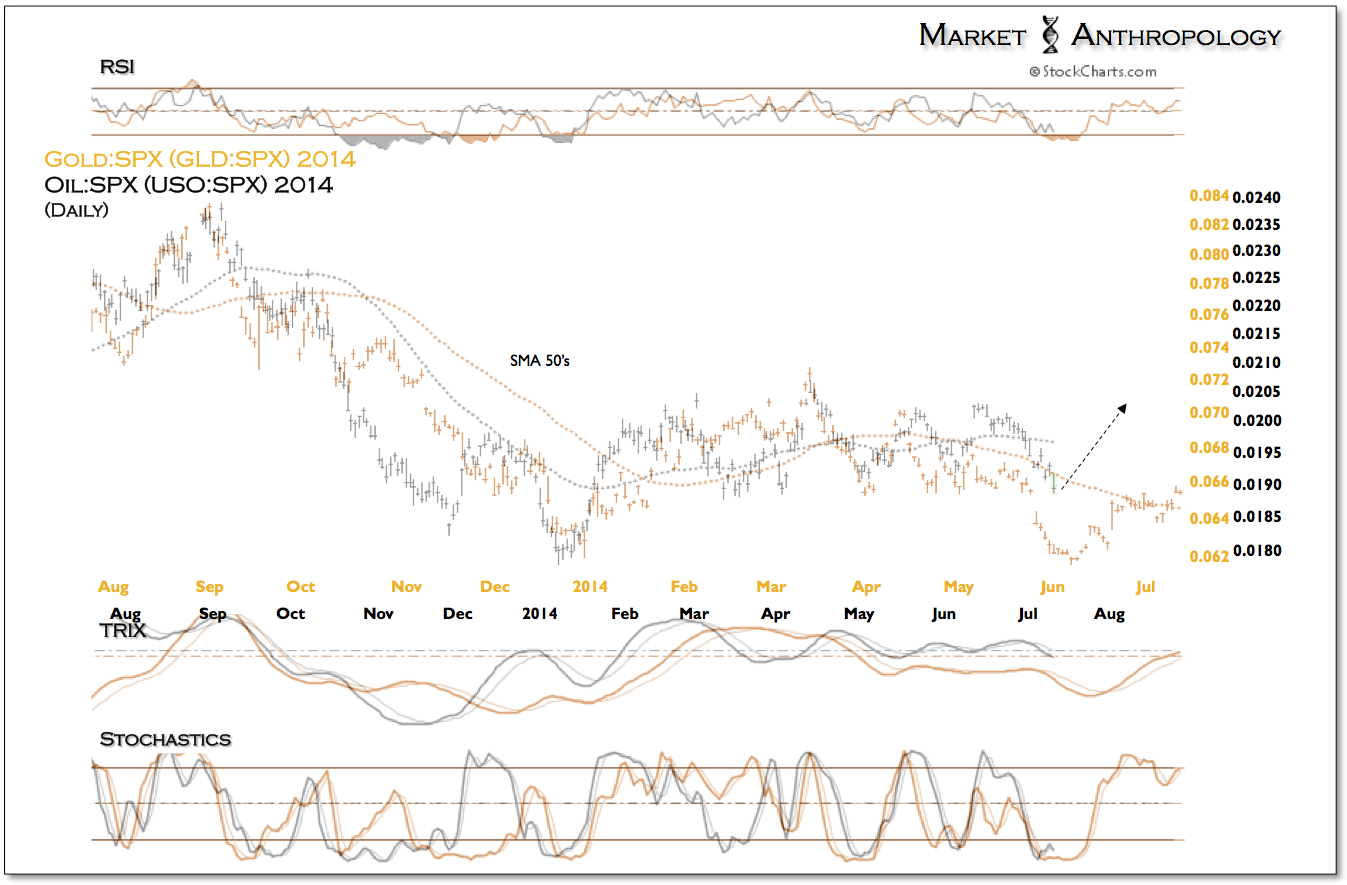

With light sweet crude falling another 2% on the day Friday, the commodity looks quite attractive for those looking to either diversify a portfolio, or capture the next leg higher - which we believe has already been foreshadowed by the recent moves in precious metals.

