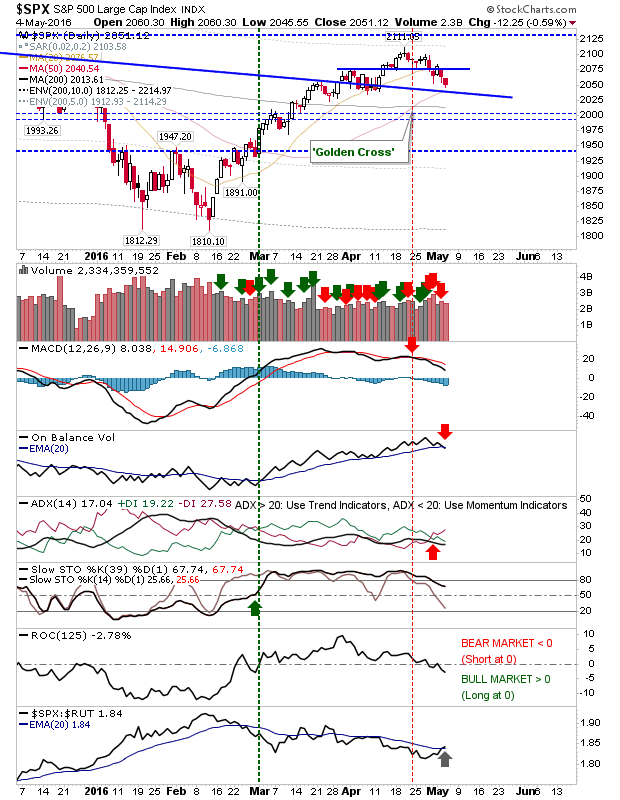

Yesterday gave an inclination that selling could be slowing. Markets did experience modest losses, but these came on low volume and support is available for some indices.

The S&P has bearish MACD, On-Balance-Volume and +DI/-DI signals to contend with, but does have converging support at declining trend and then the 50-day MA.

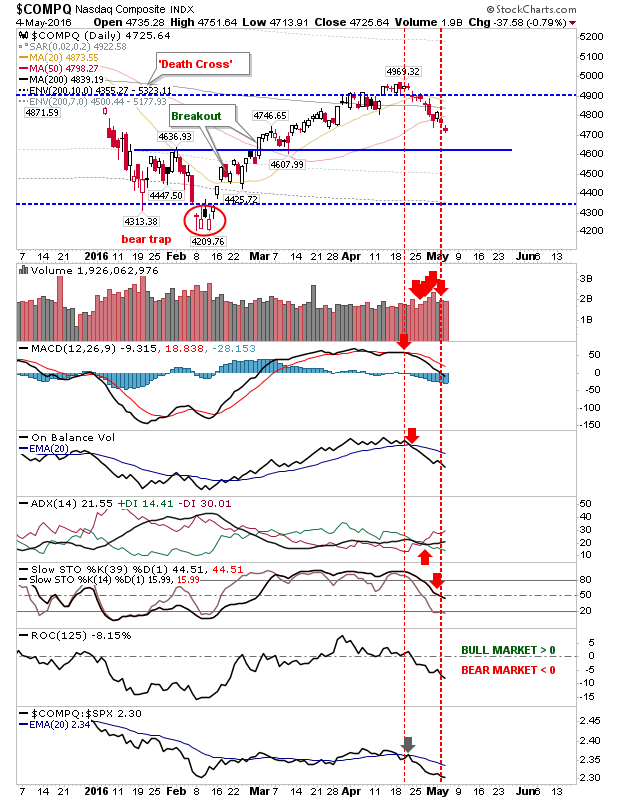

The NASDAQ is caught in a no-man's land between 50-day and 200-day MAs and horizontal support. Yesterday's action was tight, which if there is a gap higher today would set up a possible bullish morning star and potential swing low.

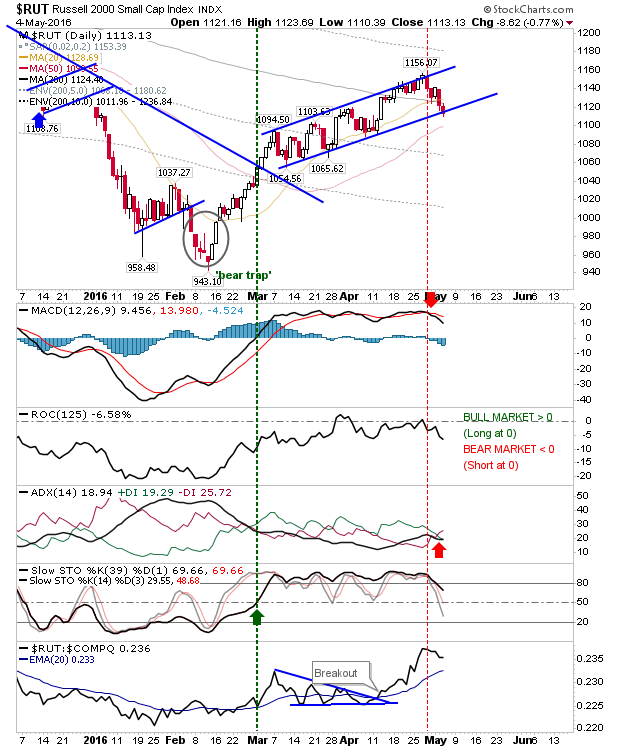

The Russell 2000 has drifted back to rising channel support. It's a good place to look for a bounce, although a spike low down to the 50-day MA would be a good alternative intraday opportunity.

The index most in trouble is the Semiconductor Index. Selling has undercut the 200-day MA but this may be an oversell generated from the sharp breakdown. Next support is down at 615, but a return above the 200-day MA might be enough to create a swing low.

Look for early strength to set up a swing low today. It may not be the absolute low in the decline, but it could be a nice 2-3 day long trade.