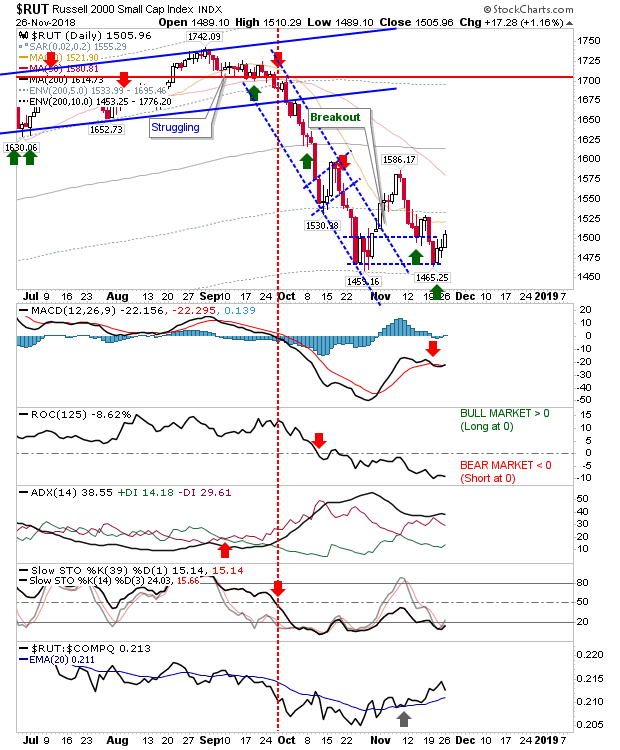

Yesterday was a good day for market bottom watchers as new support levels kicked in for indices. Best of the bunch looks to be the Russell 2000.

It still has a relative performance advantage and the bottom it's shaping came off a 'real body' bounce alongside a fresh MACD trigger 'buy'. It's early days, and the 'buy' signal I had marked as a retest was perhaps a little early but should still be good enough that such buyers will still be holding at this stage; stops on a loss of 1,465.

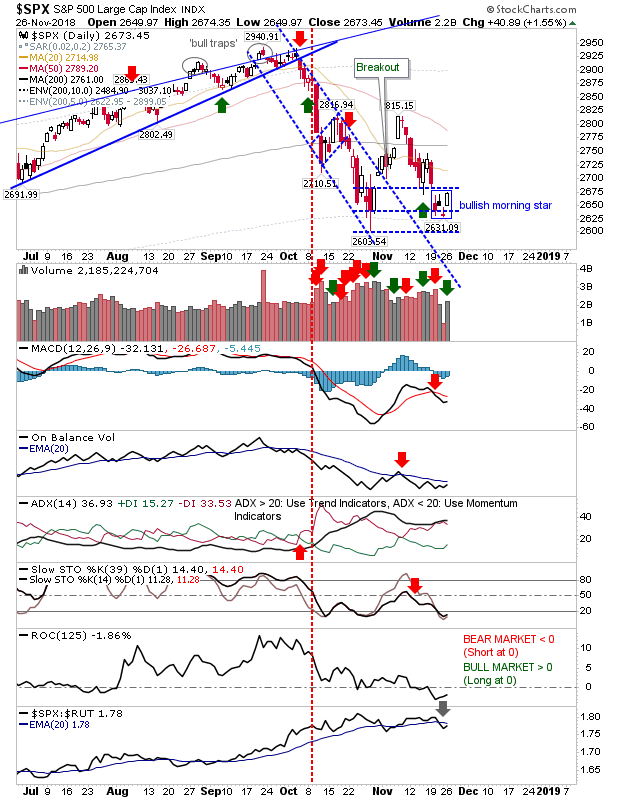

The S&P also enjoyed a nice gap higher yesterday, off Friday's close and finished the day at the day's high. Volume was better (not surprisingly) as this still looks to be a developing swing low. Buyers could continue to treat this as a tradable opportunity with stops on a loss of 2,630; the lows of a 'bullish morning star' pattern. Technicals are not great but at least momentum (Stochastics) is oversold enough to suggest a buying opportunity is available.