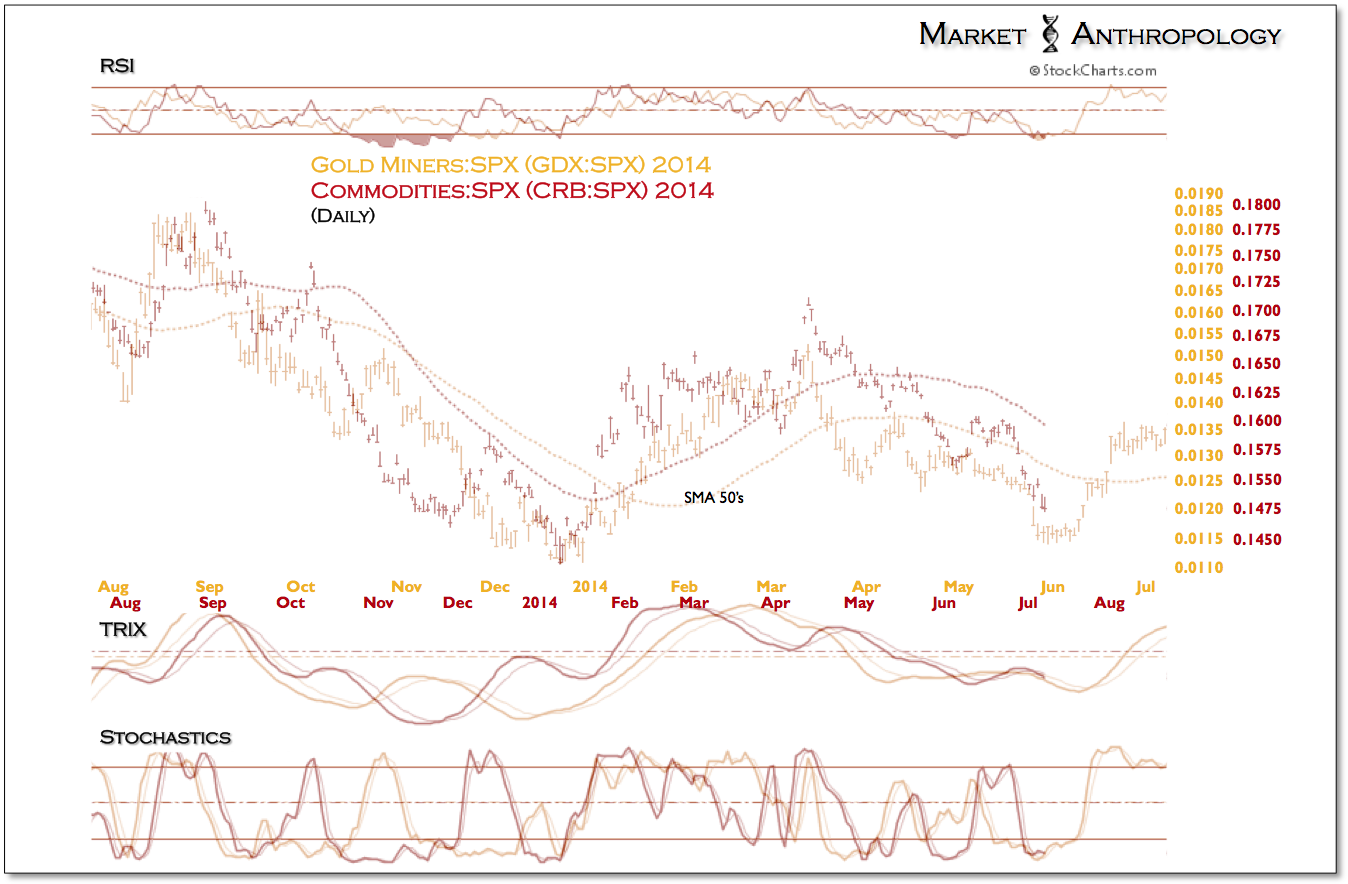

Last week we mentioned that the broader commodity space was following in the month old footprints of the precious metals sector, as the CRB (relative to equities) was testing the cycle lows from earlier in the year.

We expect that similar to the upside pivots in early June in silver and gold, oil will also find its footing and surprise to the upside.

