What bulls do not want to see, is when the long bonds (which have turned around) outperform both the S&P 500 and the Junk Bonds.

Risk-Off (things have already changed since the weekend)

- All the key indexes were down sharply on the week (between -1.5% to -3.5%) with the Russell’s now down on the year -1.25%. The Dow lost its bull phase, IWM is in a distribution phase and closed under the 200-Day Moving Average. While both the Nasdaq and S&P are hanging on to bull phases but with momentum waning across the board on the daily charts. (-) All indices now in warning or distribution phases.

- All of the key indexes have more distribution than accumulation days with the exception of the Nasdaq which is evenly split between them. (-)

- Ten of the fourteen sectors we track were down on the week, led by retail and transports which could be pointing to a slowing economy. Consumer staples and utilities were both positive on the week, a classic flight to safety reading. (-)

- The McClellan Oscilator flipped negative with the sell-off. (-)

- The new high new low ratio rolled over this week due to weakness in the market on Thursday and Friday. (-)

- The risk gauge went full risk-off. (-)

- Unsurprisingly, volatility had a big jump closing in a bull phase for the cash index. (-)

- Value began outperforming growth and the growth index moved into a warning phase. (-)

- In the modern family, Semiconductors held onto their bull phase while regional banks and grandma retail got crushed and, along with transportation, all closed in weakened phases. Despite the relative outperformance of semiconductors, the modern family is giving risk-off signals. (-) Semiconductors now in a distribution phase

- Rates eased this week across the yield curve, classic behavior in a risk-off environment. (-)

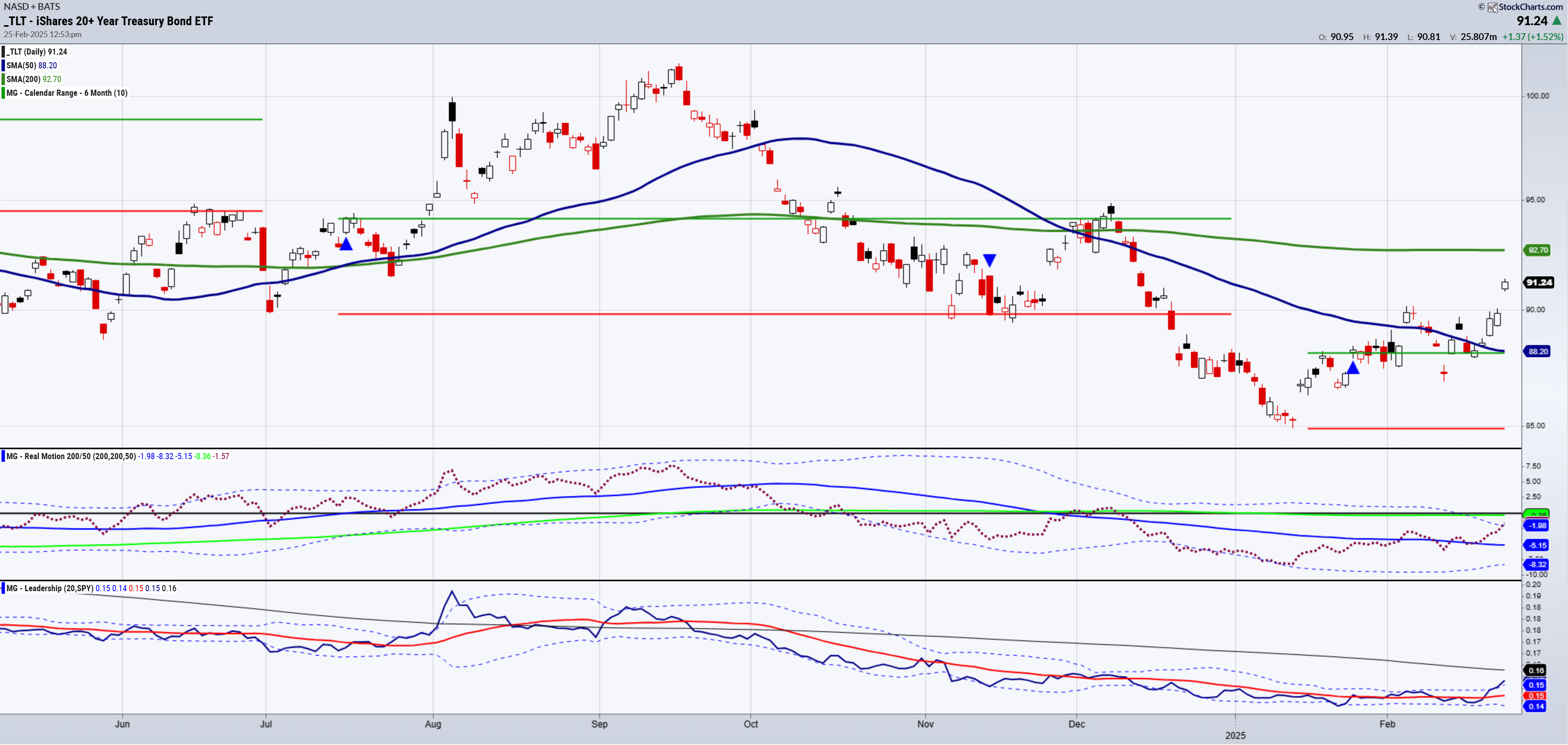

Looking at the current chart of the long bonds TLT versus the S&P 500 SPY, the TLT is outperforming. While yields have dropped, this move in TLT signals more a flight to safety.

