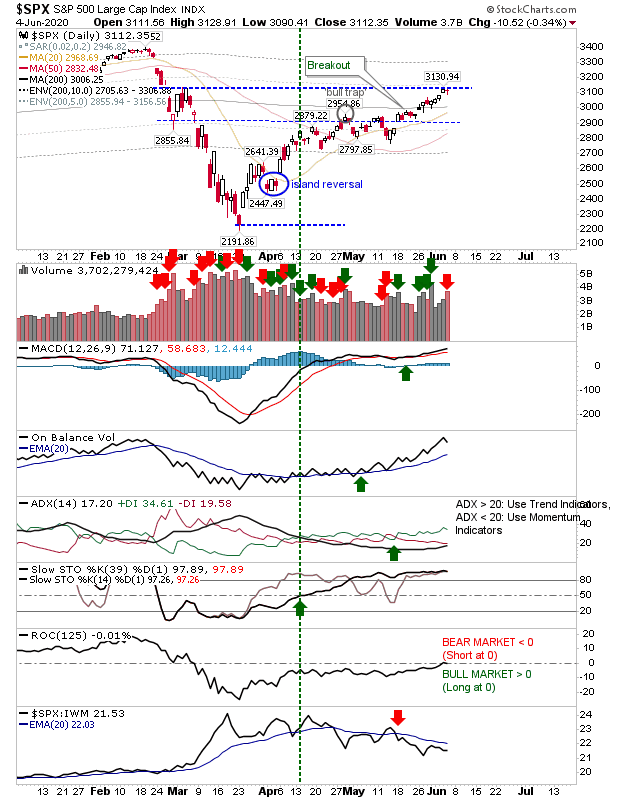

Several major markets are now poised for fresh breakouts, after having finished Thursday's session at, or just above, resistance, which has now turned into support.

The S&P 500 ended the day just below the February swing high (around 3,130) as volume climbed in resistance driven profit taking (and also ranked as distribution). Technicals, aside from relative performance, are all bullish and show no signs of divergence; so the expectation would be for a breach of resistance.

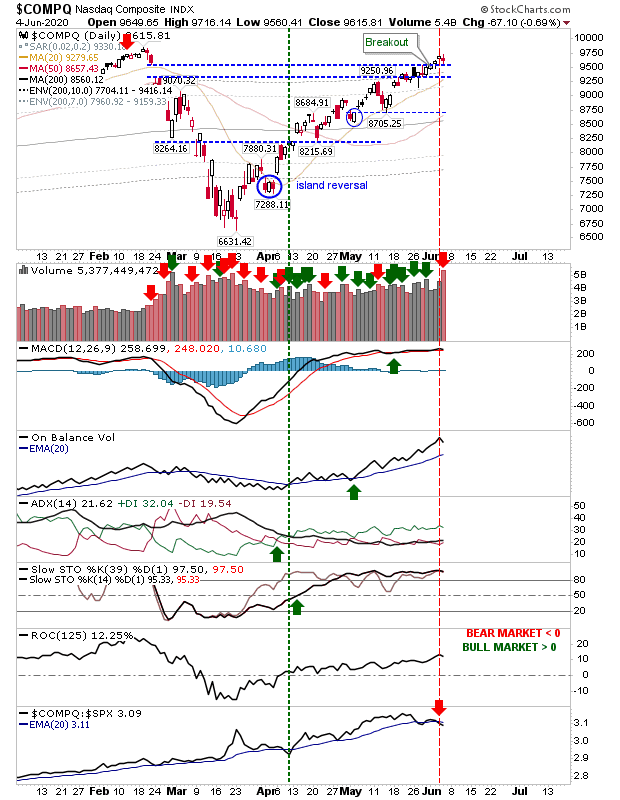

The NASDAQ had managed to close the February breakdown gap late last week and broke this resistance this week. Thursday's selling, while falling under the umbrella of distribution, didn't violate support. The MACD has effectively flat-lined, so signals from it are of less value. The index has started to underperform relative to the S&P, but other technicals are good - particularly the trend in On-Balance-Volume, which marks strong accumulation, despite yesterday's heavier selling.

