European stock markets are looking for direction after bullish sentiment in the U.S. equity markets and upbeat economic data from China. U.S. markets got a boost from the recent tax changes and news of Apple (NASDAQ:AAPL) paying about $38bn in tax on cash held outside the U.S. and that the company plans to build a new campus and create 20,000 new jobs. Overnight, China’s economy was revealed to have grown by 6.9% for 2017, but expectations were already raised so there was little market reaction.

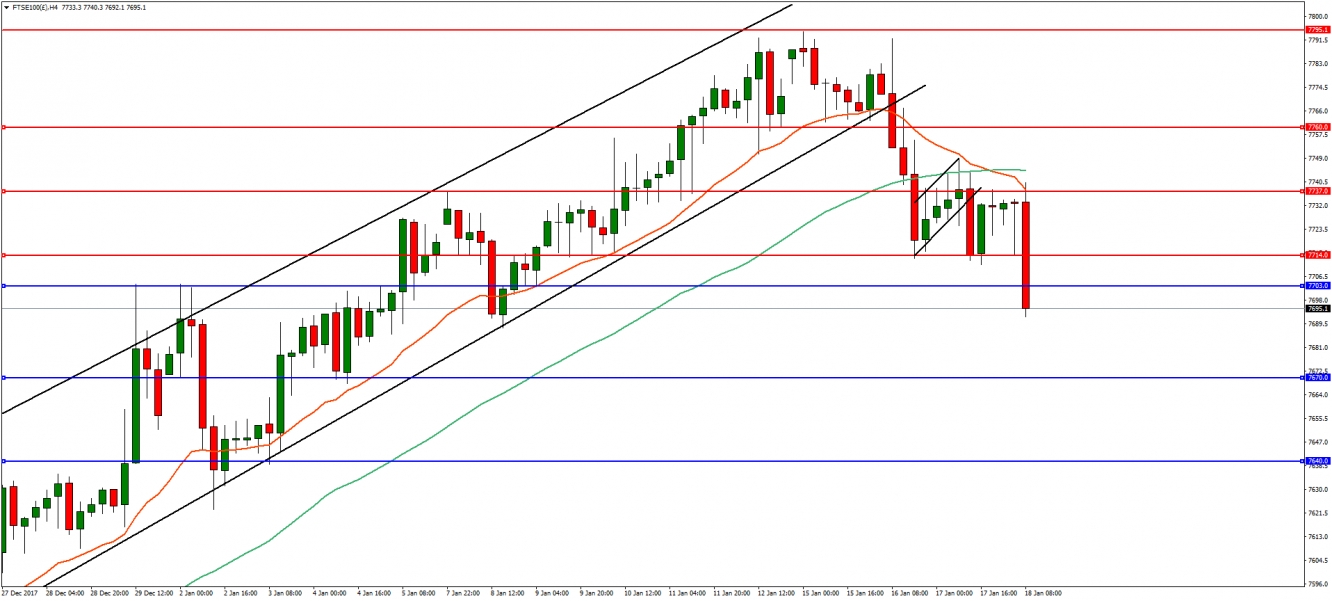

Despite opening higher, FTSE has so far ignored the bullish sentiment and is trading in negative territory for the fourth straight session. In the 4-Hourly timeframe, the index is attempting to break key support at 7700-7705. A failure here could lead to further declines to the 23.6% Fibonacci at 7670, which is also the target implied by the bear flag formation. A reversal above 7714 is needed to target resistance at 7737 and 7760.

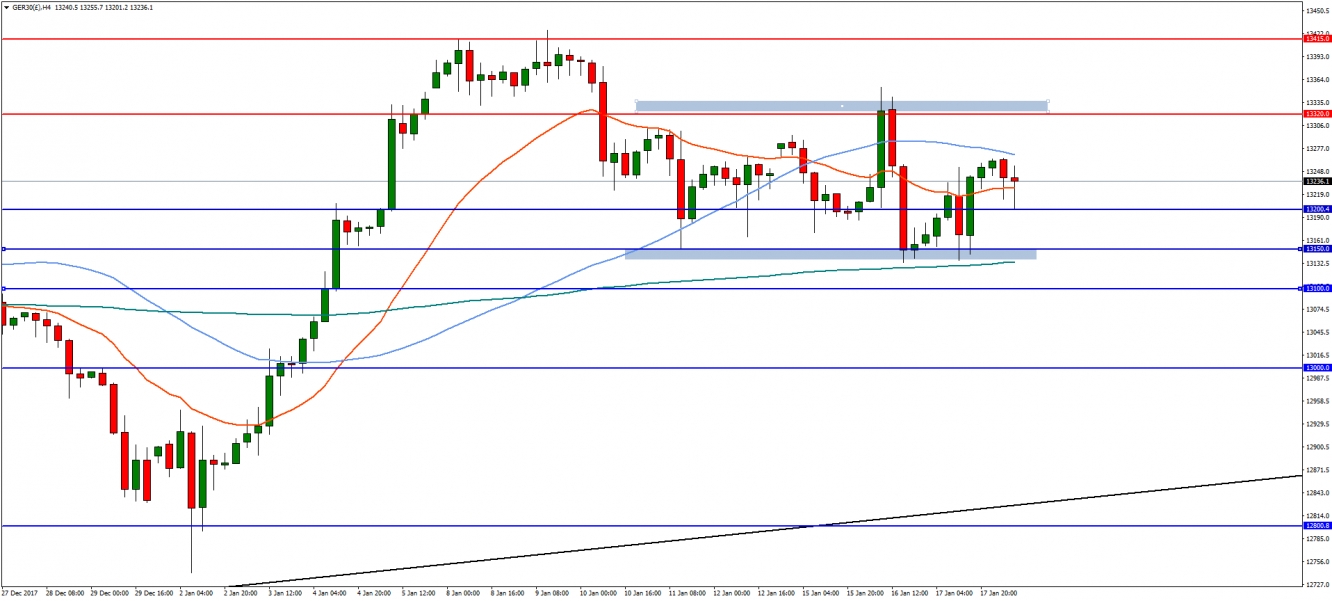

In the 4-Hourly timeframe, the German index is continuing to trade in a range between 13320 and 13150. Near-term support can be found at 13200. A clear break above highs at 13320 is needed for an attempt to achieve new all-time highs. Alternatively, a break below support at 13150 would see another leg lower with initial support at 13100.