Mark Cuban is a billionaire. He’s also an enigmatic investor on the business reality television series, “Shark Tank.”

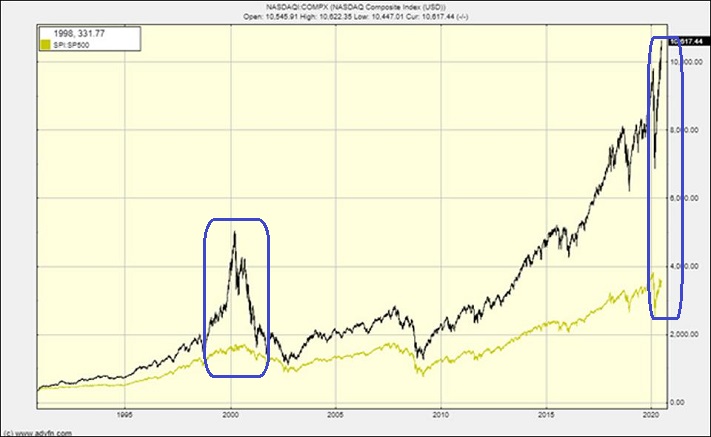

In a candid interview (7/20/20) regarding the comparisons between the 2000 dot-com bubble and the 2020 NASDAQ, Mr. Cuban said.

“In some respects, it’s different because of the Fed and the liquidity they’ve introduced. But on a bigger picture, it’s so similar.”

Cuban noted that during the height of tech mania, investors had an alternative for a 5%-6% safe yield with Treasuries. That’s not possible today.

It follows that, theoretically, trillions and trillions of Federal Reserve dollars will not stay in cash earning 0%. And once people/institutions sell a 10-year Treasury for 0.65% or a mortgage-backed security for less than 1%, the money tends to wind up pursuing higher rates of return.

Of course, now it’s getting downright silly.

Investors are not even looking for value or opportunity. They are not considering risk versus reward. They are merely performance chasing.

In particular, few are interested in old economy ‘losers’ in industrials, materials, energy or financials. Everyone is in love with tech… period.

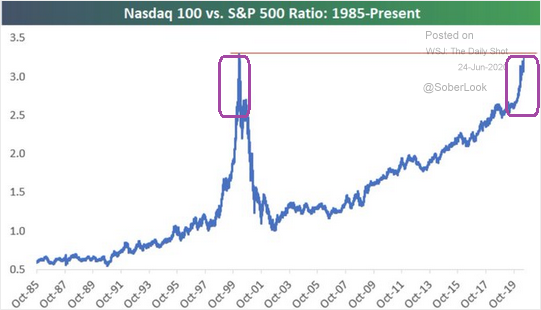

Keep in mind, the NASDAQ 100 (QQQ) (a.k.a. “the Cubes”) has been hitting record high after record high. And the relative outperformance over the broader market S&P 500 has been staggering. Notably, economic risk, corporate risk, valuation risk and/or political/tax risk are not being factored in.

In fact, as Lisa Abramowitz at Bloomberg noted, Fed policies are “…daring investors to buy the riskiest assets they can.” Worse yet, investors have not only accepted the dare, but they prefer money-losing companies over profitable ones.

This type of pursuit would be strange enough in a strong economy. But in a recession? Recessions throughout stock market history witnessed a cleansing process of asset deflation.

“Don’t fight the Fed,” you say. Perhaps. Or perhaps the Fed’s efforts to stoke the wealth effect by inflating asset prices will meet with a nasty bubble-bursting fate.

Few speculators seem to grasp that the fear of missing out (FOMO) can morph into a fear of losing everything (FOLE). Dollar printing liquidity is far from a panacea.

Indeed, the Fed may have difficulty propping up hyper-valued stock prices when less greedy folks select 0% yielding cash rather than stay too long at the NASDAQ party.