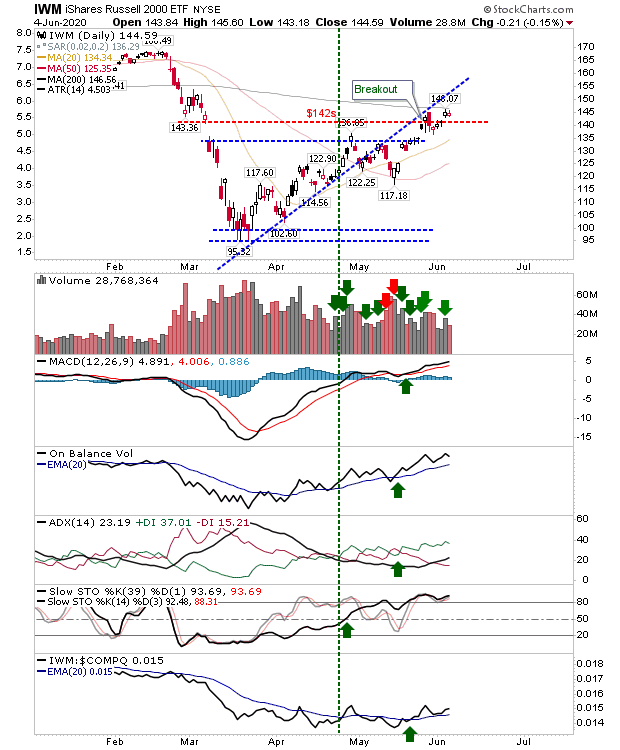

The Russell 2000 had made a strong move yesterday to clear the narrow congestion that had consolidated around the low range of last week's bearish engulfing pattern. However, it still remains pegged by 200-day MA resistance, but has the benefit of good technical strength.

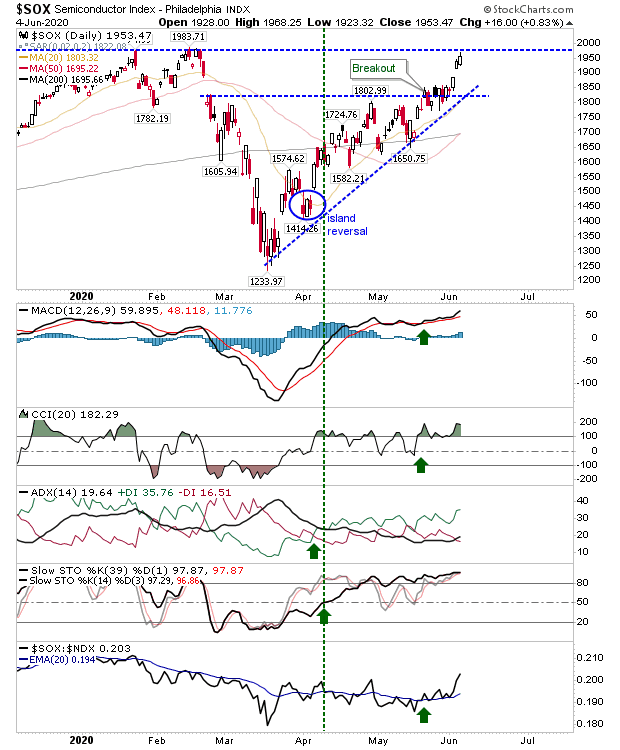

The Philadelphia Semiconductor Index has managed to make it as far as to challenge the pre-COVID-19 highs. If this is able to break through, it will bring the NASDAQ with it.

Now it's a question as to whether the breakouts can materialize? Certainly, if doing a count-back from the Semiconductor Index to the Russell 2000, the stage is set for a sequence of breakouts that will attract another round of momentum-buying by traders.