Investing.com’s stocks of the week

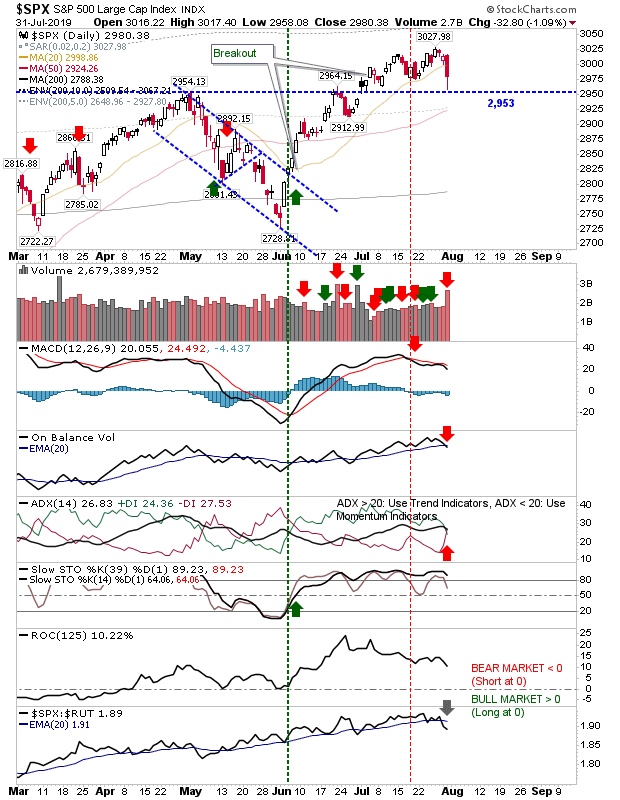

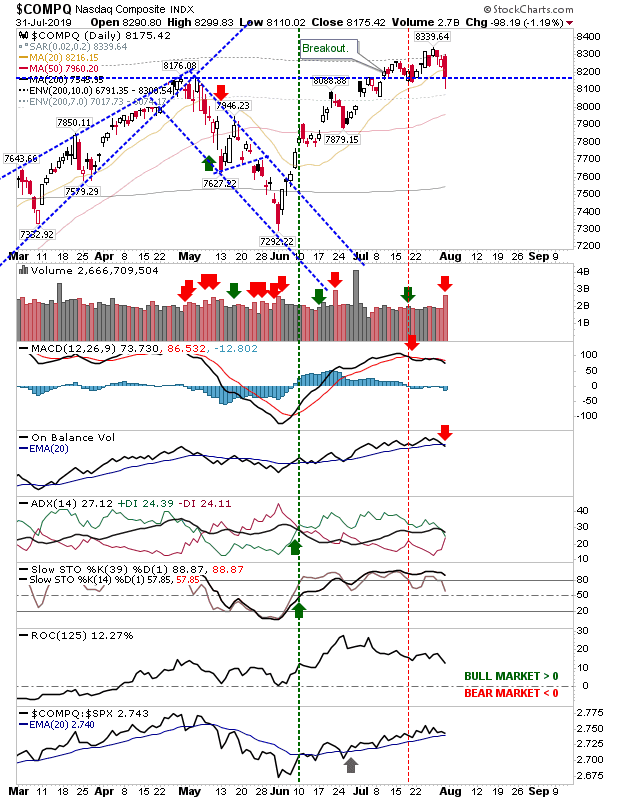

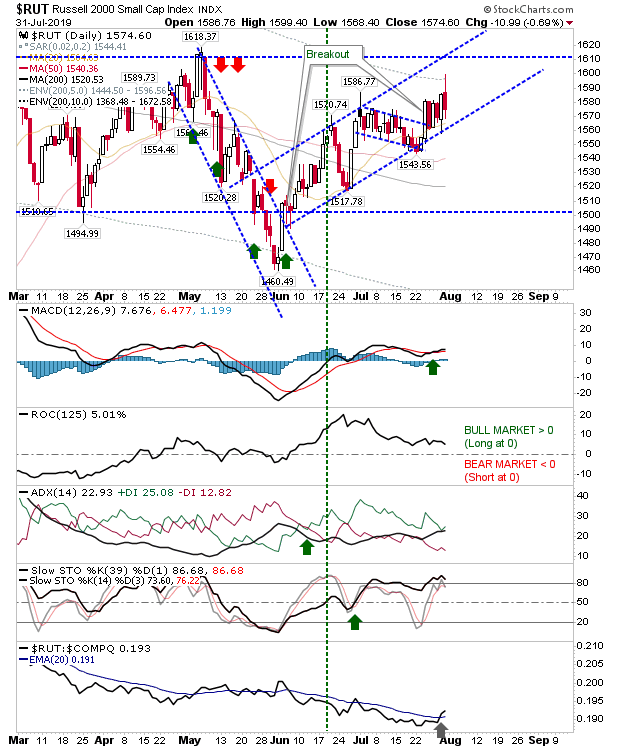

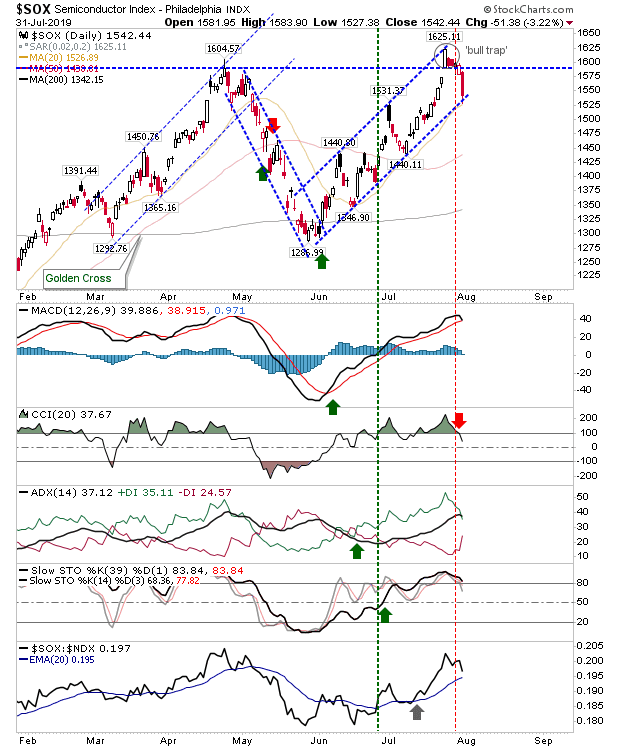

Markets didn't react well to the Fed rate cut or the words of Jerome Powell, although today's selling didn't kill the breakouts, it did leave them under pressure.

The S&P undercut its 20-day MA and only tagged breakout support of 2,953 but volume did rise in confirmed distribution. Today's action undercut the signal line in on-balance-volume and generated a sell trigger in ADX.

It was a similar story for the Nasdaq with an undercut of the 20-day MA, although the spike low did undercut 8,175. There was a new 'sell' trigger for On-Balance-Volume.

The Russell 2000 also had a wild day but remained inside its rising channel. Unlike the S&P and Nasdaq, it still holds to its MACD trigger 'buy' which protects it from the more public sell-offs in Tech and Large Cap indices.

The only index which is feeling some form of pressure is the Semiconductor Index. Yesterday's selling undercut breakout support, leaving a 'bull trap', but there is still a chance channel support can hold.

For today, the last chance saloon for bulls are the various support levels held after yesterday for the S&P, Nasdaq and Semiconductor Index. There isn't much room for maneuver so if indices are to re-establish their rallies then today is the day when buyers will have to make a stand. Otherwise, it's a drop back into prior trading ranges which - in the case of 'bull traps' - typically results in a move back to prior support, which would mean June lows.