Even as US yields edge higher, the dollar struggles. With the 10-year Treasury yields now at 1.62%, nine basis points above last week's lows, the greenback has turned mixed against the major currencies. After briefly slipping below JPY108, the dollar has recovered to around JPY108.55.

The euro firmed to $1.2080, and sterling pushed through $1.40 before seeing the gains pared. Sterling is now lower on the day as are the Scandis.

Emerging market currencies are more mixed, and the JP Morgan Emerging Market Currency Index is snapping a five-day advance. The dollar's weakness, where the Dollar Index is falling for the seventh consecutive session, may be helping to unpin commodity prices.

Although gold has extended yesterday's reversals, base metals and oil are higher, and the CRB Index is at its highest level in over a month.

US equity futures have stabilized after yesterday's fall. In the Asia Pacific region, equities were mixed, with Japan, China, and Australia moving lower. Europe's Dow Jones STOXX 600 is lower for a second session, as utilities, financials, and consumer staples act as the biggest drags. Only energy and materials are higher.

Asia Pacific

Japan's Tertiary Industry Index rose 0.3% in February, missing forecasts, though the January series was revised to show a 1.0% decline instead of a 0.7% fall. The Bank of Japan meets next week.

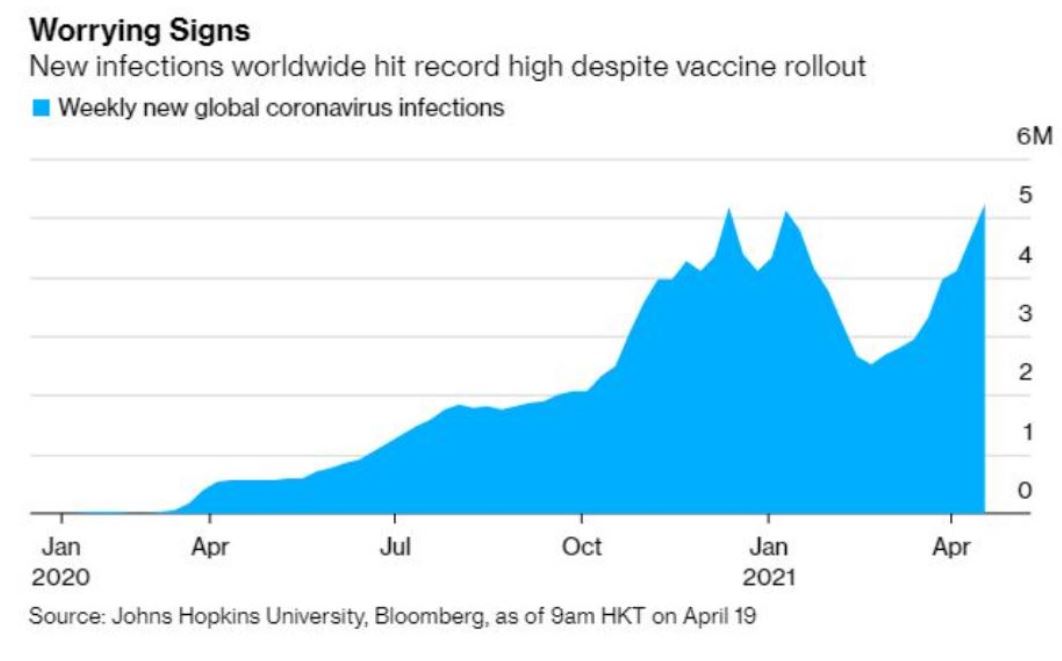

The virus is surging, and Japan lags behind most other high-income countries, rolling out the vaccine (less than 2% have been vaccinated. Tokyo, Okinawa, and Kyoto have introduced social restrictions but have not declared a formal state of emergency. Osaka is seeking a formal declaration, and Tokyo may as well.

The Japanese economy appears to have contracted by around 4% in Q1 but was expected to rebound in Q2; extended restrictions push out the recovery.

The minutes from the Reserve Bank of Australia's recent meeting warned of a coming pause in the improvement of the labor market. However, that was before the 70k+ surge in employment reported last week, which saw the unemployment rate fall to 5.6%. The RBA appears set to allow its emerging lending facilities and bond-buying programs to finish (June and October, respectively), barring marked deterioration of conditions.

About half of the lending facility has been drawn down, leaving another A$95 bln available through June. The RBA is buying its second tranche of A$100 bln of bonds. Whether to extend the yield-curve control to the November 2024 bond from the April 2024 issue does not have to be made for some time.

The central bank sees its policies as having kept the Australian dollar weaker than it otherwise would have been. It monitors the rising property prices but appears likely to rely on macro-prudential policies rather than interest rates to address excesses.

