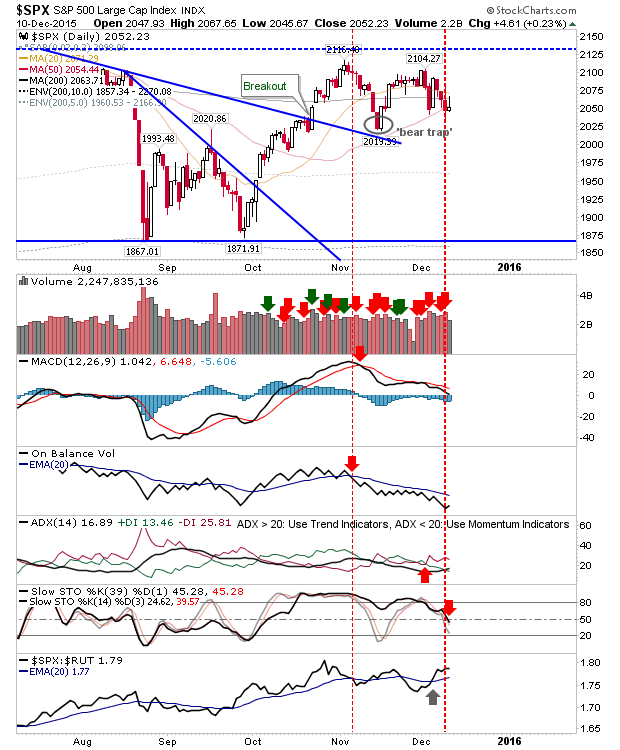

Bulls needed to do more after a decent start petered out by the close of business. While markets did finish higher, they did so only on modest volume.

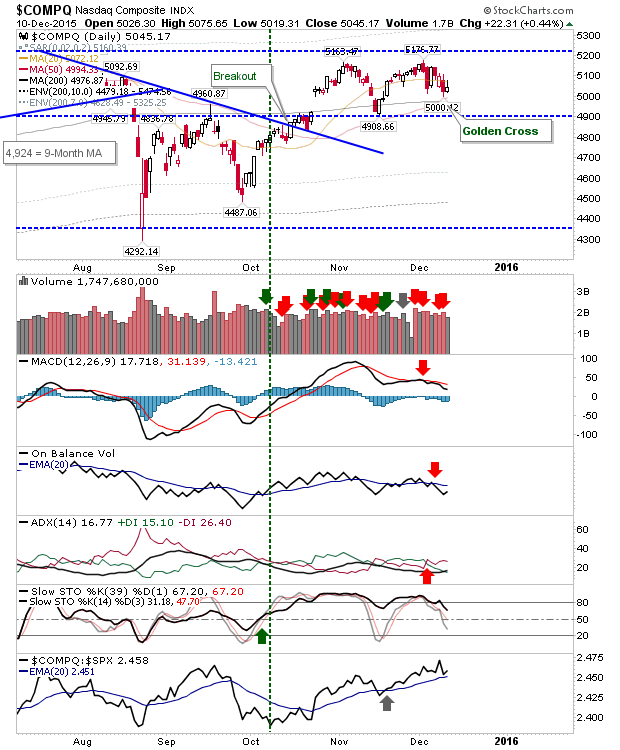

The Nasdaq had its 'Golden Cross', but it didn't see a test of this moving average cross. Given the weak finish, the test could occur tomorrow.

The S&P is looking increasingly like it's going to undercut 2,019. After today's action had it above both 50-day and 200-day MAs, to finish below both moving averages is a concern. Buying volume was also well down on yesterday's selling.

