Investing.com’s stocks of the week

Early morning selling on Thursday was reversed by the close to leave markets in a stable position and their rallies intact.

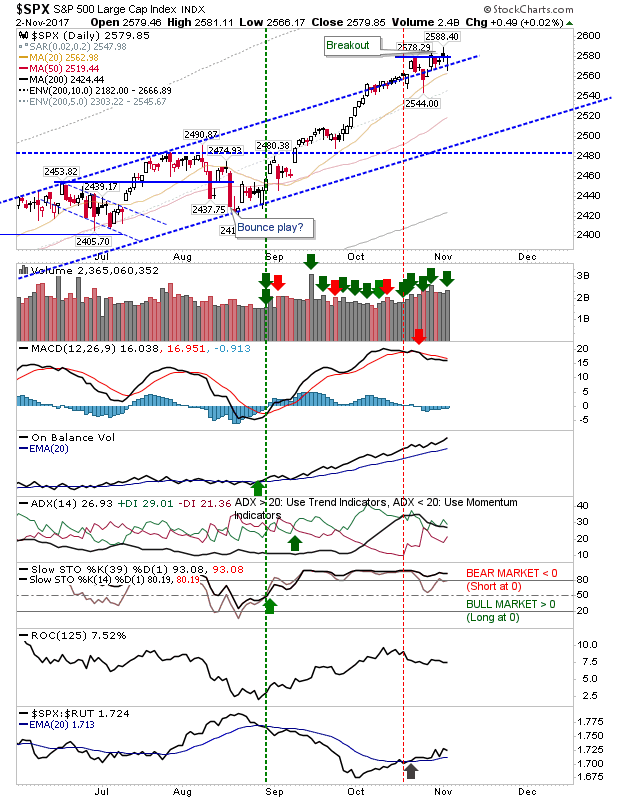

For the S&P, the risk of a 'bull trap' was negated with a return to support on higher volume accumulation. The recovery wasn't enough to reverse the MACD trigger 'sell' but any upside on Friday would probably be enough to trigger a new 'buy' signal in this indicator.

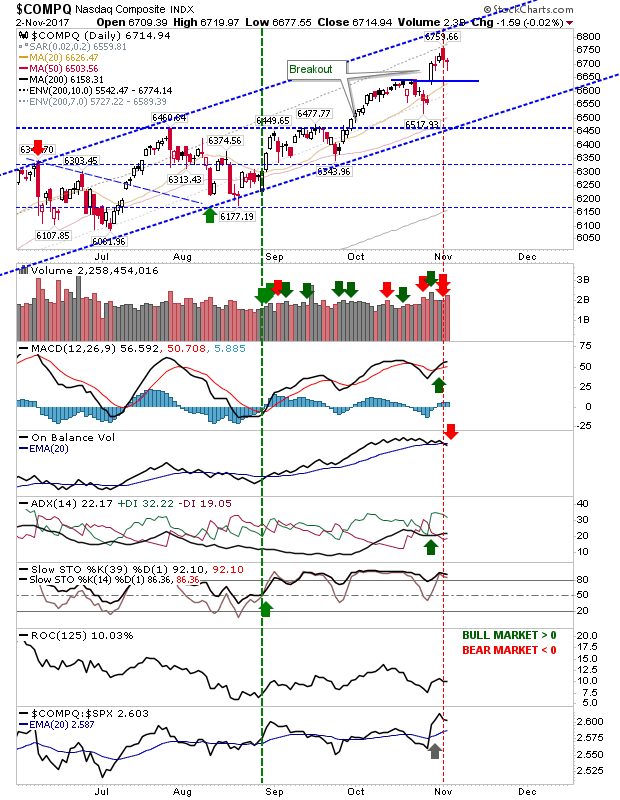

The NASDAQ is some way from testing nearest support which will keep some technical traders away. Opportunists may see Thursday's action as a pullback 'buy'. It's not a long-term buying opportunity but a trade to rising channel resistance may still be in the offering. There is a 'sell' in On-Balance-Volume to mute Thursday's action.

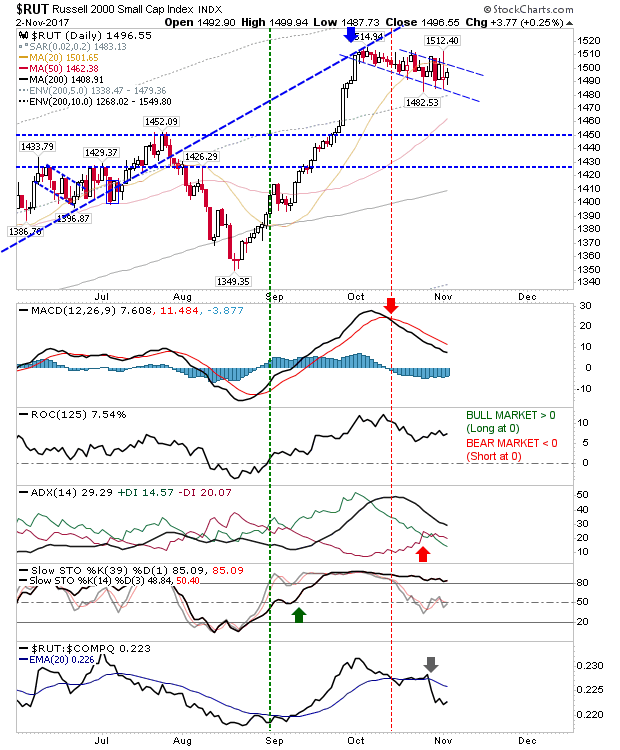

The Russell 2000 remains in its 'bull flag' formation awaiting a cue to break the consolidation. A test of the 50-day MA looks a good opportunity to spark such a breakout.

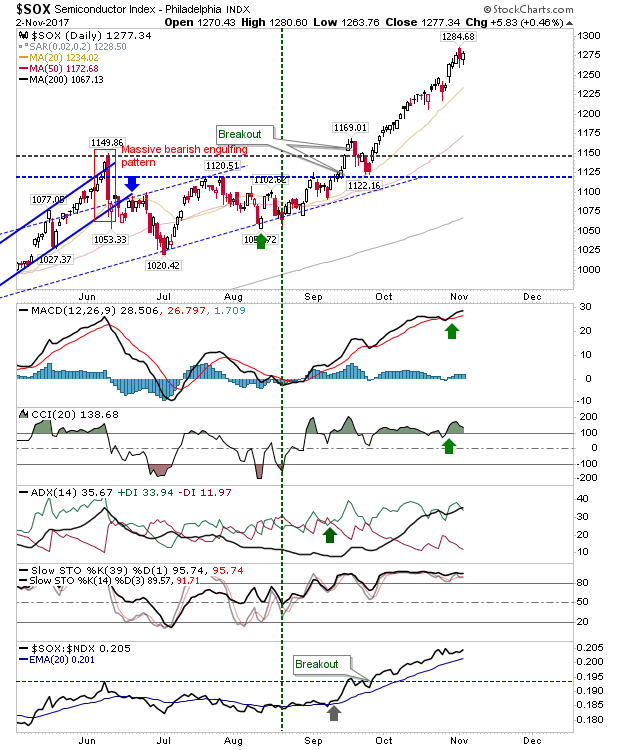

The Semiconductor Index didn't lose ground but its ascent is running a very tight rally. The index could do with a pullback, preferably back to the 50-day MA. Current holders have no reason to sell yet.

For Thursday's action to mark a swing low there can't be any persistent move into the day's trading range; anything which finishes below Thursday's close will likely undercut the low and spark an acceleration in a quest to seek stronger support.