The US efforts to strengthen regional check on China's projection of power hit a speed bump. New Zealand's Foreign Minister Nanaia Mahuta expressed concerns about the mission-creep of Five Eyes (US, Australia, New Zealand, Canada, and the UK). On a separate front, given China's continued harassment of Taiwan, the Philippines' strategic importance may be more significant, but President Rodrigo Roa Durate drew his line. Only if China drills for oil in disputed waters will he favor a confrontation.

The dollar fell by about 0.6% against the Japanese yen yesterday, its largest decline since early February, and follow-through buying today took it briefly below JPY108. It was snapped up in early Tokyo trading and reached JPY108.55 before Europe entered the fray, where it has consolidated in narrow ranges. Initial support is now seen around JPY108.20. The intraday technical readings are stretched, suggesting the JPY108.60 resistance may hold.

The Antipodeans are leading the major currencies higher today with about a 0.3% gain.

The aussie briefly poked above $0.7800 for the first time in a month but was pulling back in the European morning. A break of $0.7780 would see a test on the $0.7750 area. Note that the Aussie's strength has lifted it through the upper Bollinger Band® (set two standard deviations above the 20-day moving average) found near $0.7775 today.

The PBOC left the Loan Prime Rates steady today as expected, while the yuan advance extended for the seventh consecutive session today. The greenback fell below CNY6.50 for the first time in a month. The PBOC set the dollar's reference rate at CNY6.5103, which was as anticipated.

Europe

The optics of the UK's employment data were better than the details. The ILO measure of unemployment fell to 4.9% in the three months through February, from 5.0%. However, this seemed to be more a function of people giving up looking for work (~80k in the three months through February), as employment fell by 73k and by another 56k in March. The claimant count rose by 10.1k in March after a revised 67.3k increase in February (initially 86.6k). Overall employment is about 800k below pre-pandemic levels.

Germany's center-right politics remains unclear. The CDU leader Armin Lashet emerged victorious at the party's leadership vote, with CSU candidate Markus Soeder losing by a wide margin. Still, the party's youth wing backed Soeder, as did Angela Merkel's ally and Economic Minister Peter Altmaier.

Three CDU state leaders also broke ranks and supported Soeder. The CSU leadership will hold a vote as well. While the CDU/CSU is running ahead in the polls, its support is declining. A split in the CDU/CSU coalition could weaken its position. Meanwhile, the Greens appear poised to become Germany's second-largest party.

The euro reached $1.2080 in late Asian turnover and has pullback back to around $1.2050 in the European morning. The trendline connected the January high (~$1.2350), and the late February high (~$1.2245) comes in near $1.2140 today. The market may turn cautious now ahead of the ECB meeting on Thursday. Support is seen in the $1.2000-$1.2020 band.

Sterling is a particularly narrow trading range today of about a third of a cent. It traded to almost $1.4010 in Asia and has slipped to about $1.3975 in the European morning. Yesterday's 1.1% gain was the largest so far this year and capped a five-day advance. Note that the $1.4020 area corresponds to the (61.8%) retracement objective of the decline since the February high near $1.4235.

America

The dollar's decline has coincided with the market having second thoughts about the timing of the Fed's first hike. The December 2022 Eurodollar futures implied a 57 bp yield on Apr. 5, suggesting a rate hike more than a year earlier than the Fed's dot plots projecting. The implied yield is now about 43 bp. The May contract implies 19 bp. The same broad pattern is evident in the fed funds futures contract. The December 2022 contract implied an average effective funds rate of 32 bp earlier this month, and it settled at 23.5 bp yesterday.

Canada's budget presented yesterday will also likely serve as the economic platform for the minority Liberal government. The deficit is projected to fall toward 6.4% of GDP this fiscal year after 16.5% last year. It includes C$101 bln of new initiatives, including a national childcare plan.

Canada will proceed with a digital tax that is likely to irk the US, which is working with the OECD for a broader resolution. A tax on foreign-owned but vacant houses seems an administrative nightmare to implement.

However, the focus in Canada shifts back to monetary policy with the CPI tomorrow shortly before the outcome of the Bank of Canada meeting is announced. Many expect the BoC to signal intentions to taper its C$4 bln a week of bond purchases. That said, the trajectory of the policy mix toward less accommodative monetary policy and more expansionary fiscal policy tends to be supportive of the currency,

North America has a light economic calendar today, and Fed officials are in the blackout period ahead of next week's FOMC meeting.

The Canadian dollar is firm but within yesterday's range. The greenback has held below yesterday's high (~CAD1.2545) and yesterday's low (~CAD1.2470). We suspect some of the late USD shorts may move to the sideline ahead of tomorrow's central bank meeting.

Similarly, the US dollar edged to a new three-month low against the Mexican peso near MXN19.7850 but recovered toward MXN19.90 in Europe. Initial resistance is seen near MXN19.95. A consolidative session is likely. The data highlights of the week include the bi-weekly CPI and March unemployment on Thursday and retail sales ahead of the weekend.