Wednesday November 9: Five things the markets are talking about

History in the Making without Clinton

Polls, media, markets and the rest of the world got it wrong – Donald Trump has become the 45h President of the United States.

It’s a stunning and shocking victory that’s going to take investors and dealers awhile to adjust to, a powerful rejection of the establishment forces, from the world of business to government.

A republican win was always going to have a massive negative effect on the market, but the extent, depth and magnitude is never going to be easy to calibrate – this shock will take some time.

The worst of the “risk-off” overnight moves have been completed. The markets partial “risk-on” bounce has occurred since the new President’s victory speech said that “America would deal fairly with countries that deal fairly with it” – the key will be his definition of “fairly.”

Trump’s inexperience in policymaking and unpredictability in style will surely spell greater uncertainty over time.

1. Stocks scale back negative knee jerk moves

After initially sliding the most since June’s shocking Brexit vote to leave the EU, European bourses in particular, have managed to pare back some of their losses that started with Asians stock rout.

Japan’s Nikkei Stock Average shed -5.4%, its biggest loss since Brexit, as USD/JPY fell to an intraday low of ¥ 101.19. Hong Kong’s Hang Seng Index finished -2% lower (after being down as much as -4%), India’s main bourse lost close to -2% (after shedding around -6%).

In Europe, markets initially carried on Asia’s rout with Germany’s DAX shedding -2.7% while markets in Spain and Italy shed over -3%. However, their losses have since moderated with the Stoxx Europe 600 trading down just -0.8% and FTSE100 clawing to parity as commodity and mining stocks trade sharply higher and both oil and commodity prices “bounce”.

After initially sliding the maximum allowed, S&P futures have dramatically pared their declines to -1.8% ahead of the U.S open.

Indices: Stoxx50 -1.0% at 2,992, FTSE +0.1% at 6,849, DAX -0.5% at 10,430, CAC-40 -0.7% at 4,445, IBEX 35 -1.6% at 8,796, FTSE MIB -1.2% at 16,616, SMI +1.3% at 7,845, S&P 500 Futures -1.8%

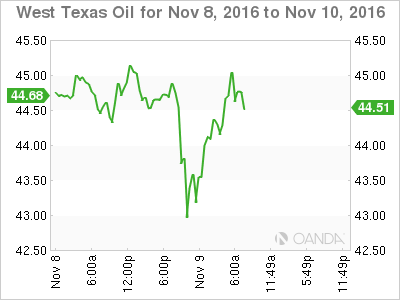

2. Oil prices slip under $46 on risk-off mode

With Brexit deja vu occurring stateside, both geo-political and political uncertainty is creating a price vacuum in the various asset classes and energy prices are no exception – crude prices are on the back foot with Trump’s surprise victory.

Brent crude fell almost -4% in Asian trading on initial early results, although it has managed to recover some of its earlier losses.

Currently, Brent futures are down -47c at +$45.57 a barrel, having traded intraday as low as +$44.40, the weakest print since August 11. West Texas Intermediate (WTI) is down -50c to +$44.48 ahead of the open stateside.

Once dealers can get a handle on the overnight fallout, only then will the market shift its focus to OPEC’s meeting at the end of the month (November 30).

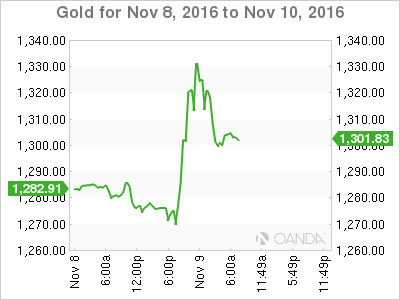

In commodities, many had expected gold to be more of a “risk-off” coveted asset. The precious metal has managed to pare its biggest surge since the U.K.’s Brexit vote in June as an investor’s rush to haven assets has since subsided a tad.

Bullion for immediate delivery was +2% higher at +$1,300.80 an ounce, compared with a gain of as much as +4.8% in panic overnight trading.

3. Bonds – Trump steepens U.S. curve

Initial reaction from fixed income dealers is that Trump’s victory means the Fed is unlikely to go through with its long-awaited “token” rate hike next month.

Why? The Fed has been very vocal about external economic sentiment and the Republican victory across the board (both Houses) will have other G10 central banks recalibrating their own monetary policy requirements.

Currently, the fed fund futures odds have fallen to +47% from yesterday’s close of +82%.

Trump’s victory has steepened the U.S curve. Long-bonds or 30-year bonds have backed up +18bps to +2.80% while five-year debts yield has fallen -4bps to +1.37%. The benchmark U.S. 10-year yield has climbed +10bps to +1.96%, just shy of the markets psychological +2% medium target and this after falling to an overnight low yield of +1.71%.

4. “Mighty” Dollar rises from its lows, for now

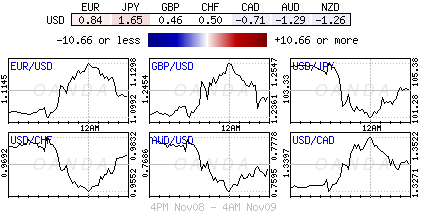

Ahead of the open stateside, the dollar index is currently trading -0.6% lower at 97.28 after Donald’s win. Bouncing back from its one-month low print overnight of around 95.89.

The safe-haven JPY and CHF have been some of the main overnight gainers and this despite the strong rhetoric of possible intervention from either central bank (BoJ and SNB).

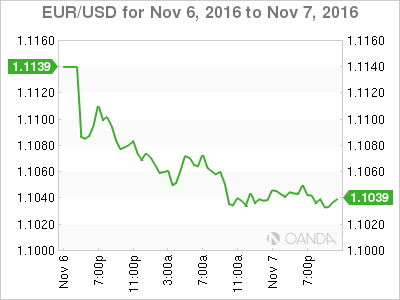

USD/JPY is trading down -1.5% at ¥103.44, having dropped to a one-month low around ¥101.194. USD/CHF hit a three-month low of around €0.9550, but has since recovered to trade atop of €0.9751. Europe’s single unit has also gained, with EUR/USD trading north of €1.1100, having earlier hit a two-month high €1.1305.

The biggest loser is no surprise; MXN has been the worst performer. The peso managed to plummet to a new record low at $20.78. However, it has since pared back some of those losses to trade at $19.91. Other higher-yielding currencies have also fallen, ZAR has weakened -2.3% while KRW is down -1.3%.

5. Riksbank to ease further?

The Minutes this morning from Sweden’s central bank indicate that are ready to ease monetary policy further in order to boost inflation, but a number of policy voters seem uncertain of how big an impact any further stimulus would have on their own economy.

Comments from Deputy Governor Per Jansson indicate the probability for a -10bps rate cut in the Riksbank’s forecasts has increased to +60%, with an extension to the asset-purchase program considered a done deal. Dealers now see a cut to -0.6% from -0.5% coming next month.

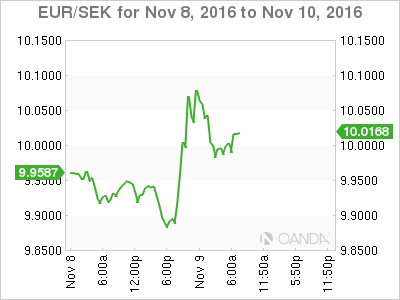

The unexpected Trump victory in the U.S. elections certainly increase market uncertainty on the economic outlook, and with that, both Tier 1 and 11 central banks will most likely need to recalibrate their own monetary policies – EUR/SEK trades atop of €9.99.