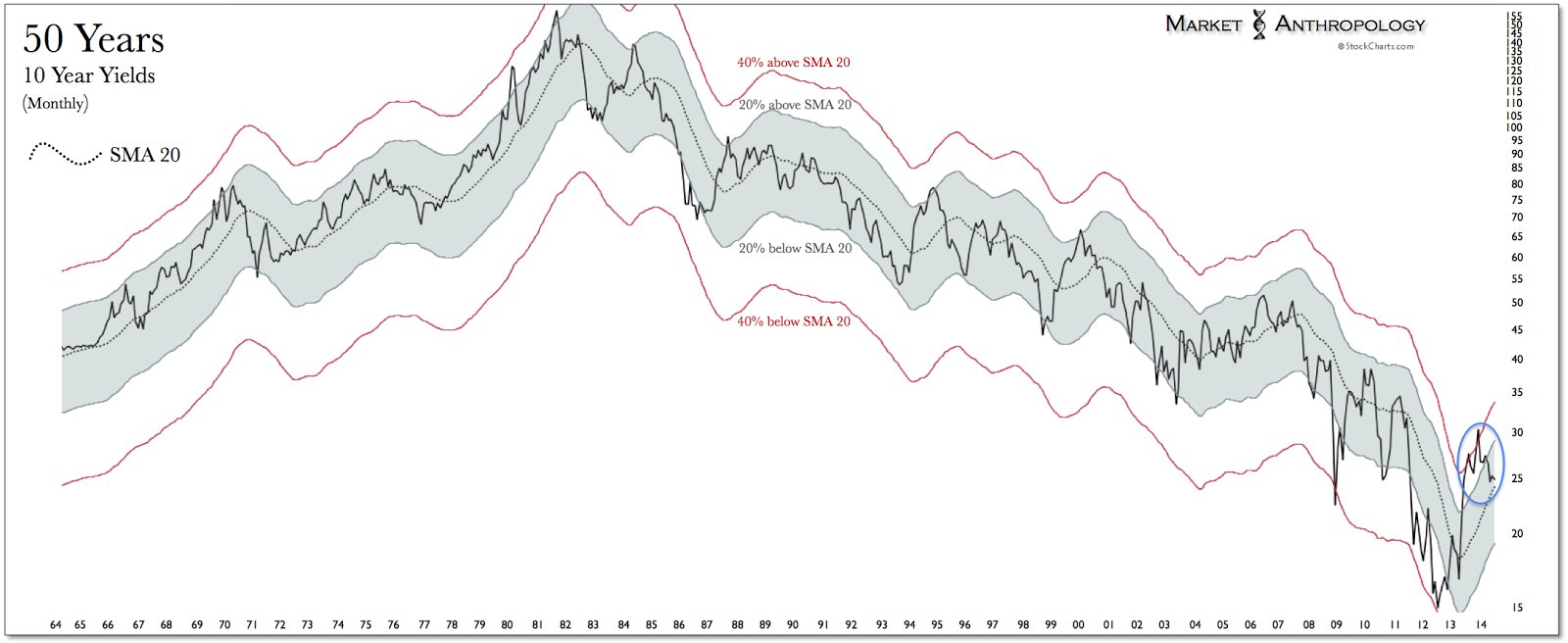

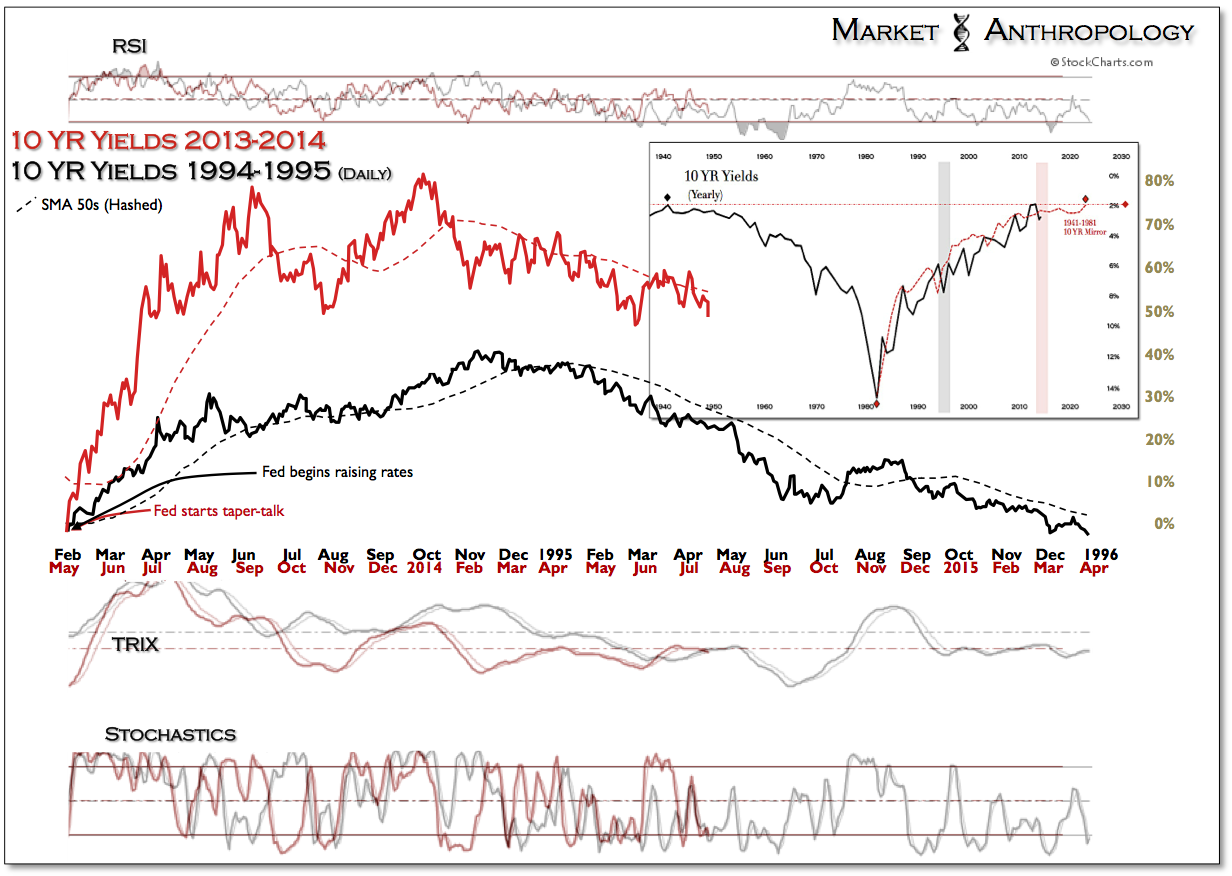

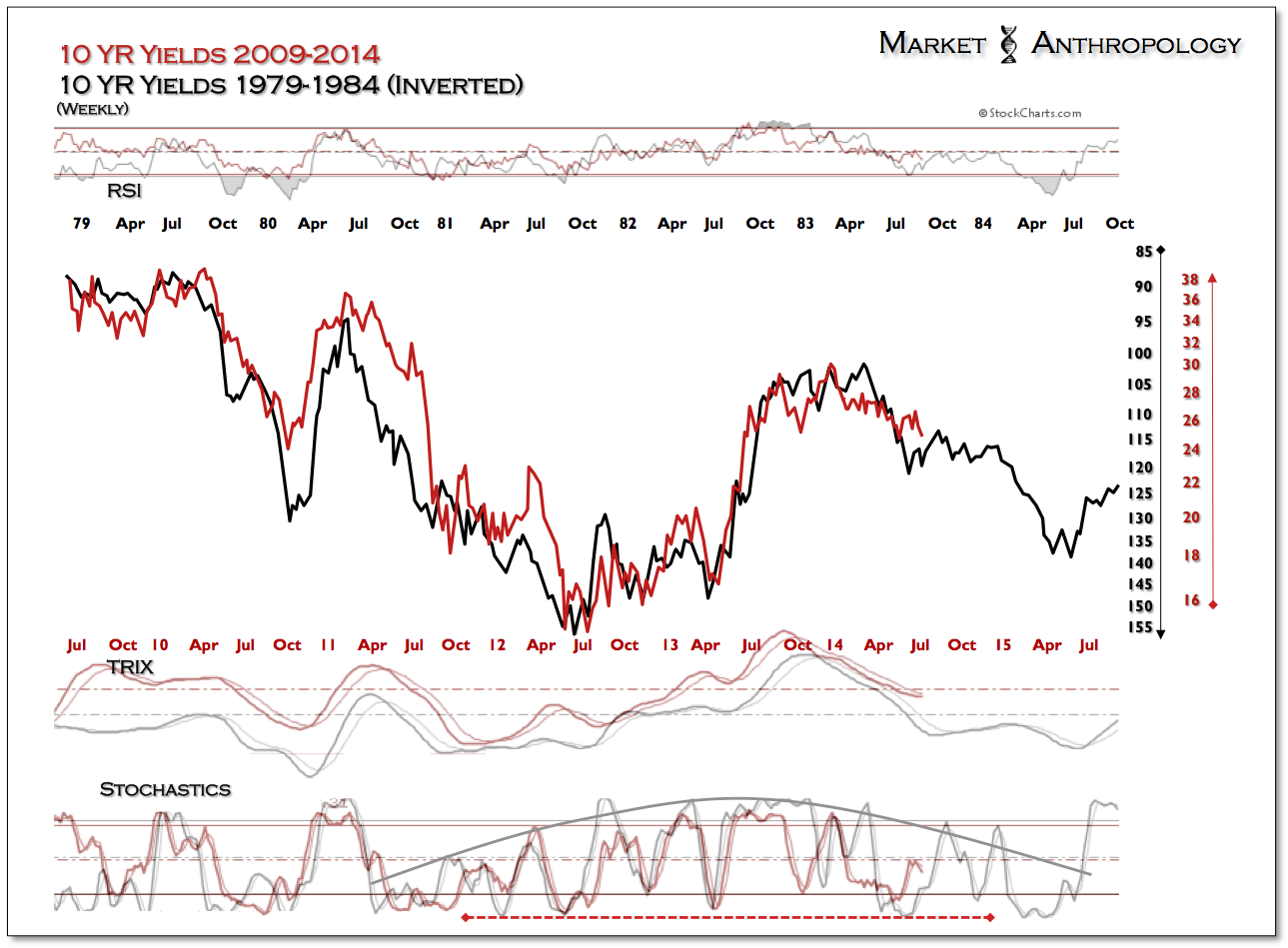

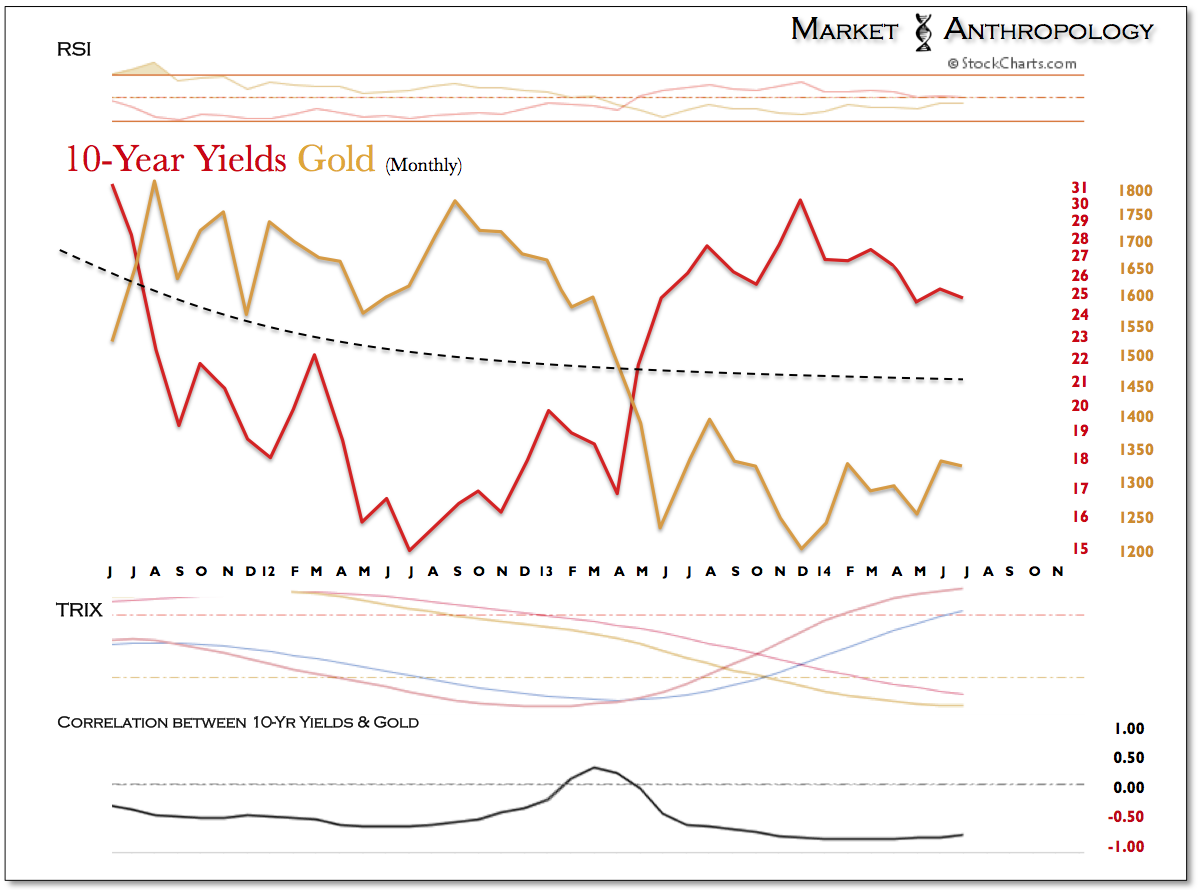

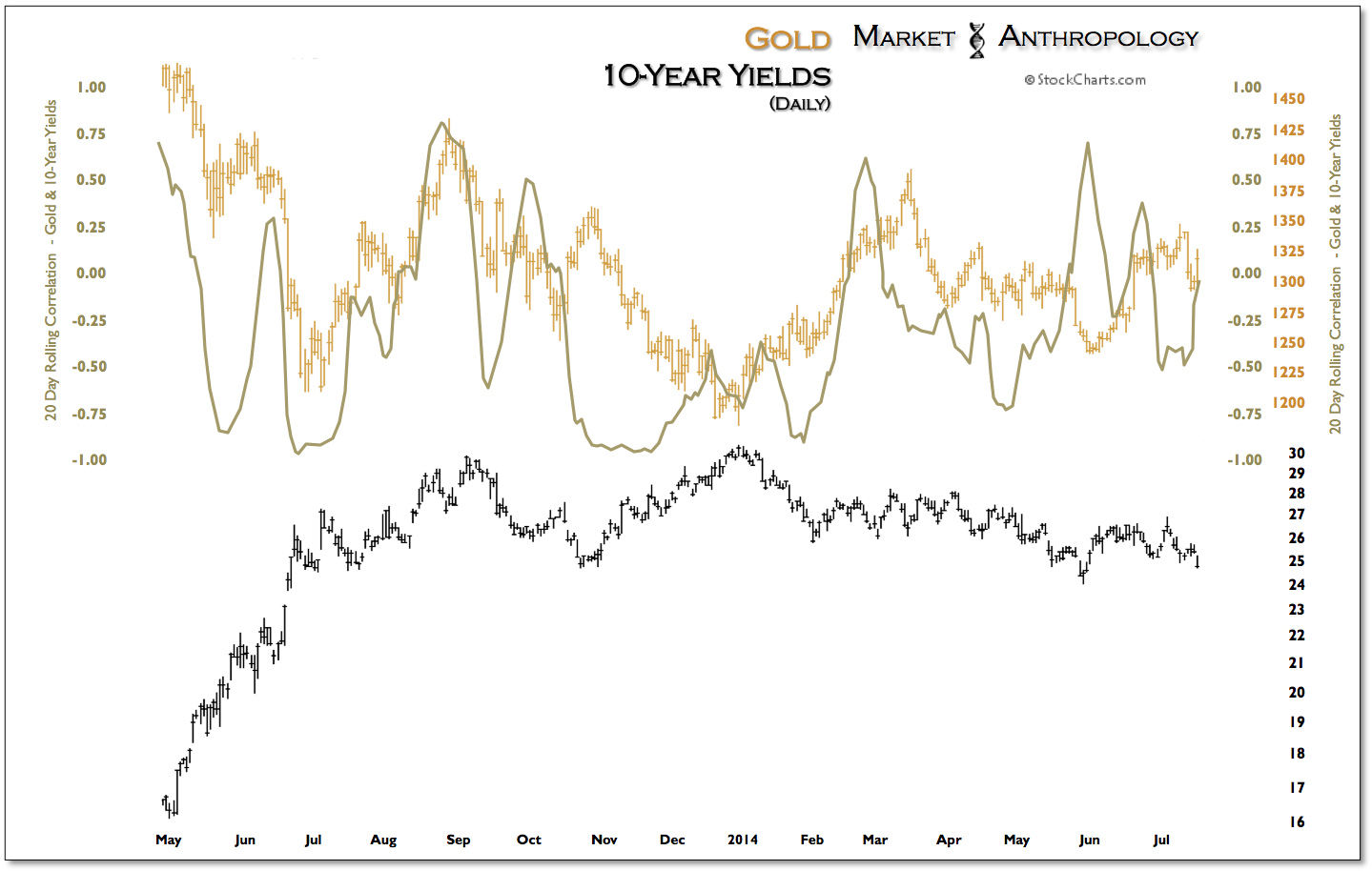

