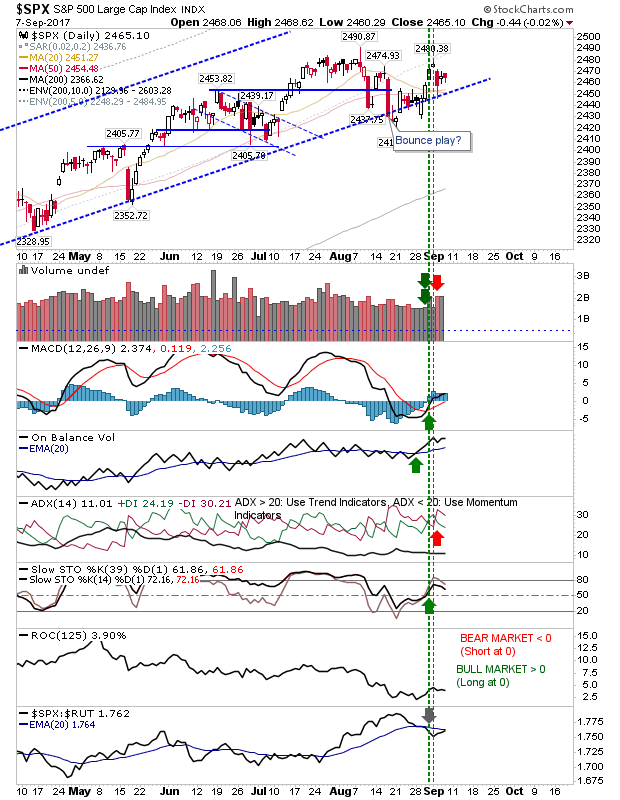

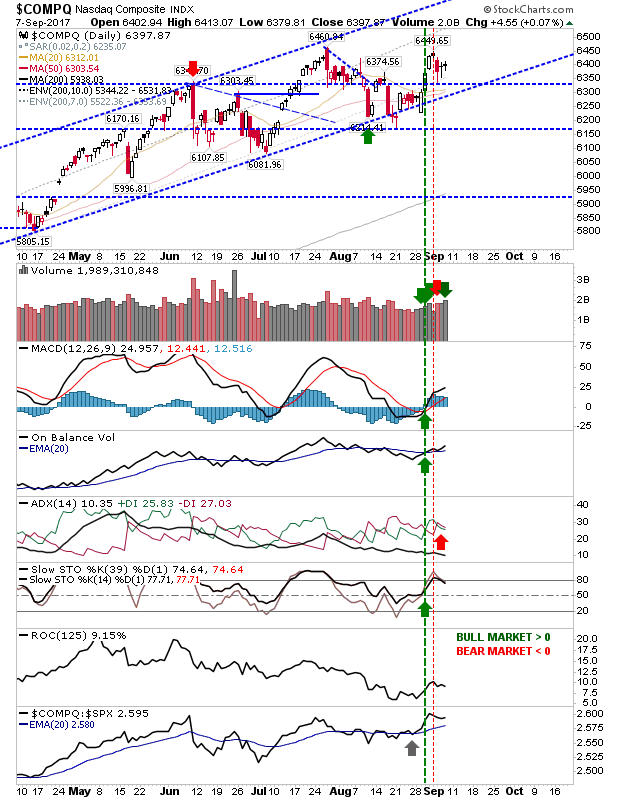

After Tuesday's sell off markets have traded into tight coils (inside days) which are traditionally viewed as swing trade opportunities; buy break of high/stop on reverse side + vice versa for a short.

The S&P is sitting just above its converging 20-day and 50-day MAs and rising channel support. Technicals are still on the bullish side so I would look for an upside breakout.

The NASDAQ has a better coiling setup; Thursday's small doji is an inside day of an inside day. The index has done well to hold above support and is very close to pushing above the 52-week high of 6,460. Technicals are also well placed with plenty of room before they become overbought. Favoured upside.

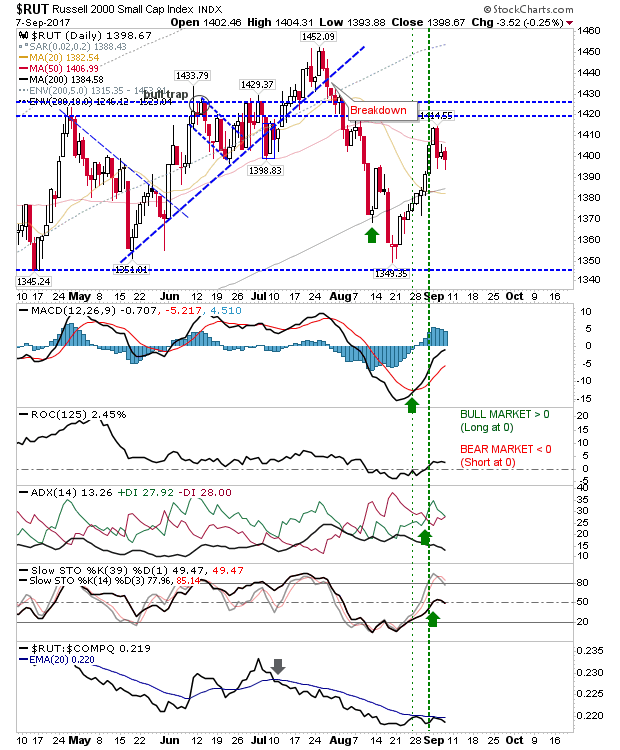

The Russell 2000 hasn't followed the coiling action of other indices, but it is shaping a good pullback which will offer bulls a buying opportunity if it can tag its fast rising 200-day MA.

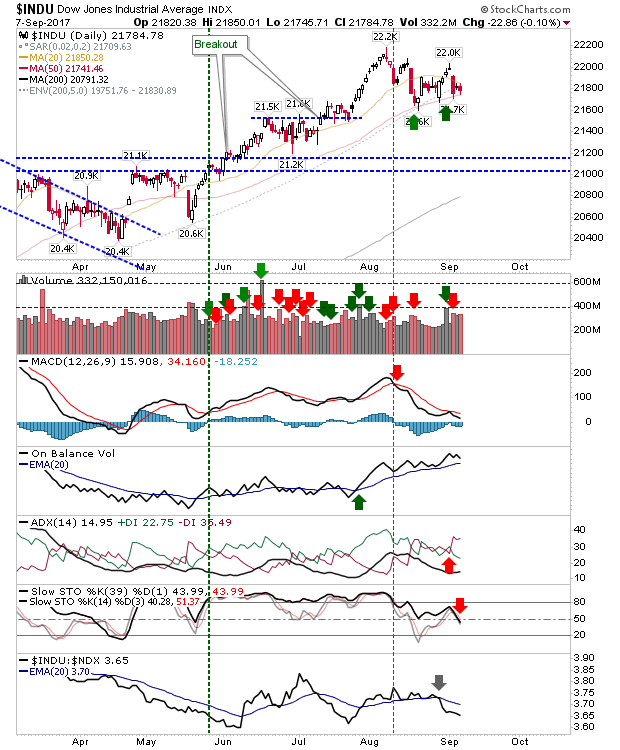

The Dow may be the index to offer shorts something. There was a small loss which accounted for a fourth tag of 20-day and 50-day moving averages – each tag weakens the support. The technical picture has three out of four monitored indicators in the red. Stops go above 22,000.

Plenty of scope for opportunity on Friday. Swing trades are a two-way play although many of these coiling patterns are supported by technicals which suggest highest prices will prevail.