All the major equity indexes closed lower Wednesday, with broadly negative internals on the NYSE and NASDAQ as all closed at or near their intraday lows as buying interest failed to appear approaching the close.

The bulk of the charts saw further technical damage with all but one now in near-term downtrends as cumulative market breadth has turned negative across the board.

The McClellan 1-day OB/OS Oscillators are nicely oversold, suggesting a pause or bounce from recent weakness. However, our concerns regarding an excess of bullish sentiment on the part of investors has not abated, as the sentiment data is little changed despite the recent market drubbing.

So, while the futures are indicating a positive open, as the OB/OS would suggest, we suspect the “wall of worry” needs further strengthening for an “important” market low to be established. As well, yesterday’s move up on the 10-year Treasury yield implies we may not be out of the woods just yet.

We remain “neutral” in our near-term macro-equity outlook.

On the charts, all the indexes closed lower yesterday with negative internals on the NYSE and NASDAQ as trading volumes dipped on the NYSE and rose on the NASDAQ.

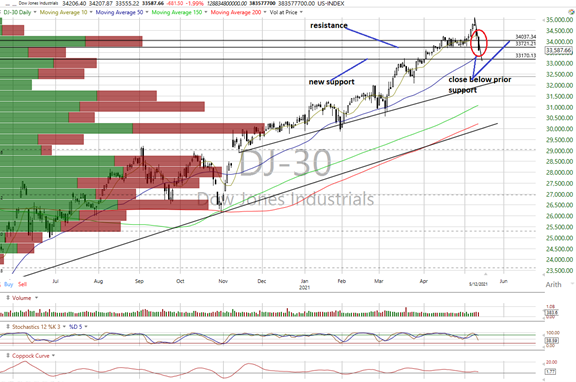

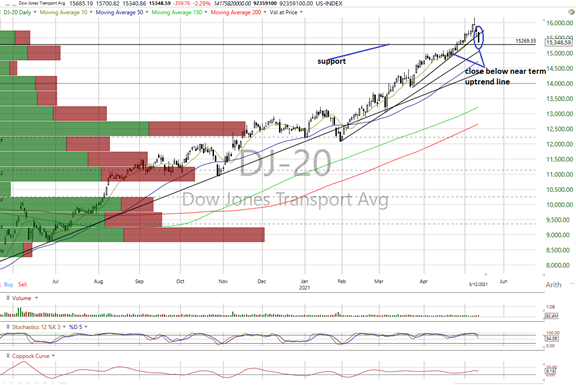

- Every index chart, with the exceptions of the COMPQX and DJT , closed below its respective support level.

- As well, the DJT closed below its uptrend line and is now neutral with all the other indexes now in near-term downtrends.

- Only the SPX, DJI and DJT remain above their 50 DMAs.

- Cumulative market breadth took another hit with the All Exchange, NYSE and NASDAQ A/Ds negative and below their 50 DMAs.

- The NASDAQ (COMPQX) and NDX stochastic readings are now very oversold but we await bullish crossover signals before becoming more constructive.

On the data, the McClellan 1-Day OB/OS Oscillators are now well into oversold territory and suggesting a pause or bounce from recent weakness (All Exchange: -94.28 NYSE: -99.83 NASDAQ: -92.05).

- Sentiment indicators, however, still suggest an excess of bulls as the wall of worry needs repair.

- The Rydex Ratio measuring the action of the leveraged ETF traders was unchanged at a bearish 1.04.

- This week’s Investors Intelligence Bear/Bull Ratio saw a rise in bullish sentiment at 16.8/60.4 as the AAII bear/bull ratio at 23.1/46.3 as both remain in bearish territory.

- The Open Insider Buy/Sell Ratio rose to a neutral 26.9 but still lacks any signal of significant insider buying interest.

- Valuation still appears extended with the forward 12-month consensus earnings estimate from Bloomberg rising to $189.04. This leaves the SPX forward multiple dropping to 21.5. The “rule of 20” finds fair value at 18.3. The valuation spread has been consistently wide over the past several months while the forward estimates have risen rather consistently.

- The SPX forward earnings yield rose to 4.65%.

- Importantly, the 10-year Treasury yield closed at 1.7% and above what we viewed as 1.63% resistance. We now see support at 1.63% with resistance at 1.75. This may be the key metric to watch going forward.

{{166|SPX}: 3,965/4,120 {{169|DJIA}: 33,170/33,721 NASDAQ: 13,020/13,500

NDX: 12,954/13,400 DJT: 15,270/NA MID: 2,628/2,700

RTY: 2,100/2,150 VALUA: 9,131/9,385

S&P 500

Dow Jones Industrials

NASDAQ Composite

NASDAQ 100

Dow Jones Transports

S&P Midcap 400

Russell 2000 Small Caps (RTY)