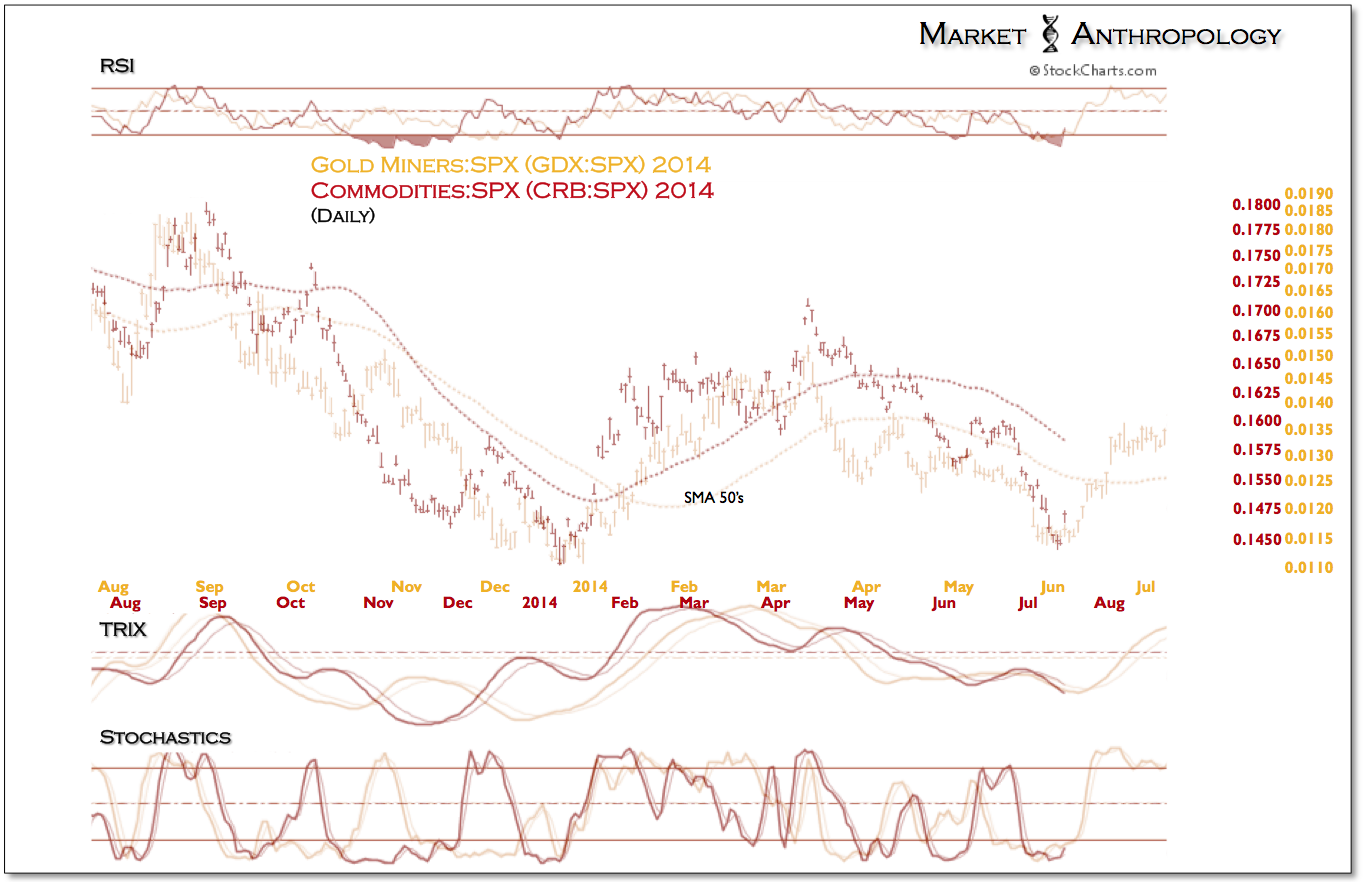

U.S. 10-Year yields continue to drip lower, reacting to the recent and heart-wrenching geopolitical tragedies that appear to flame a growing instability behind a benevolent market environment. And while the latest turn of events has provided further motivation for participants' reflexive appetites toward certain safe-haven corners of the market, these respective asset trends have been in place all year. Long-term Treasuries and precious metals continue to outperform equities, while the broader commodity sector has recently retraced back to commensurate returns with the SPX this year.

