Markets In Conflict

According to stockcharts.com, trading ranges speak to a fairly even battle between stock-market bulls and bears:

Price action depicts a market in conflict. Only until the price breaks above resistance or below support will it be clear which group has won the battle.

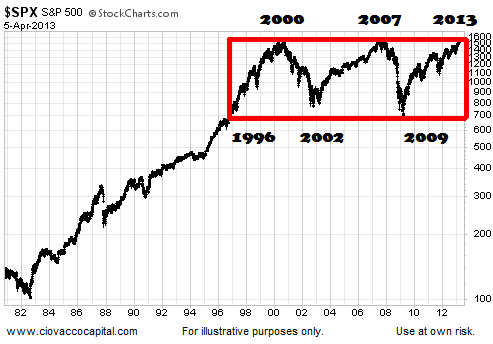

As shown via the 1981-2013 S&P 500 chart below, neither the bulls nor the bears made much sustainable progress between 1996 and 2013, which resulted in a long-term trading range.

Worth A Thousand Words

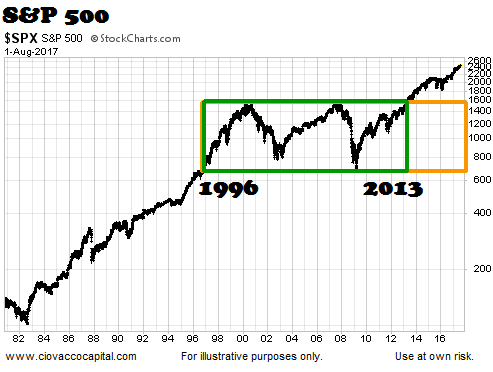

The S&P 500 broke above prior resistance in 2013, meaning the bulls won the long-term battle that took place between 1996 and 2013. The lows in 2015 and 2016 served as a retest of the 2013 breakout.

Where Does The Average Stock Stand?

Has the average stock broken above long-term resistance? This week’s video uses present day market fractals to help assess the outlook beyond the major U.S. stock indexes. Some fascinating market fractals have formed over the past 35 years, which may have a significant impact on stock market behavior over the next 20 years.

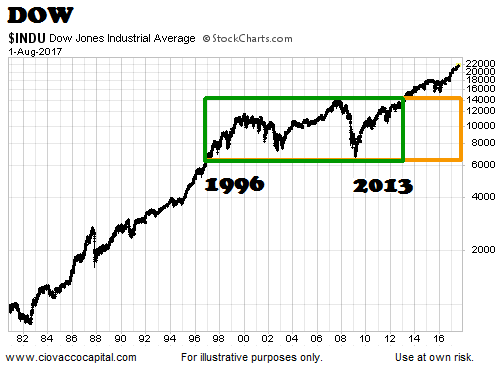

Dow Jones Industrial Average

The Dow entered the box in 1996 and remained there until the breakout in 2013.

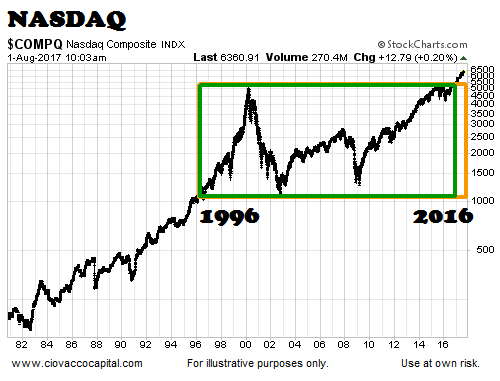

NASDAQ/Tech Stocks

In 2016, the NASDAQ completed the trifecta by breaking above resistance that dated back to the highs made at the peak of the dot-com hysteria.

2017 And Beyond

From a short- and intermediate-term perspective, markets will always be volatile and challenging. However, given what we know today, the charts above tell us the odds favor good things happening over the next 5 to 20 years. Therefore, under our approach, we will continue to give the long-term trends the benefit of the doubt as long as they remain in place. The closer we watch the markets and our account balances, the more difficult it will be to stay focused on the longer-term, and bullish, outlook.