TLT does have significant price resistance at the 200 Daily moving average (green.)

The price level of $90 is now the support to hold. And of course, this trajectory for bonds could change.

For now, though, we must take the risk-off scenario seriously and be very careful about which instruments to invest in and which stocks to buy the dip.

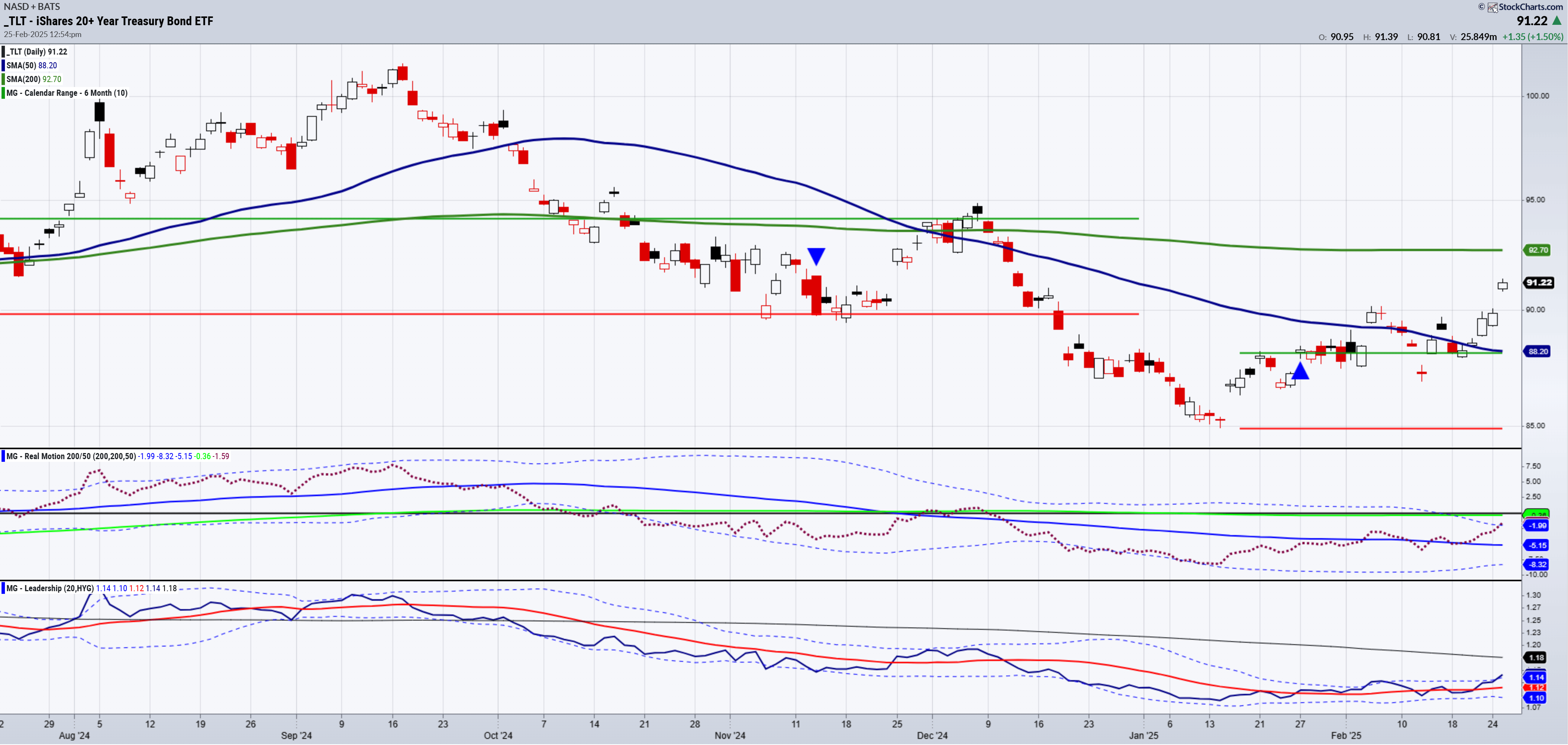

Even more interesting is the ratio between long bonds and junk bonds.

The chart of TLT shows how it outperforms HYG (junk bonds or high-yield high-debt bonds).

That alone is risk-off.

Investors like junk bonds when the market is solid.

