Last week, with this “stylebox” update, the longer-term returns on the S&P 500, NASDAQ Composite and Nasdaq 100 are really nothing to write home about, given the risk of downside of an exogenous shock.

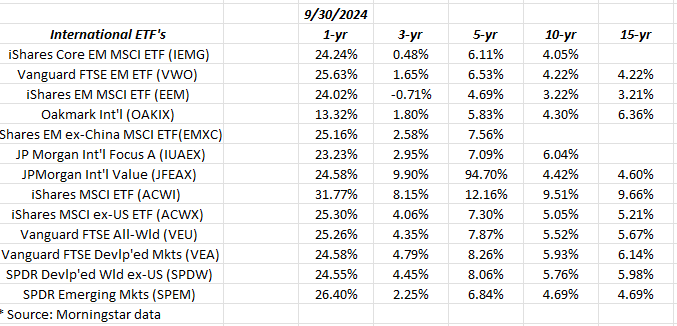

Look at the 3-year, 5-year, 10, and 15-year annual returns for this smattering of international ETFs and mutual funds.

Recently this blog sold the Oakmark International fund, which was tough to do given David Herro’s track record. David is a high-quality manager, but all that longer-term alpha of Oakmark Int’l has been whittled away in the last 12 – 18 months as David has stayed true to his core discipline.

The 1-year returns on international are very attractive, and this blog has captured some of that for clients with the iShares MSCI Emerging Markets ex China ETF (NASDAQ:EMXC) and the Vanguard FTSE Developed Markets Index Fund ETF Shares (NYSE:VEA).

Oakmark International has been replaced with the JP Morgan Int’l Value Fund.

Summary/conclusion:

Take all this for what you will. When the US secular bull market ended after 18 years in March 2000, you saw a dramatic rotation from technology and large-cap growth to mid-cap, smallcap (both US), value, and emerging markets and international.

The thing that shocked me back then was the incredible rallies in coal stocks like Peabody Energy Corp (NYSE:BTU). Equity asset classes and stocks that had gone nowhere for most of the 1990s, i.e. 1%, 2%, 5% annual returns versus the S&P 500’s 28% annual return from 1995 to 1999, suddenly took off like bottle rockets and mimicked the tech returns of the past years.

China has a huge part of this new-found growth since it grew 15% a year from the late 1990s through to probably 2009 – 2010.

And then – once the US and rest of the world slowed down after 2008, and Europe was faced with Brexit – China’s growth became like rest of the developed world.

It’s interesting that the mega-caps have started to fade in terms of outperformance just as those 1-year international returns above (on the spreadsheet) have started to turn higher.

More client money will find it’s way into international, probably after January 1 (or maybe before).

You have to play the long game.

***

None of this is advice or a recommendation, but only an opinion. Past performance is no guarantee of future results. All performance data cited is sourced from Morningstar. Investing can and does involve the loss of principal even for short periods of time.