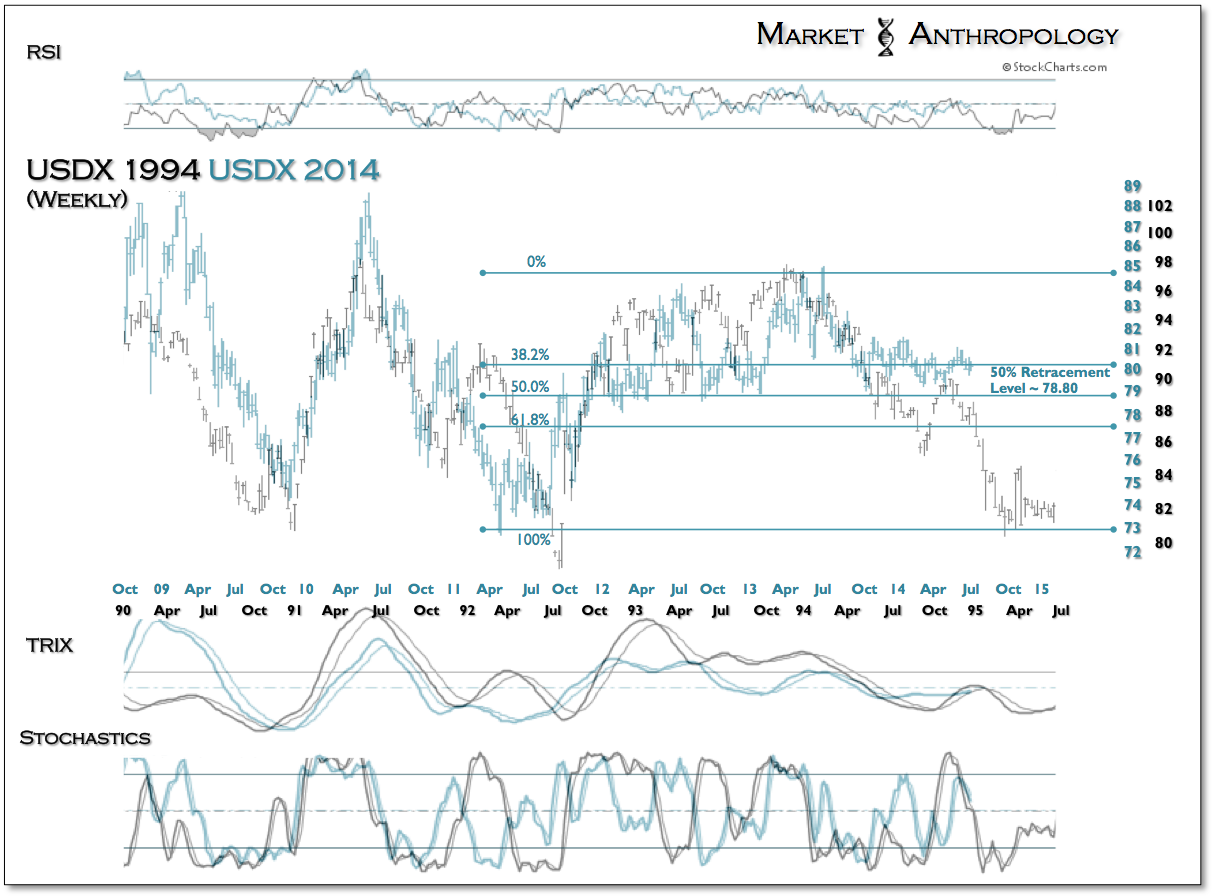

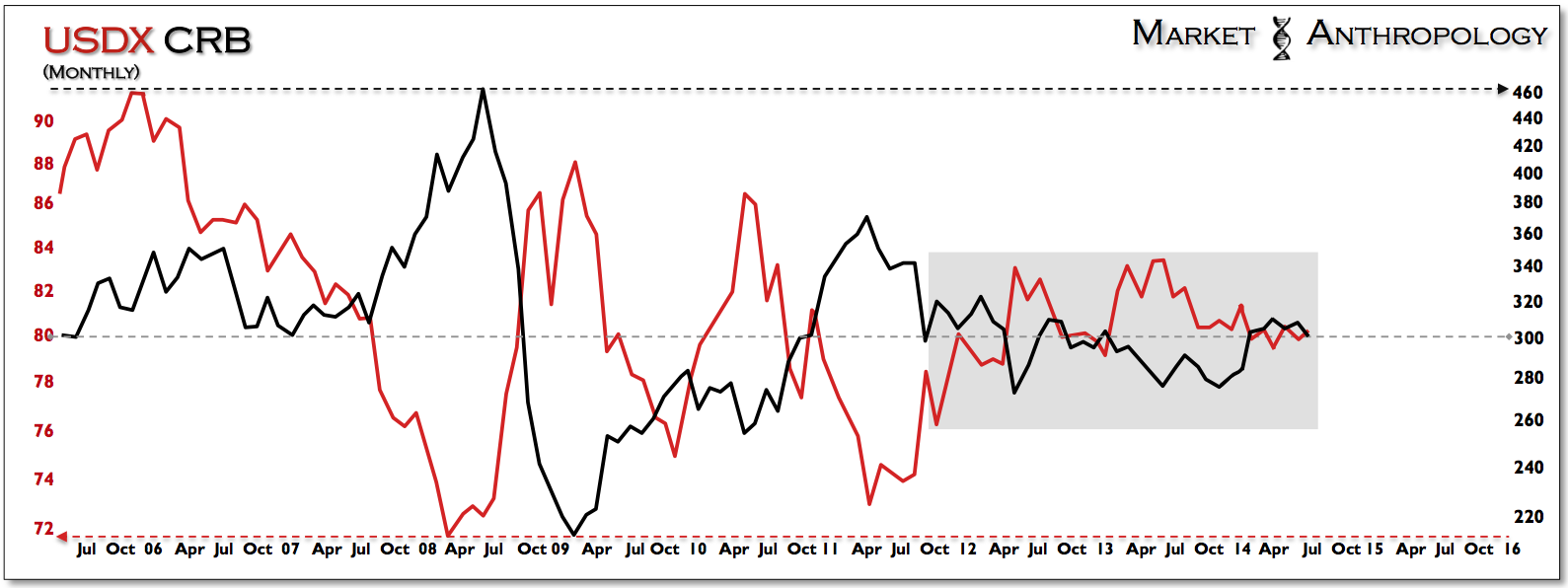

To a large degree, the commodity sector is jockeyed through major pivots by trends in the US dollar.

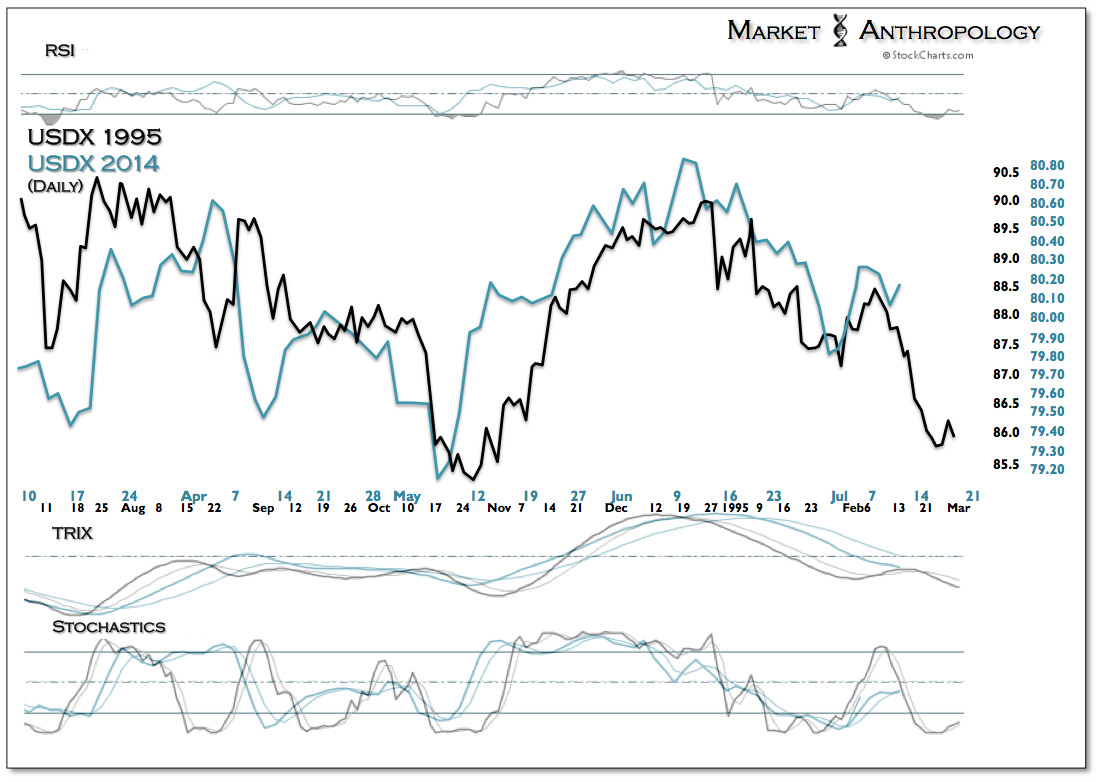

Since turning bearish on the US dollar index last June, we have followed a historic momentum comparative of the index - that continues to point towards lower lows in the dollar. All things considered, the CRB should break higher towards its previous cycle peak - as the US dollar index plumbs the bottom of its long-term range.