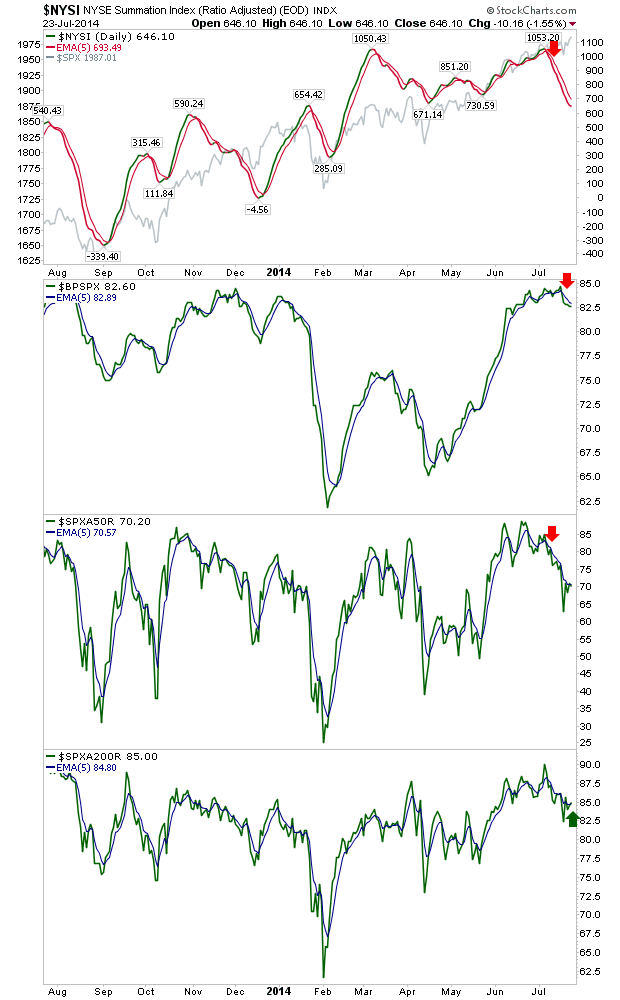

While the S&P 500 and NASDAQ have recovered strongly, supporting breadth for these indices hasn't been so glowing.

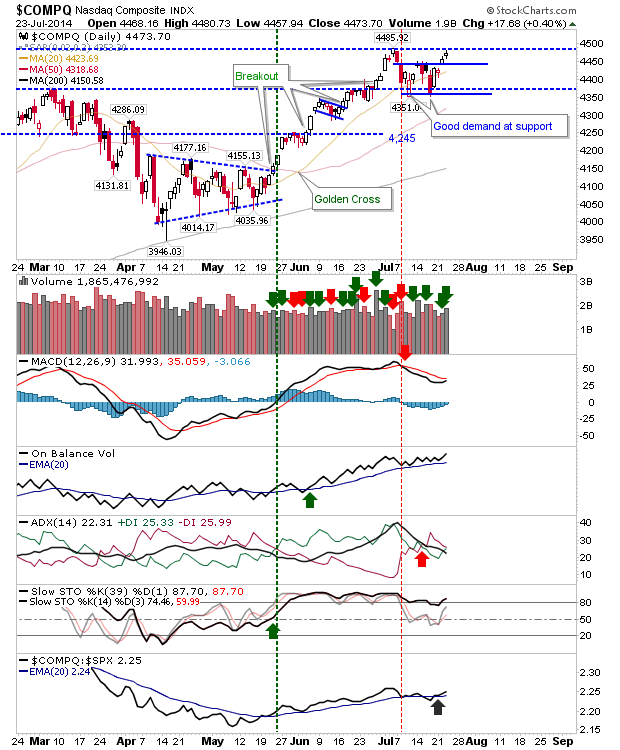

For example, the Nasdaq is on the verge of a move to a new high, sitting just below the July peak, on a second day of accumulation.