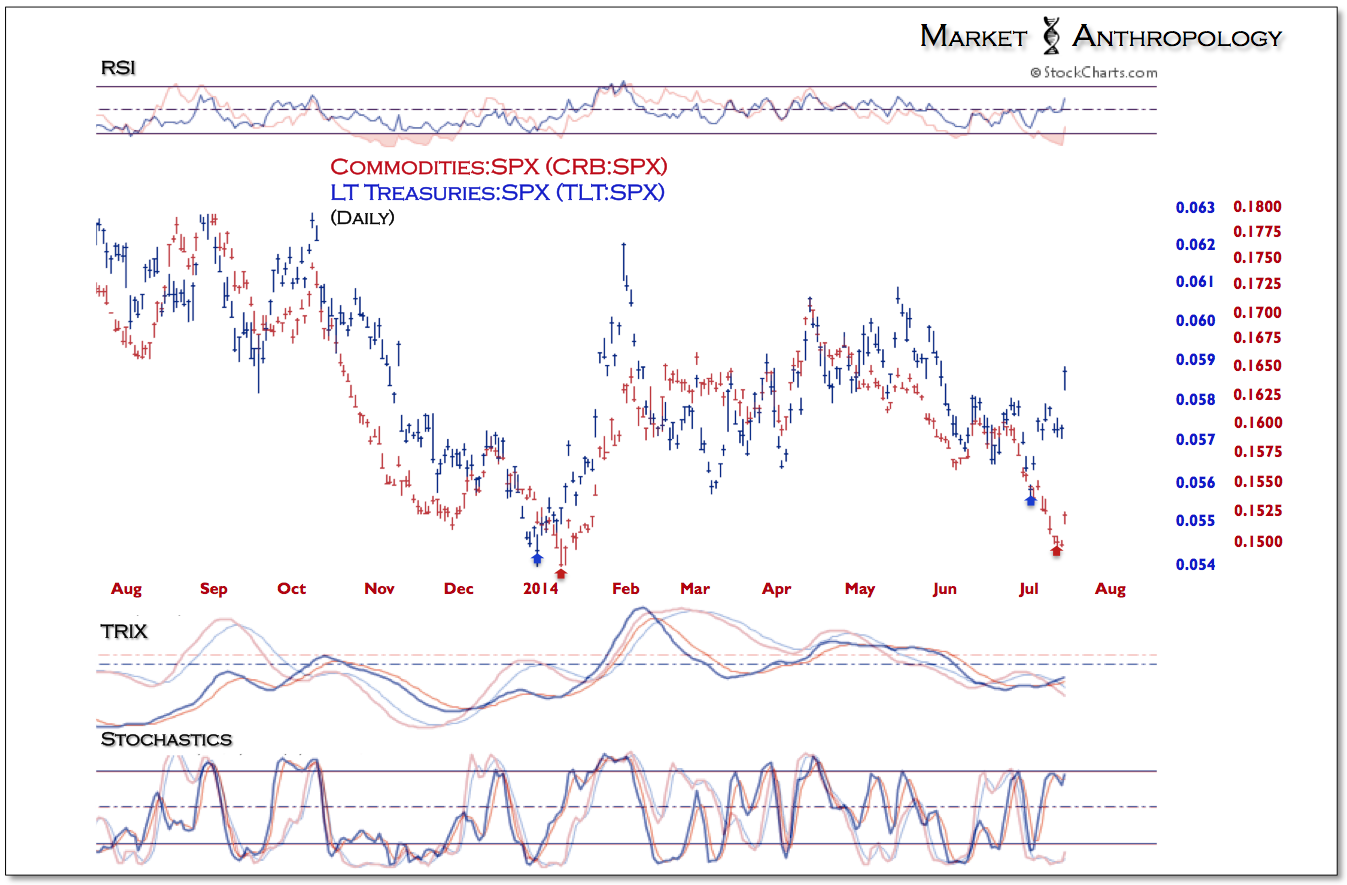

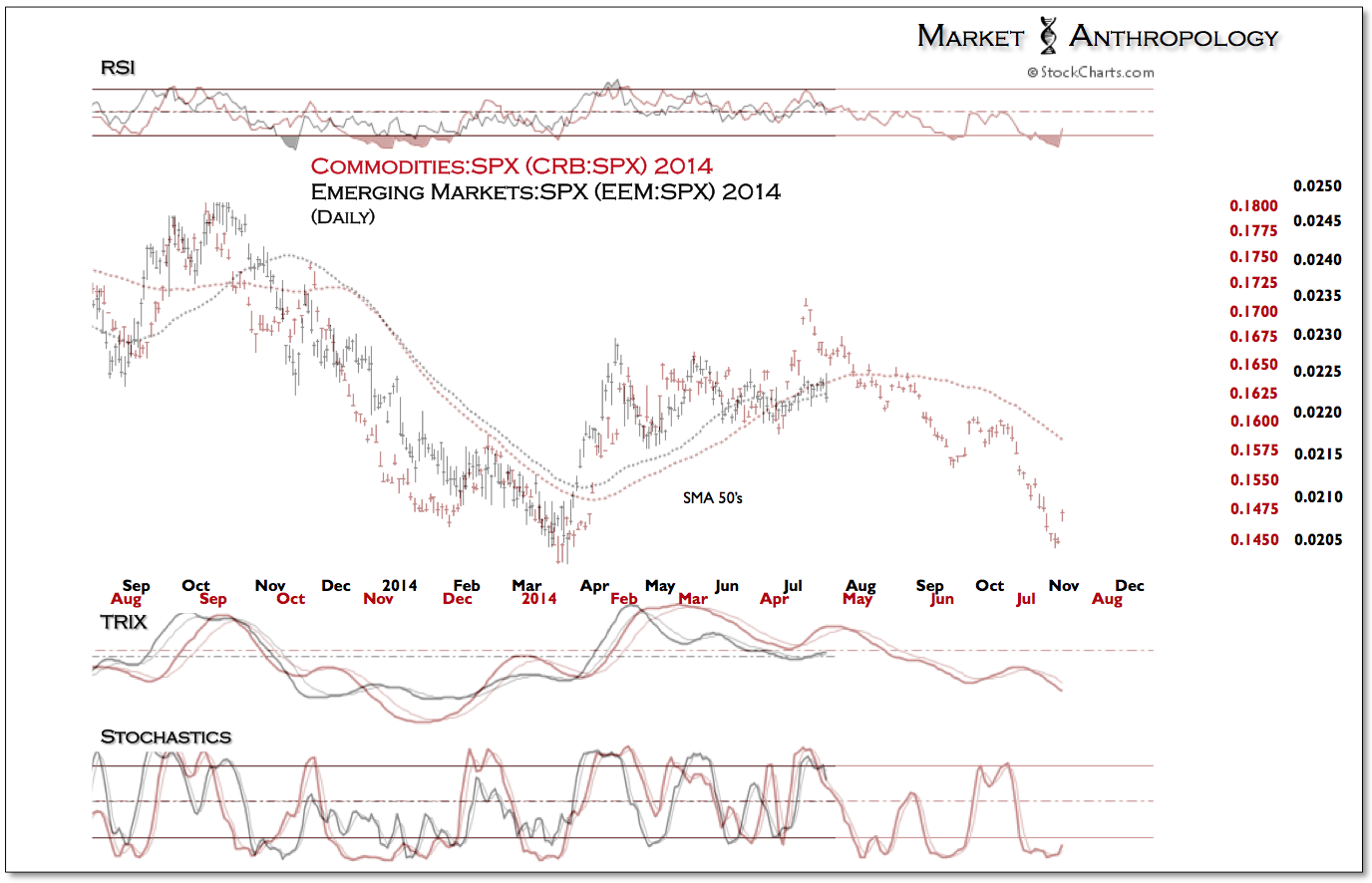

As we highlighted in last week's notes (here and here), long-term Treasuries and commodities were following in the month old footprints of the precious metals sector. Filling out the proportion of the pattern, both asset classes have pivoted higher over the past week after testing the lows (relative to the SPX) from earlier in the year. Long-term Treasuries have been leading the move higher over the past two weeks and we anticipate that the broader commodity space will be pulled up in its wake going forward. Following the lagged blueprint of the study, emerging market equities look susceptible over the coming weeks to retracement declines relative to the SPX.