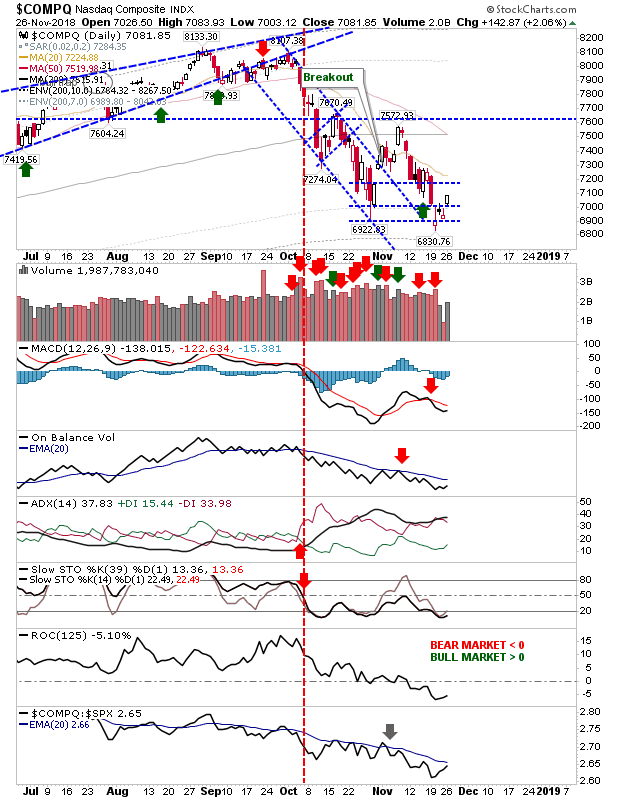

Likewise, the NASDAQ enjoyed a bigger bounce but the decline from highs has hit it hard (relative performance is tanking and technicals are weak). The resulting bounce may gain more in absolute terms but the bounce is also more likely to fail; look to November and October swing highs as the potential stumbling blocks for such a rally.

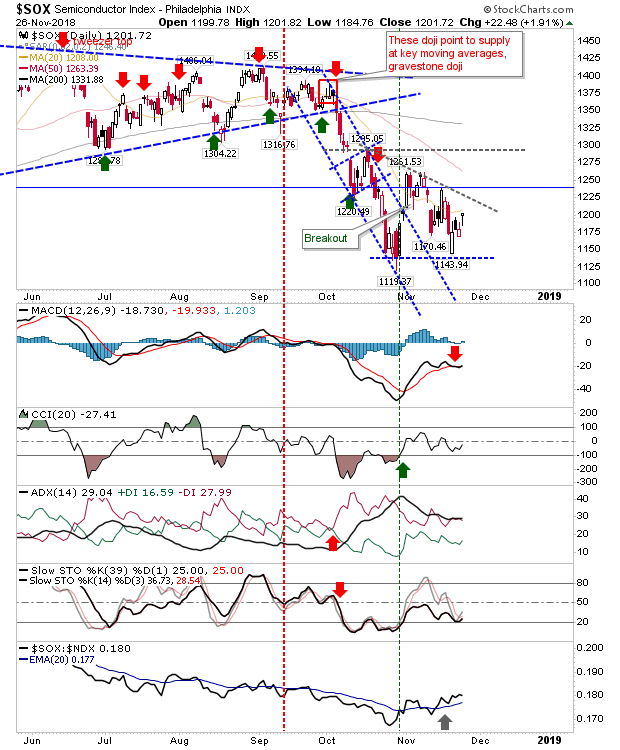

As a final note, the Semiconductor Index continues to shape a traditional double bottom with a fresh 'buy' signal. Risk is measured off a loss of 1,143.

For today, I will be looking for more of the same or at least a defense of the second swing low. Santa will be here soon with his rally and this would be an ideal starting point.