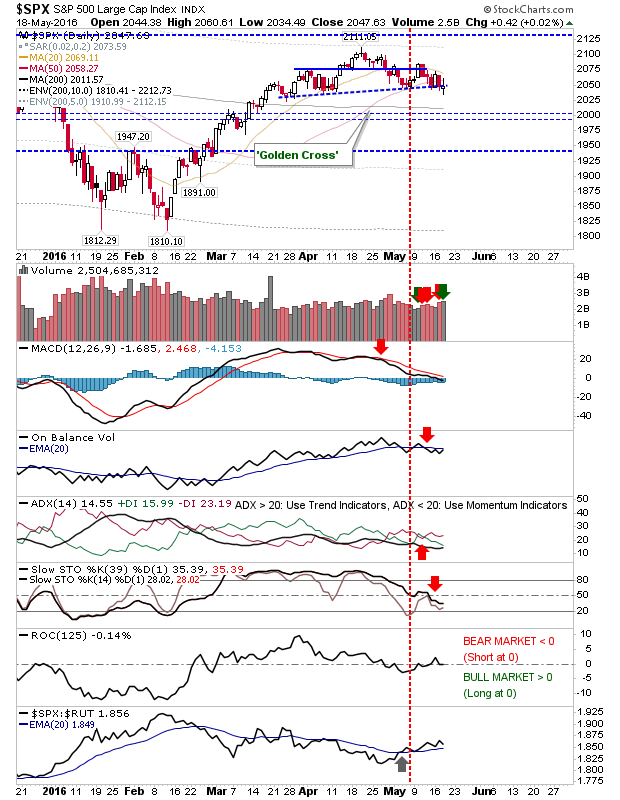

Small gains yesterday failed to recover Tuesday's losses. The trend is down, but losses are still modest - thanks to these regular gains.

The S&P is still clinging on to the neckline of the head-and-shoulder pattern. Volume climbed yesterday to register an accumulation day, but the 'spinning top' finish for the day leaves things in a more neutral state. A swing-trade using the day's highs/lows as the trigger would be ideal, but an inside day would offer better risk:reward.

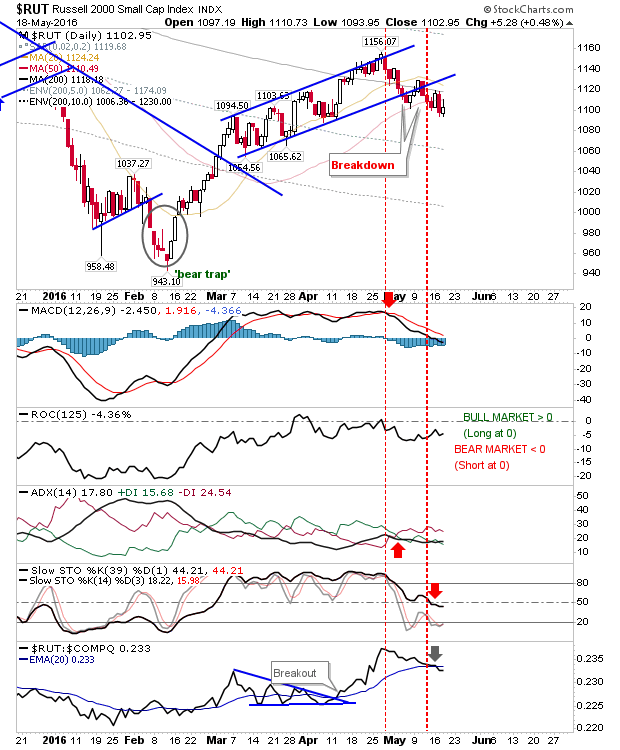

After an extended period of relative outperformance by the Russell 2000 against the NASDAQ, the Russell 2000 has begun a period of underperformance with supporting technicals bearish. The failure to recover the 50-day MA along with the downtrending 200-day MA compounds the bearish picture.

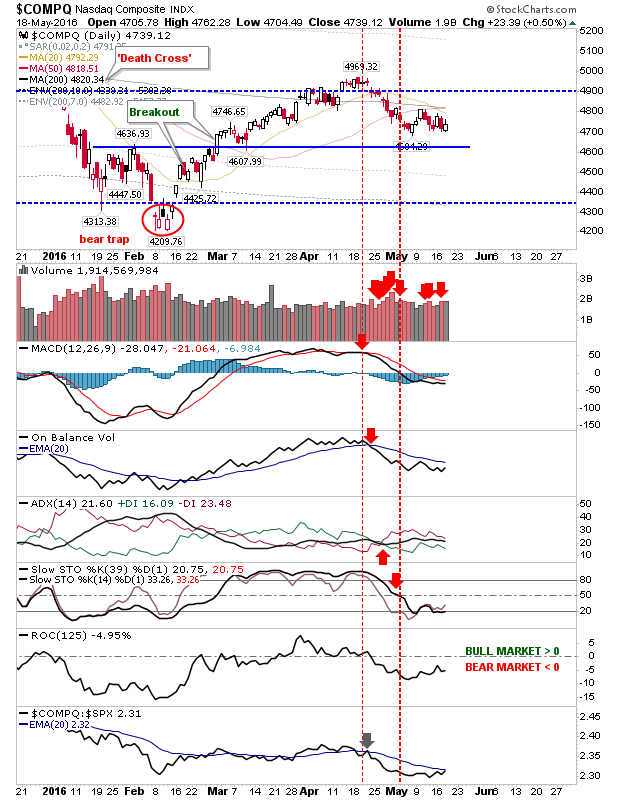

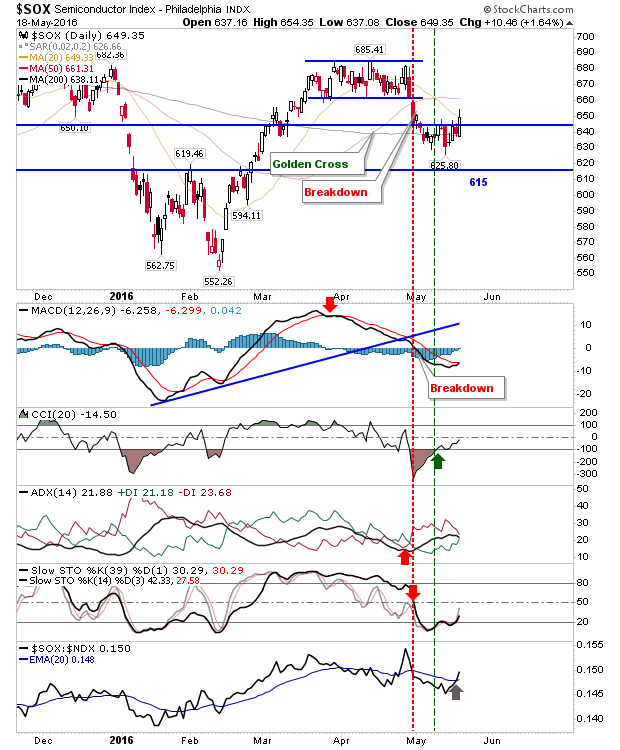

The NASDAQ remains below the 20-day, 50-day, 200-day MAs on net bearish technicals. So while it may be outperforming against the Russell 2000, it's not doing so from a position of strength. However, the silver lining for the index is the building swing low in the Semiconductor Index.

For today, bulls should look for a bounce opportunity off neckline support in the S&P, and the potential for a rally through converged support in the NASDAQ; the latter would likely see a swathe of short covering given the negative technical picture. The Russell 2000 is not offering a clear risk:reward trade.