by Chaim Siegel of Elazar Associates LLC

After another scare on Tuesday that caused US indices to fall, the market did it again. It quickly brushed off losses to set up for another up-leg today.

And today is going to be fun. After yesterday’s close the US Federal Reserve gave sweeping approvals for US banks to raise dividends and buy back shares. Sorry bears, new highs here we come.

The Federal Reserve Passes Banks In Stress Tests

At 4:30PM yesterday the Fed said,

“The Federal Reserve Board…did not object to the capital plans of all 34 bank holding companies participating in the Comprehensive Capital Analysis and Review (CCAR).”

Ah, music to a bull's ears.

And what happened next?

- JP Morgan (NYSE:JPM) announced a $10.6B stock buyback program.

- Citi (NYSE:C) announced a combination of stock buyback and dividend increases that will amount to $18.9B in the next four quarters.

We expect to hear more. We expect the market to soon hit new highs on the news.

With or without President Trump's plans for deregulation, the Fed feels confident in the economy. For the first time in years, their approvals to banks frontruns the need for deregulation to be passed.

This is a bullish positive surprise for markets that were giving up hope on ever seeing pro-business legislation passing.

But that’s the way the market has been acting. Bad news is quickly followed by good.

What Did The Market Just Brush Off?

The market has faced some pretty big challenges from headline news over the past few days, but has quickly been brushing it aside.

Tuesday had the market in the proverbial “corner” based on the news. Wednesday though, saw the market make another quick comeback, true to recent form. The more “bad” you hear about and the more the market holds up, the more you have confirming bullish action. If you’re a bull, it’s getting exciting.

First, What Was So Big About Tuesday-Wednesday Trading?

We had a nice comeback on Wednesday in the S&P 500 ETF (NYSE:SPY) along with the NASDAQ and most major indices like the Dow, but we’re not here to be cheerleaders. There is important data in these stock market moves that should get your attention.

Let’s see what the market rallied back from:

- San Fransisco Fed President John Williams

What if we were to tell you a Fed official called for a stock market correction? Where would you think the market would go? Here’s what SF Fed President Williams said two days ago:

"The stock market seems to be running pretty much on fumes. It's something that clearly is a risk to the U.S. economy, some correction there -- it's something we have to be prepared for to respond to if it does happen."

An outspoken Fed official came out and said the stock market is at risk for a “correction.” Frankly it’s irresponsible for such a highly placed official to outright say something like that, not to mention that the market is not running on fumes. And with the stress test news after the close yesterday, it makes the timing of his comments even more questionable. Nonetheless markets took a hit because of it on Tuesday.