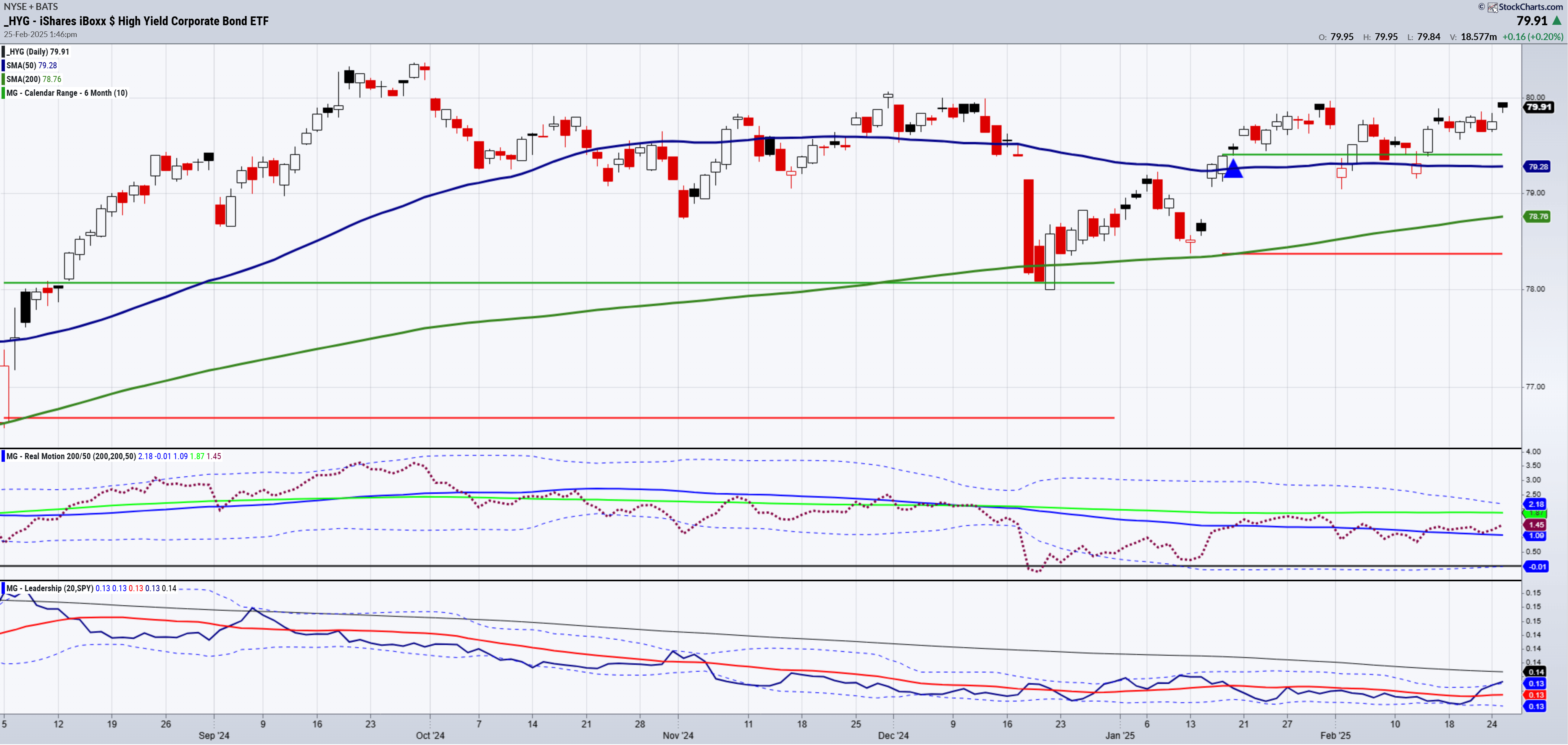

However, looking at HYG or junk bonds on their own?

Notice how HYG gapped higher today.

There is a ton of price resistance at $80. Nonetheless, the ratio shows risk-off, but the junk bonds on their own say something else.

They say that bond traders still like the risk.

This suggests to me that opportunities will arise in the overall or broader market and this correction is nothing more than a correction.

This also suggests that the MAG7 stocks taking the hit do not reflect what bond traders see -no real risk of a credit default or recession.

Of course, should HYG turn lower, we can revisit that theory.

In 2020 when COVID struck, HYG sold off hard.

I am not seeing that here despite the ratio warnings.

Put this all together and you have a beautiful landscape for seasoned traders with patience and experience to understand which instruments to buy with the least amount of risk.

ETF Summary

(Pivotal means short-term bullish above that level and bearish below)

- S&P 500 (SPY) 590 support 599 resistance

- Russell 2000 (IWM) 2025 low made Tuesday at 213.49-but closed above

- Dow (DIA) 432 support must hold

- Nasdaq (QQQ) 510 support 520 close resistance

- Regional banks (KRE) 60 area support

- Semiconductors (SMH) 237 has support but now needs to clear 241

- Transportation (IYT) 69-70 support

- Biotechnology (IBB) 140 resistance

- Retail (XRT) 74 major support and until it clears 77 still looks weak

- iShares 20+ Treasury Bonds (TLT) 90 now support