Investing.com’s stocks of the week

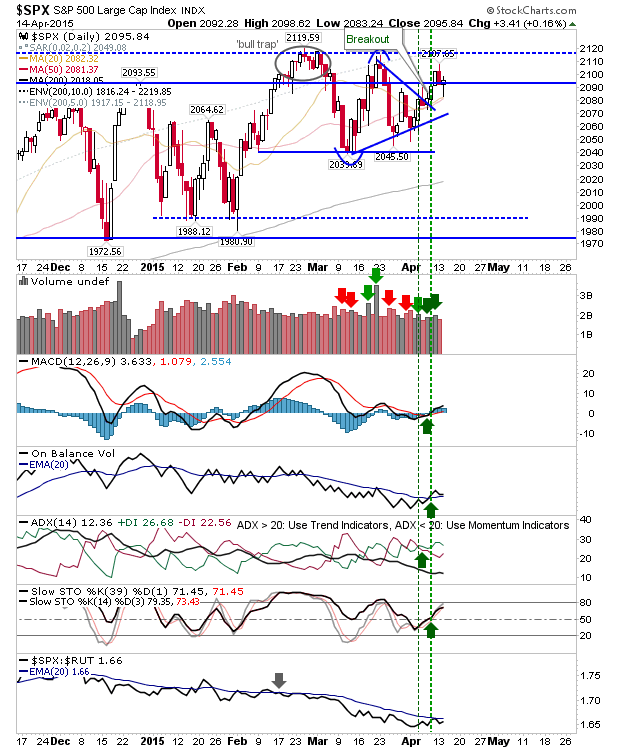

Markets suffered heavy selling during early action yesterday, but were able to regain a large section of lost ground by the close.

Large Caps (via the S&P 500) had the best of the action, skewing buying towards more defensive issues, not surprising given the early scare. The 20-day and 50-day MAs have converged, and these played as a rally point for longs. Technicals retained their bullish picture.

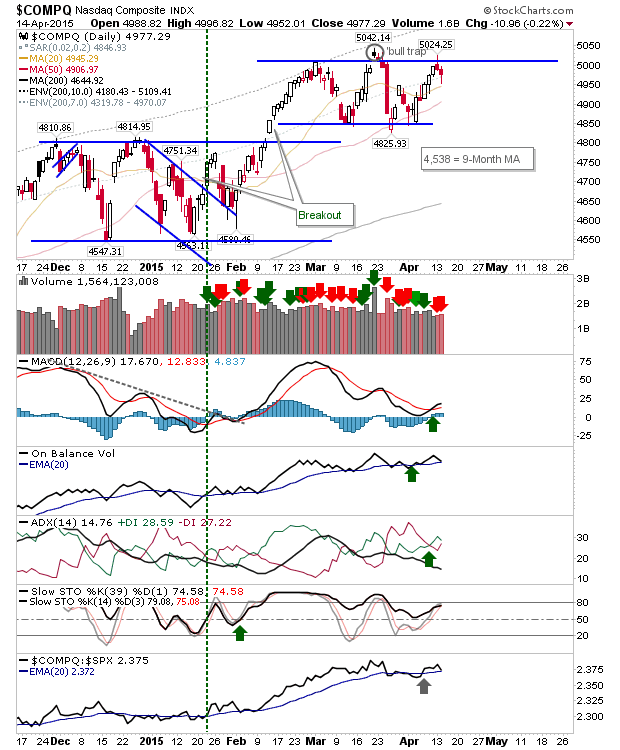

The NASDAQ rallied off its 20-day MA, but it didn't make it back all the way to yesterday's open. Volume climbed to register as distribution.

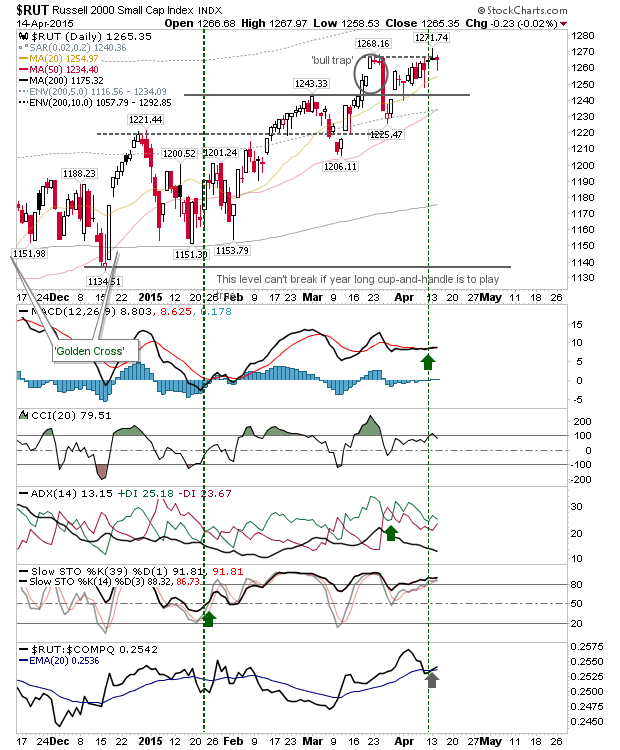

Meanwhile, the Russell 2000 shifted from a bearish gravestone doji to a bullish dragonfly doji. The combined action over the last two market days is neutral, but given the pressure on highs it's more likely to continue higher.

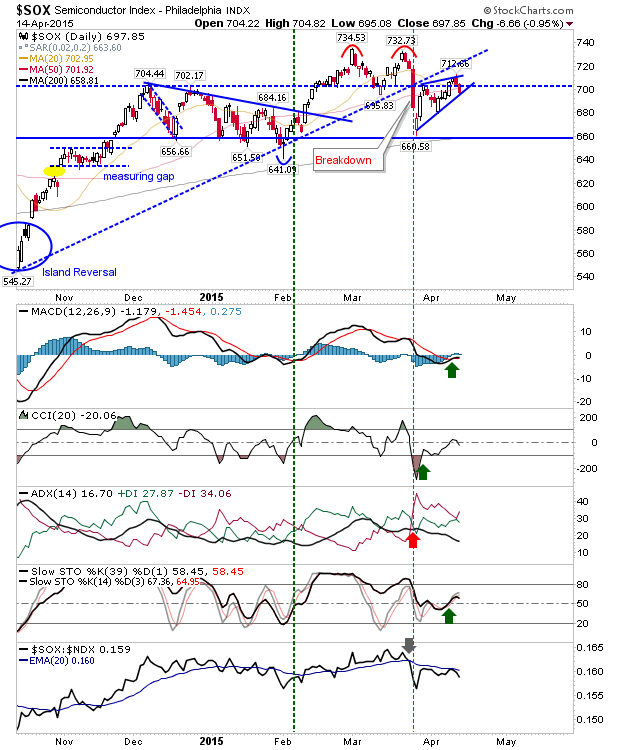

The Semiconductor Index is playing to the bearish wedge and dipped below 700. It's set up for a move down today.

For today, bulls can look to the Russell 2000 and Large Cap indices, while bears should look to the Semiconductor Index.