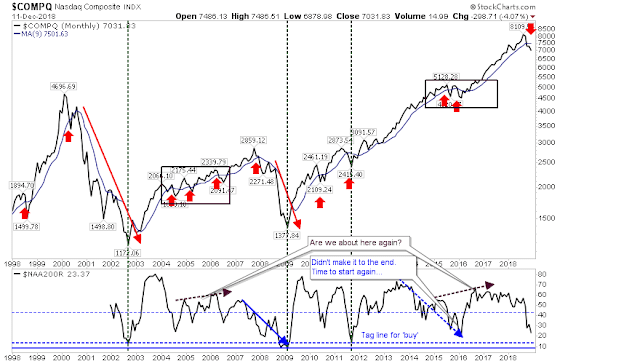

The NASDAQ closed with a 'black' candlestick, typically a bearish candlestick. Volume was at least lighter although there was a MACD trigger 'sell'. On the good news front, relative performance to Large Caps ticked higher so the index may start to benefit from some sector rotation.

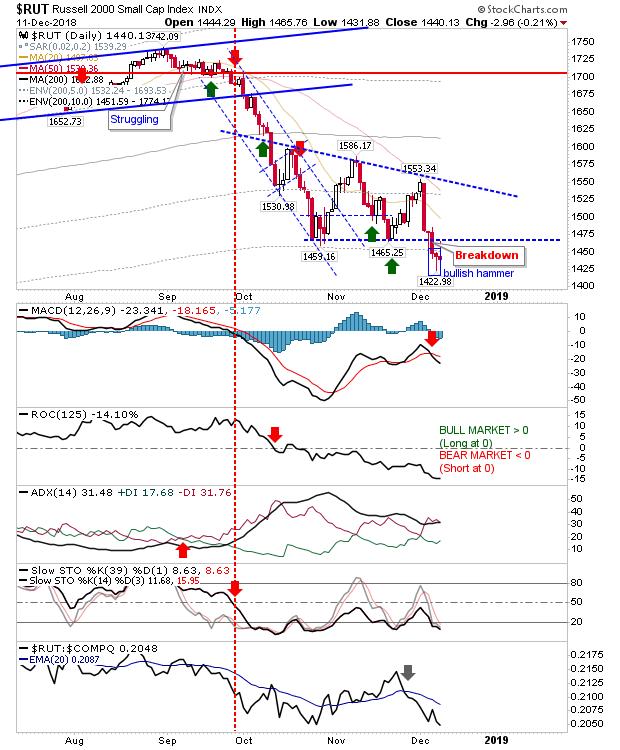

The Russell 2000 was the only index to undercut Monday's low before it managed a recovery. Yesterday's candlestick finished as a neutral 'doji' but there should be good support at 1,420 which will help bulls looking to fish for orders near the lows of the last couple of days. Traders should watch this closely, there is potential for a decent long trade.

Investors can keep buying here as markets remain in an accumulate zone, with the Russell 2000 down in the 10% block of historic underperformance relative to its 200-day MA.

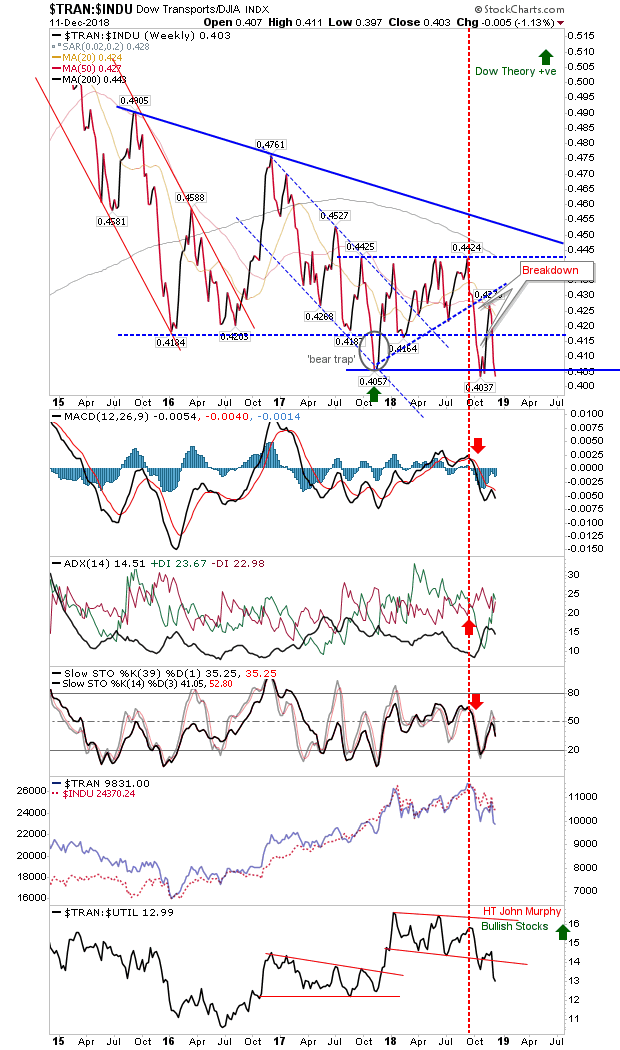

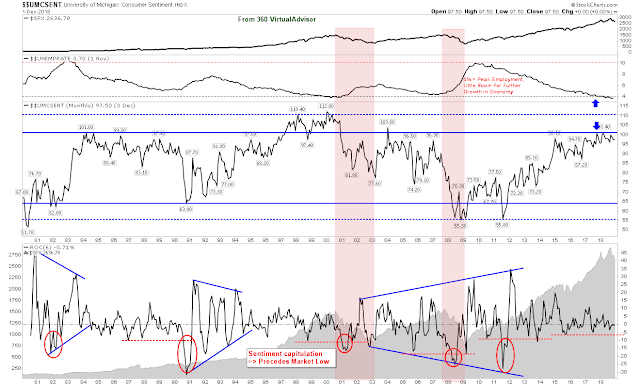

Longer term charts are looking more onerous. The performance of the relative relationship between the Dow Jones Industrial Average and the Transports Index has swung back to bears—the ratio is trading at horizontal support but is looking vulnerable to a breakdown. This relationship has been struggling since 2015; the economy is not shipping the number of goods required to keep it afloat; recession beckons.

The monthly S&P is on a 'sell' trigger but the percentage of S&P stocks above its 200-day MA has not reached a buy zone yet.

U.S. unemployment has nowhere to go but up. Consumer sentiment is not looking great either.

Trouble all around with a weak President to lead. How long before things turn into a rout? Investors should keep dipping their toes on the buy side but further losses still look likely.