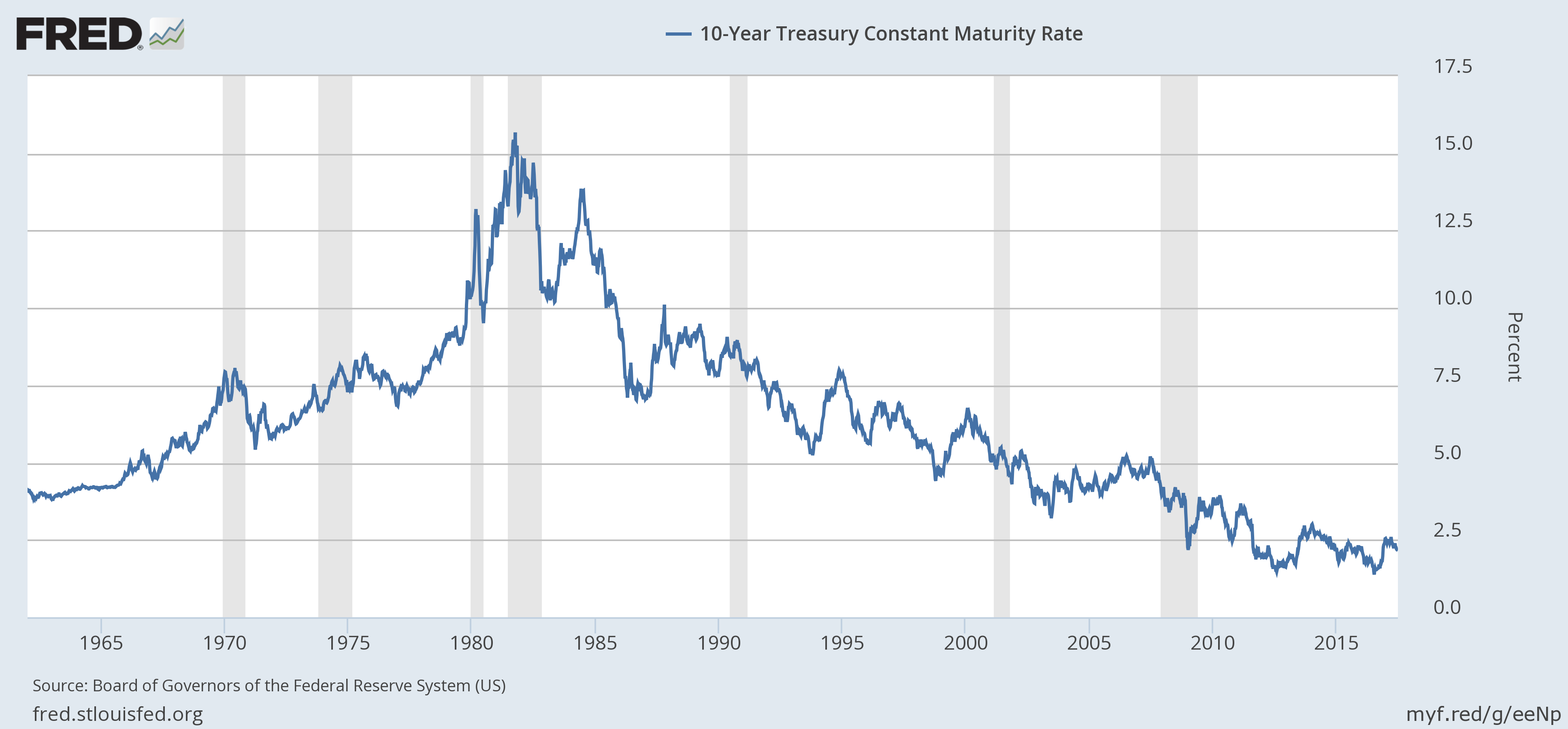

As for fumes, interest rates are at record lows while earnings are moving up. Ultimately that’s the formula for valuations in the widely used discounted cash-flow formula.

Discounted cash flows match future earnings to interest rates. This is the formula in simplistic terms.

- Future Earnings Streams / rates = Present Value Of Stock Prices [Future Earnings divided by rates equals PV of Stock Prices]

When the denominator is very low as rates are today, then the present value is mathematically higher. That’s not running on “fumes,” that’s running on math.

As for earnings, future earnings expectations are widely influenced by current earnings. The first quarter earnings growth was the best in almost six years according to Factset. No fumes here either. And with the bank announcements of buybacks, that’s only going to send earnings higher.

- Obamacare Repeal Gets Pushed Out Again

Tuesday’s news also included another Republican disappointment. They pushed out the planned vote to replace Obamacare with Trumpcare.

For traders, failing to pass legislation means that pro-business legislation will also face resistance. It’s a bearish story. That also hit markets two days ago.

- Draghi Turns Hawkish? You’re Joking, right?

This one is the toughest story to believe. Who would have thought ECB President Mario Draghi would ever back off his inflation-at-all-costs mantra?

Tuesday’s markets reacted to President Draghi saying:

“Any adjustments to our stance have to be made gradually…”

Reuters, on Wednesday cited sources that markets in fact misinterpreted that saying:

“The market failed to take note of the caveats in Draghi's speech.”

That means he wasn’t so hawkish after all. Who could have believed that one anyway?

That’s The Story Of This Bull Market

One day Trump’s under investigation, the next day he’s not. One day it’s a good leak, the next day it’s not.

One report says hawk, the next day dove.

One Fed president says crash, One Fed Chair says, “not in our lifetime” and the very next day, bam, sweeping approvals for banks to raise buybacks and dividends.

Whatever bad news you have one day, the market finds a way the next day to roar back on counter-news.

Not once, not twice. We’ve seen it many times. It’s a pattern.

It’s a sign of a bull market.

Conclusion

As bad as the news gets one day, don’t get down on the markets. Pay attention to the pattern. Tomorrow will be brighter.

You have the trend, action, earnings, and low rates on your side. Enjoy the ride. It’s OK to be bullish. Oh, and for today, with the Fed stress test news, we can all tilt our seats back and enjoy the view (of green on our trading screens).

Disclosure: Portions of this report may have been issued in advance to subscribers or clients. All investments have many risks and can lose principal in the short and long term. This article is for information purposes only. By reading this you agree, understand and accept that you take upon yourself all responsibility for all of your investment decisions and to do your own work and hold Elazar Advisors, LLC and their related parties harmless. Any trading strategy can lose money and any investor should understand the risks.