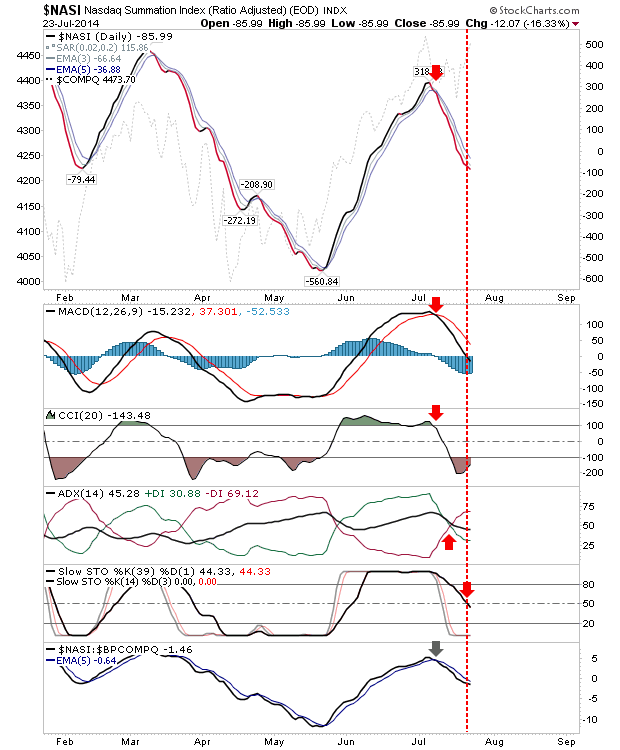

But the recovery in the Nasdaq Summation Index (the breadth index which best defines trend direction) has yet to occur. It's firmly net bearish.

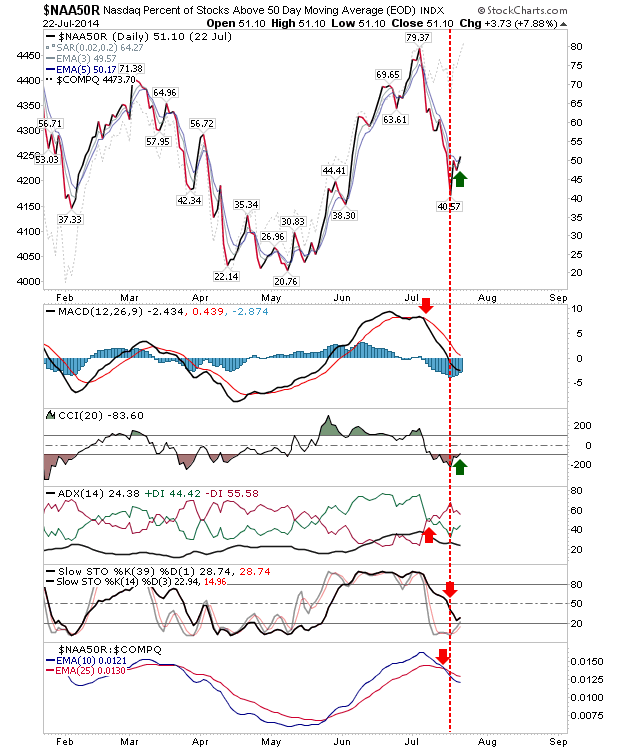

Even the highly reactive Percentage of Nasdaq Stocks above the 50-day MA is net bearish too.

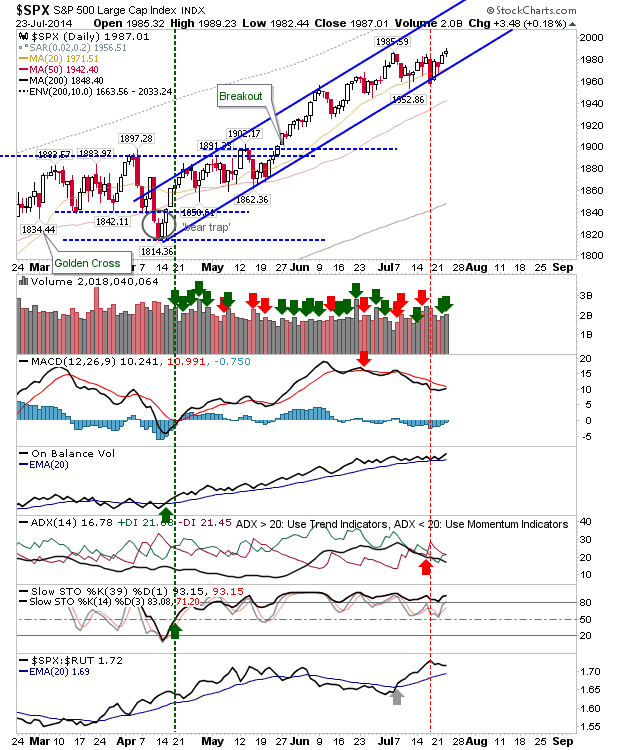

S&P Breadth isn't as bearish as it is for the Nasdaq, but bears hold the near term advantage. Again, the Summation Index is the clearest indicator of trend direction, and it's heading firmly lower.