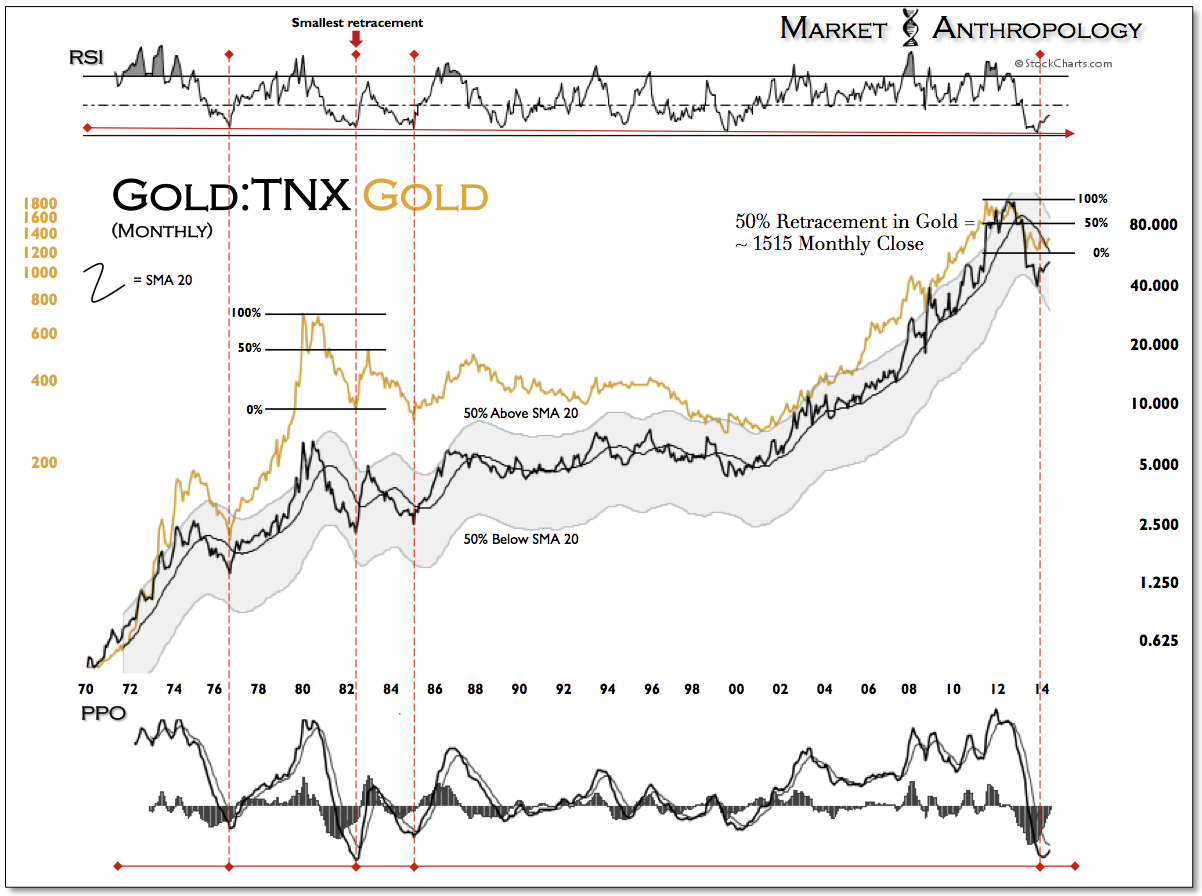

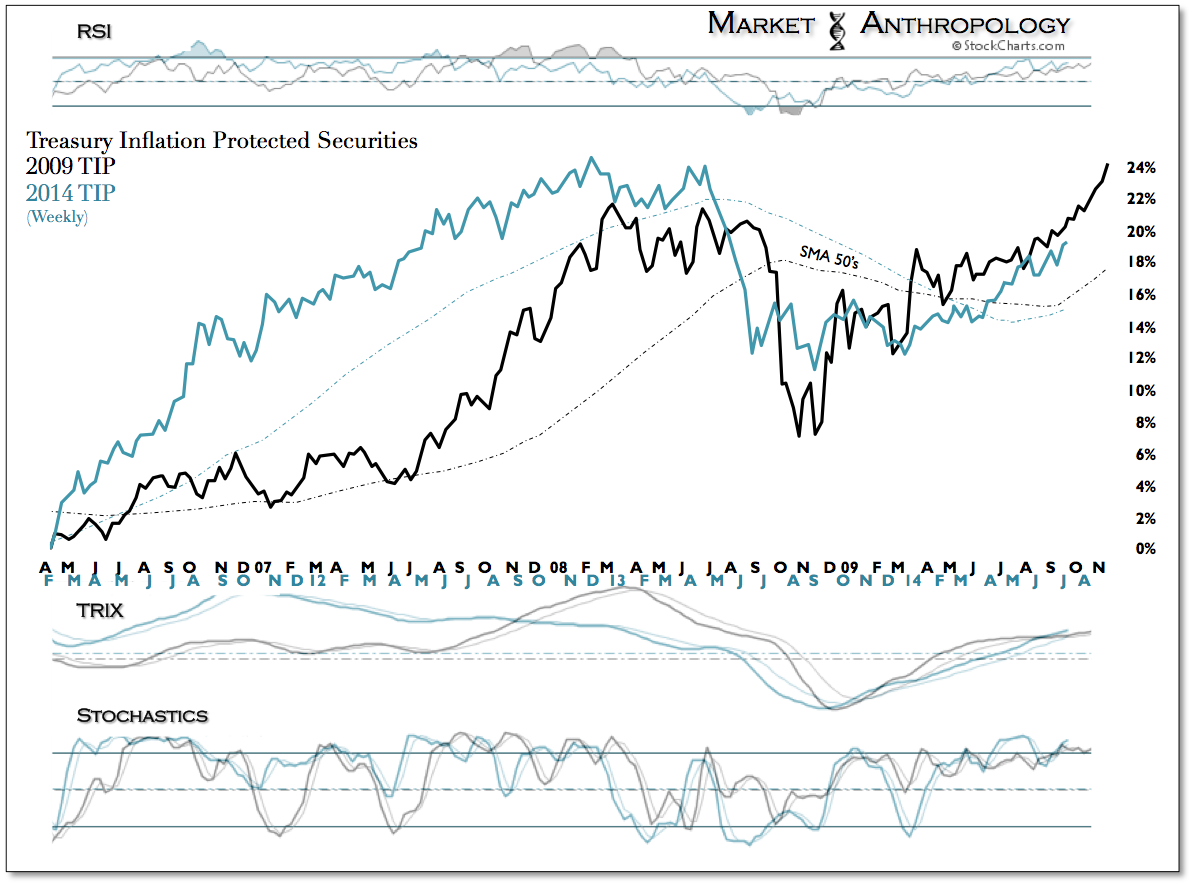

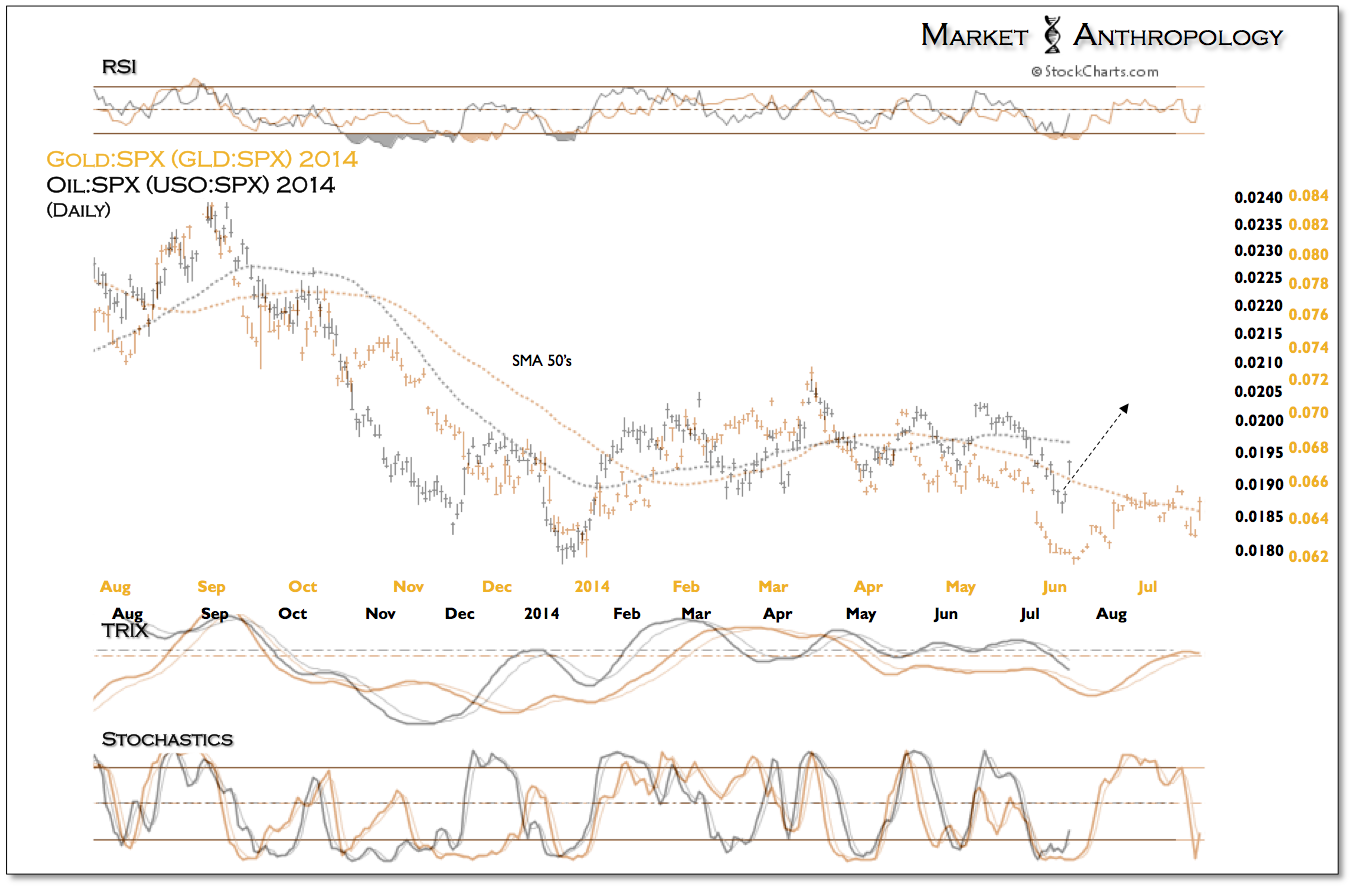

The precious metals sector retraced sharply lower over the past week, turning down for the first time since the explosive rally out of the June 2nd lows. Relieving strongly overbought conditions while the currency markets complete their retracement obligations, we remain firmly bullish towards the sector's