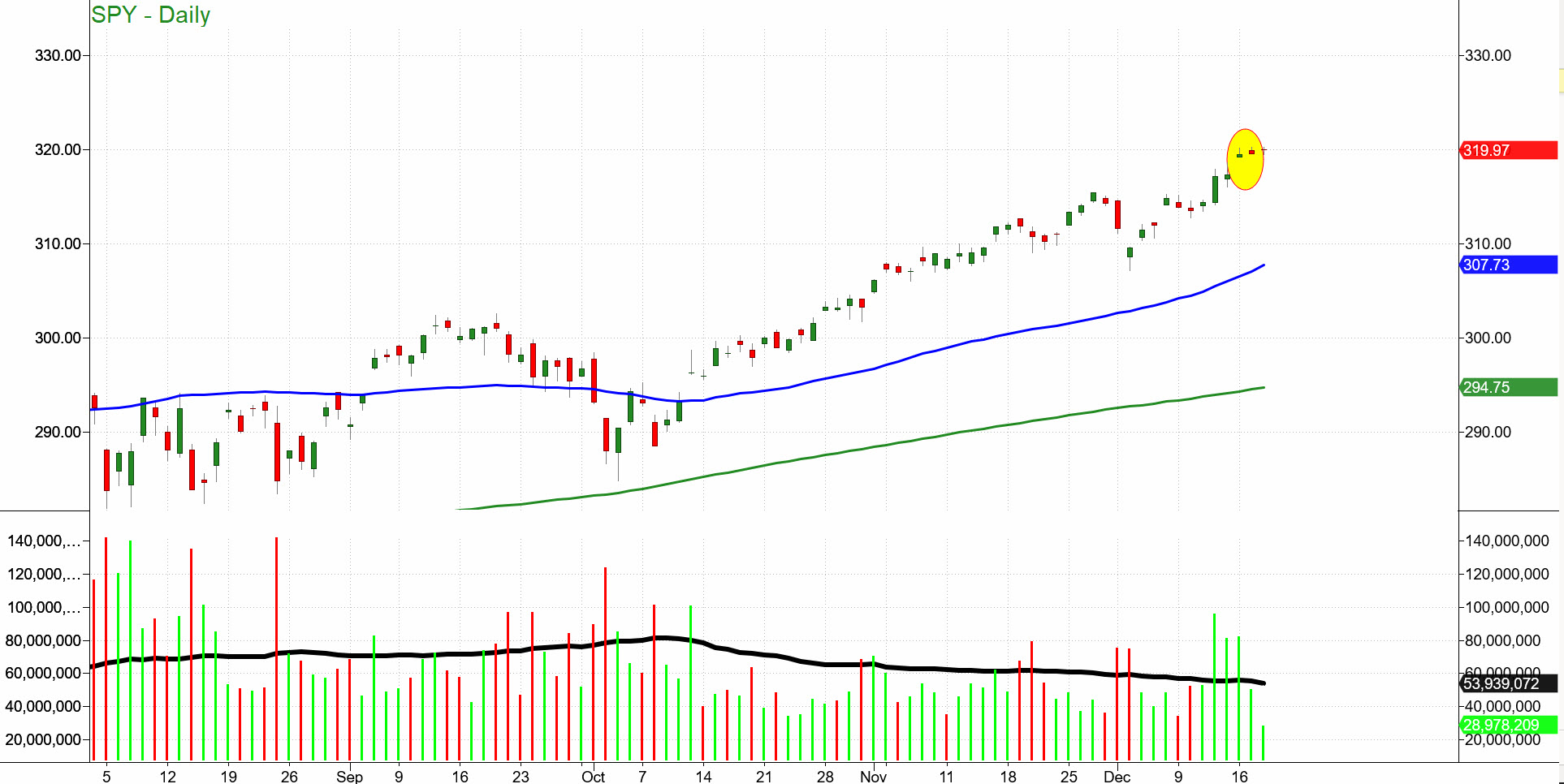

Day 3 and our sloppy shooting star scenario still plays out in the S&P 500. What struck me about the chart of the SPDR S&P 500 (NYSE:SPY), was the volume patterns that accompanied the potential shooting star formation.

However, after great volume (better than the daily average) on December 13, 15, and 16, yesterday, the volume was scant in comparison. As we have learned, shooting stars (even sloppy ones) could be a sign that the end of this rally is near.

I call this pattern sloppy because the opening and closing prices were not close enough. Nevertheless, with two highs at 320.25 and a red close, should the price decline Thursday, bears may get yet another chance to go short with a tight stop.

However, if the prices rise and hold over 320.25, than we can consider it a false signal or a consolidation pattern, where overbought conditions get resolved with time rather than with a price correction.

That is precisely why we need to check in with the Economic Modern Family, below, to see what information they offer us. However, before we go into the Family’s performance, another note on junk bonds.

We said that junk bonds, via SPDR® Bloomberg Barclays (LON:BARC) High Yield Bond ETF (NYSE:JNK), head into the euphoria stage around 110. Yesterday’s high was 109.98. The relative strength on the daily chart is overbought at nearly 100%.

Euphoria is here. And wouldn’t that be just the perfect time for the shooting stars to play out, she says cynically?

As far as the Economic Modern Family, as predicted, Granny Retail, via SPDR® S&P Retail ETF (NYSE:XRT), played more catch up. Granny get your guns, because we need you to shoot a bullseye.

Transportation, iShares Transportation Average ETF (NYSE:IYT), took a hit with the dismal earnings performance in FedEx (NYSE:FDX). That’s a key component of the market as it represents consumer demand. In other words, we need to see demand grow not shrink.

Biotechnology, iShares Nasdaq Biotechnology ETF (NASDAQ:IBB), a leader in the current rally, took a breather. Some news about the U.S. buying drugs cheaper from Canada could explain the red day.

Regional Banks failed to hang onto its early gains. Not so worrisome at this point.

Sister Semiconductors also took a breather. Whether that turns into a more significant correction remains to be seen.

The Russell 2000, iShares Russell 2000 ETF (NYSE:IWM), gained in price. The interpretation is that investors are optimistic that the manufacturing sector will grow. That is the best sign from the Family. Clearly IWM cannot falter here.

After a euphoric move in junk bonds, a potential bearish signal in SPY (NYSE:SPY) should recent lows break, and a Family that hinges hopes on supply more than on demand, Santa’s sleigh carries tricks and treats.

S&P 500 (SPY (NYSE:SPY)) 316.20 or the 10 DMA support. 320.25 new all-time high matched today. Watch for any selling under the last 2-day lows

Russell 2000 (IWM) 163.25 support and must clear/hold over 165.10 to keep going-did so intraday but backed off by close

Dow (SPDR® Dow Jones Industrial Average ETF Trust (NYSE:DIA)) Inside day. 281.10 the support with a ATH at 284.11

NASDAQ (Invesco QQQ Trust (NASDAQ:QQQ)) With a small breakaway gap, 206.25 or the 10 DMA support 210.13 new ATH.

SPDR® S&P Regional Banking ETF (NYSE:KRE) (Regional Banks) 57.52 support, 59.50 resistance.

VanEck Vectors Semiconductor ETF (NYSE:SMH) (Semiconductors) Want to see this hold 140.93, then 137.40 support. 142.20 the ATH.

IYT (Transportation) 195 is still key pivotal area with 192.35 key support.

IBB (Biotechnology) 116.30 key support 122.97 the 2018 high

XRT (Retail) 45.41 cleared now pivotal.