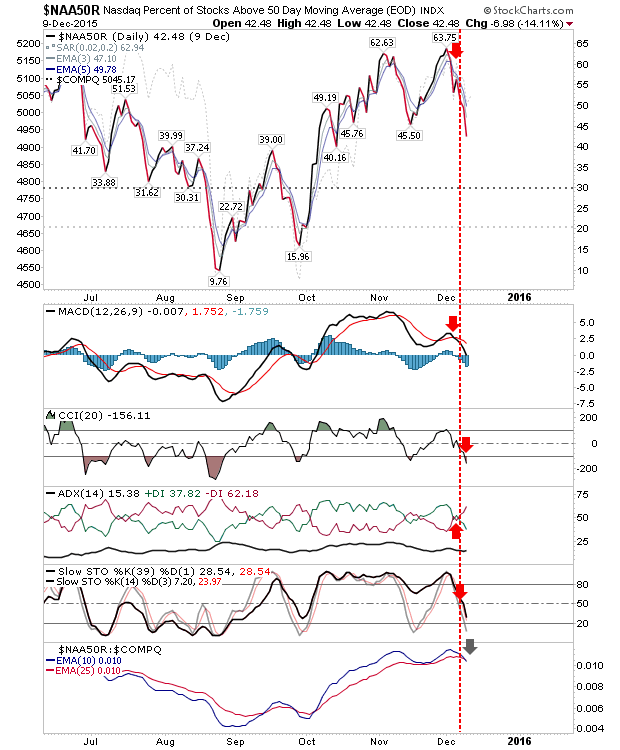

The Percentage of Nasdaq Stocks above the 50-day MA peaked at 63% before dipping below 50%. Today saw a net bearish turn for supporting technicals, setting up for a move to sub-20% and potential lower prices for the Nasdaq.

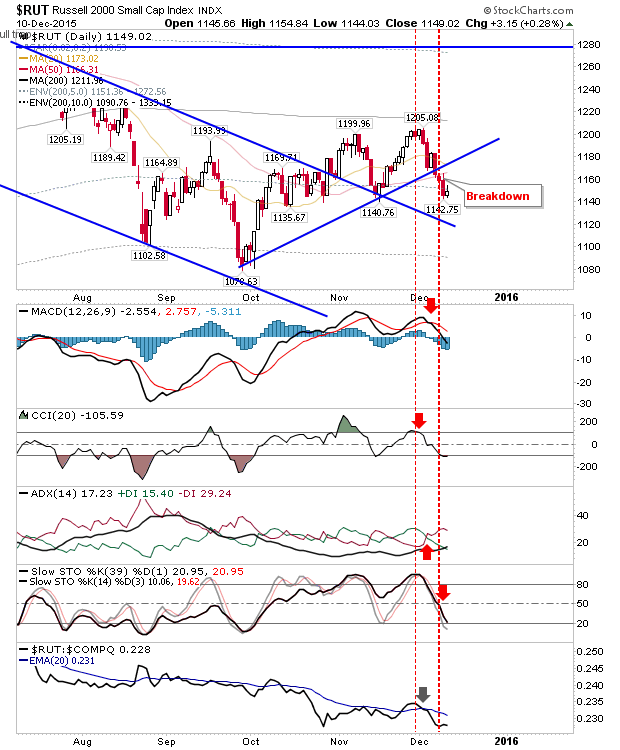

The struggling Russell 2000 was another index threatening to break November swing low support. It's brief moment in the sun as a relative market leader looks over, and the current outlook suggests a a retest of the 1,079 swing low had a high probability of coming true.

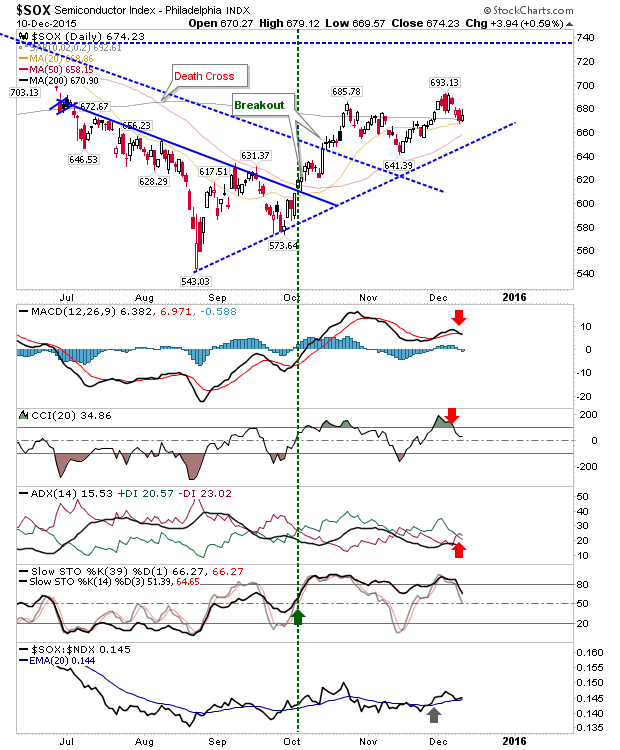

Bulls may continue to look at the Semiconductor Index. Today's action was similar to other indices, but it was able to defend converged 50-day and 200-day MAs. However, technicals are rolling in favour of bears.

Tomorrow, bears should monitor both S&P and Russell 2000 for a loss of November swing lows. Bulls should watch the Semiconductor Index for a bounce off the 200-day MA.