Though there was a shaky start to the week, so far markets have managed to hold on to Friday's gains. The small gaps haven't filled, however, although they are not true breakout gaps as we are still waiting for the actual breakouts. But, it's healthy action and the possible short opportunities mentioned from the drop outside of the channel don't look likely to succeed.

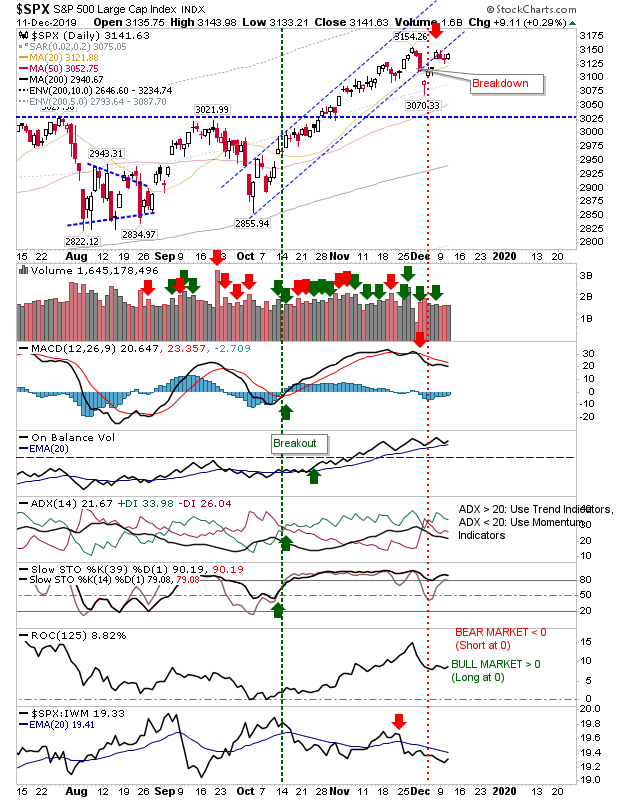

The S&P is no longer in its rising channel but a slower advance may be emerging. The MACD is still on a 'sell' signal and relative performance remains on the bearish side.

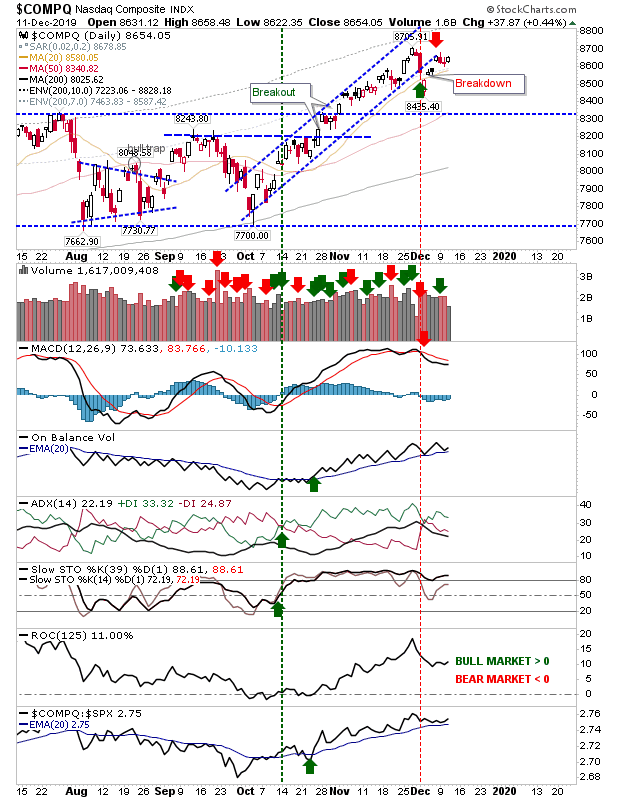

The NASDAQ is also outside its channel with an established MACD 'sell' to overcome. It does have the benefit of a relative performance advantage.

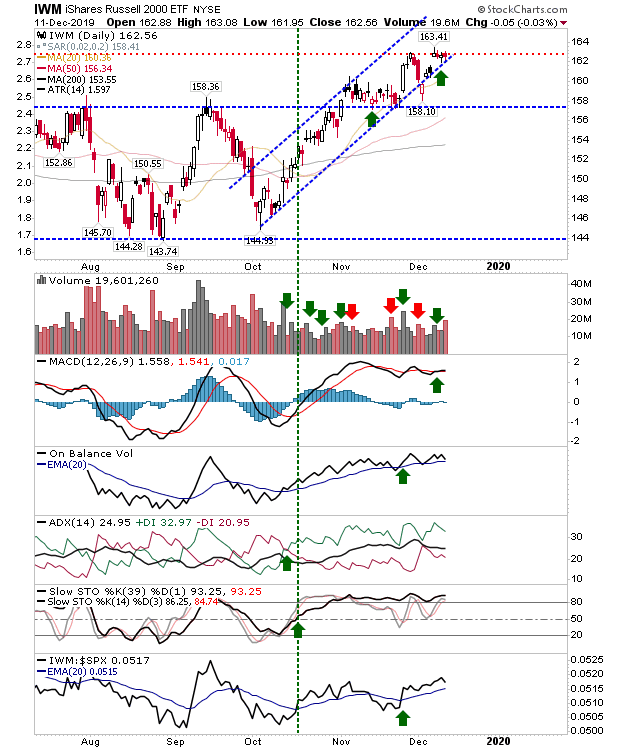

The one index which is well placed to advance is the Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)); it rests against channel support with buyers building momentum.

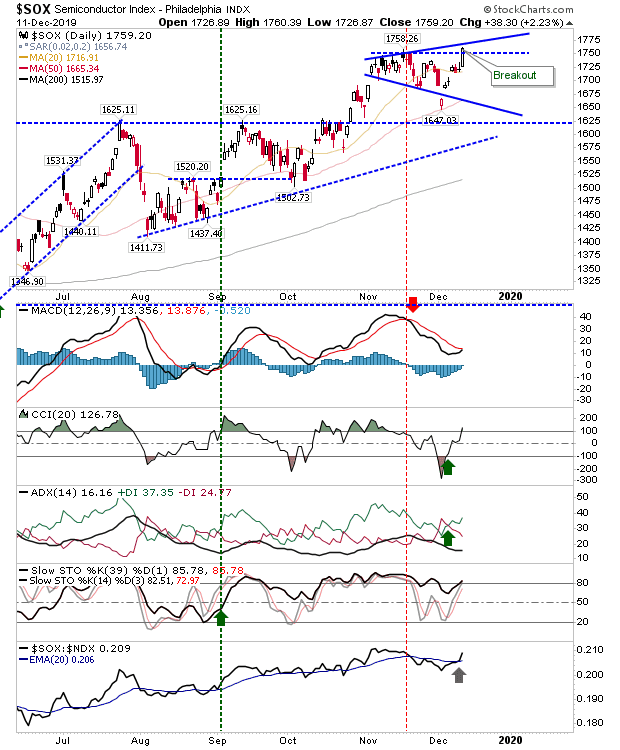

The big gainer on the day was the Semiconductor Index. The difficulty is that there is no well-defined pattern to define support and resistance but a case could be made for a breakout based on the last swing high.

For today, look to the Russell 2000 to break out and for the Semiconductor Index to consolidate its gains.