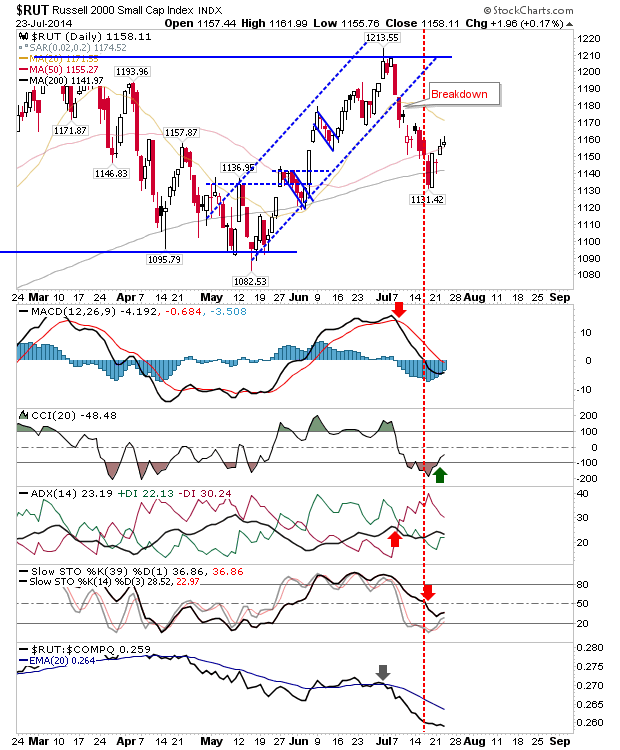

The Russell 2000 managed to stage a recovery at its 200-day MA, but there is risk of a double top with the current bounce tiring - note narrowing of intraday range of the bars since the bearish engulfing pattern, and today's inverse doji. Aggressive players could short a loss of yesterday's low with a stop above the high.

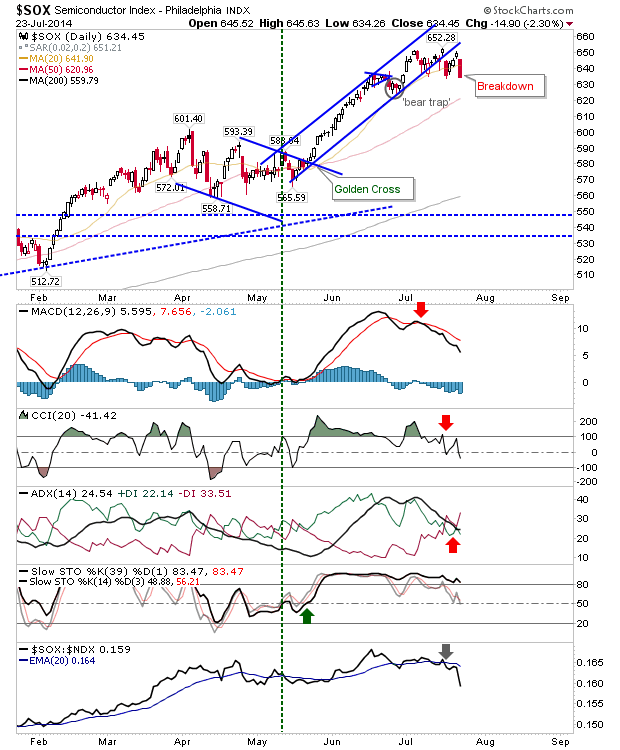

Another bearish possibility (and further warning for the Nasdaq) is the Semiconductor index. It has dropped out of its rising channel, and undercut its 20-day MA, with only trading range support around 635 available as its last stand.