prospects in the balance of the year. Our comparative studies of the US dollar, the euro and 10-year yields all point towards favorable backdrop conditions, as real yields walk lower - encouraging the developing trends in long-term Treasuries and commodities. The TIP study that we have highlighted throughout the year continues to make its way towards another leap higher in the range that we anticipate will be made in the second half of summer.

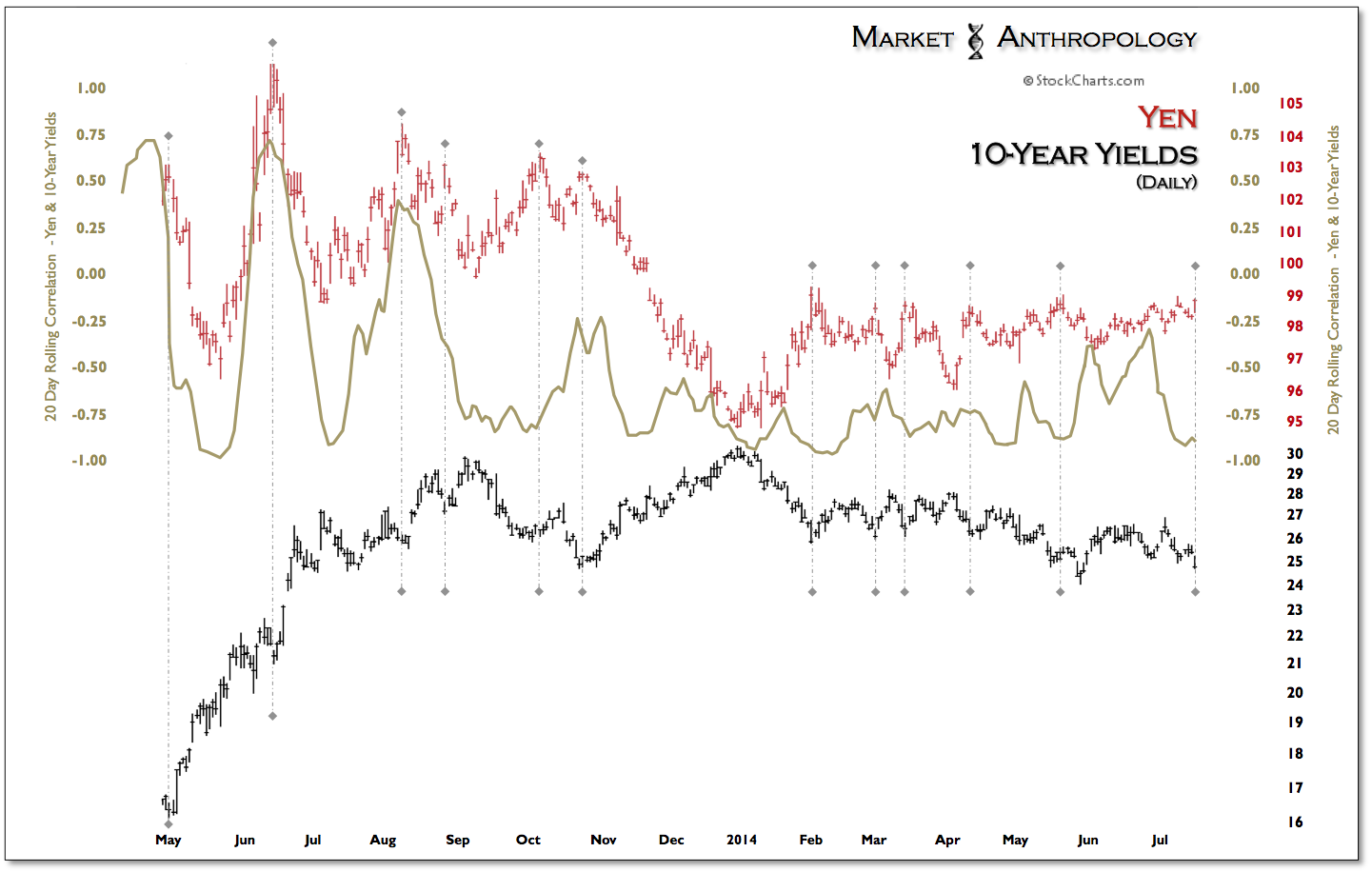

As 10-year yields work towards another breakdown below the late May lows, we expect the yen will finally break higher out of the flagging range it has traded in throughout this year. All things considered, this is buttressed by our comparative expectations that the Nikkei will make another retracement move down - before finally making a break higher above long-term resistance this fall.