While the US stock market had a long overdue correction in February of 2018, the first quarter ended merely flat eventually. Continuing from the rebound since February's low, the stock market kept rising strongly in the second quarter.

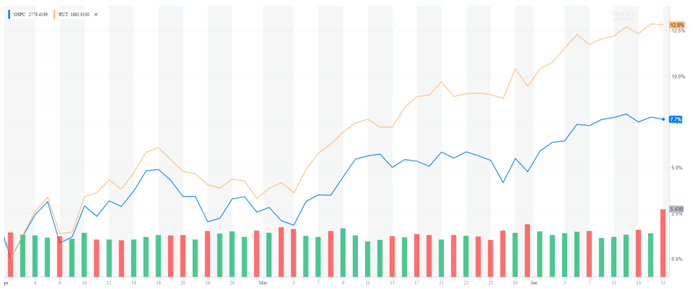

Out of the three major indexes, the NASDAQ is leading the race by miles. The technology-heavy index has closed at all-time highs 20 times as of June 15 this year, piling upon last year’s record of 72 times. Although the Dow Jones Industrial Average had comparably 71 closing all-time highs in 2017, the Dow has only closed at all-time highs for 11 times this year, all of which were from January 2018. Moreover, the NASDAQ has also outperformed the Dow by roughly 10% including dividends during the first half of 2018. Standing in between the NASDAQ and the Dow, the popular benchmark S&P 500 has been relatively benign in 2018. Although this large-cap index has risen over 2% in both May and June so far, investors certainly have poured more interest into the small caps in the meantime, evidenced by the second quarter performance comparison below.

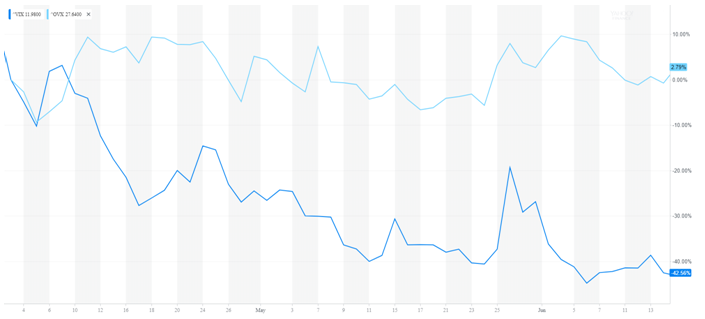

The second quarter has seen a lower volatility level compared to the first quarter. The VIX has calmed from above 20 down to 11 handle since April. Some major factors such as the alleviated concern over trade war and the improving US-North Korea relations most likely contributed he significant downward shift in volatility. However, there are still some dark clouds in the near-blue sky. For example, crude oil is still fighting to hold the $60-$70 per barrel ground. Not surprisingly, oil volatility OVX has gone up in the second quarter.

The recovery from the February correction has shown the resilience in the stock market. It is likely that the stock market can move higher in the next quarter if the volatility remains at or below the current level. However, as some sectors such as technology have demonstrated in the second quarter, not all sectors will be able to take advantage of the calming volatility equally this year. Perhaps, 2018 will be a year that favors active investors.

by Leo Chen