Investing.com’s stocks of the week

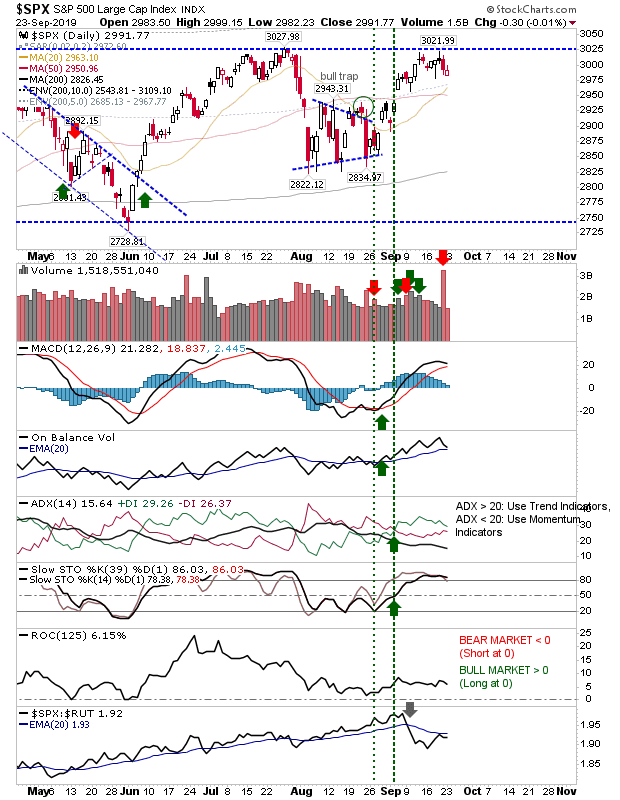

There wasn't a whole lot to yesterday's action aside from reaffirming the consolidation in lead indices. Trading volume returned to normal after Friday's Triple Witching.

For the S&P there was a bullish cross between the 50-day MA and 20-day MA as the narrow consolidation near resistance stretched into a second week.

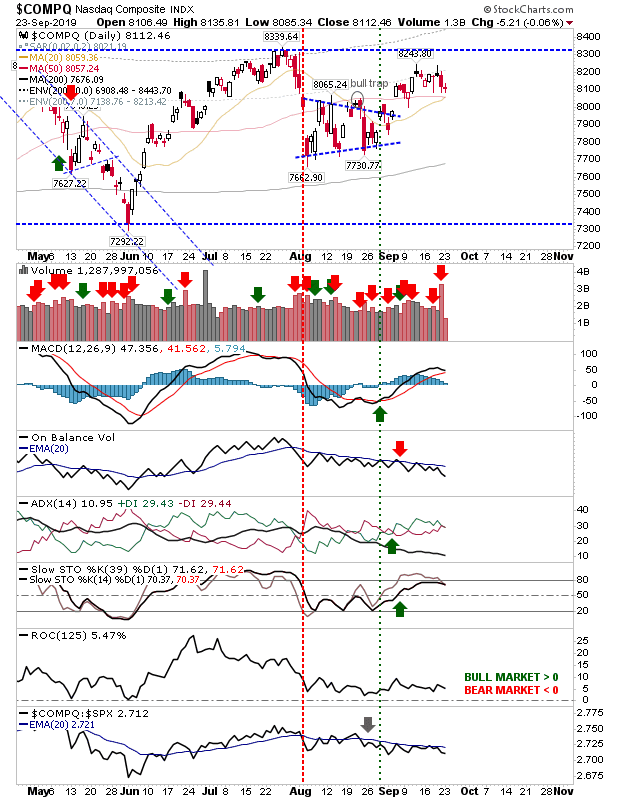

The NASDAQ experienced a narrow range day—again, just above converged 20-day and 50-day MAs. I'm liking this for a bounce, but my comments around 52-week high and lows from yesterday remain.

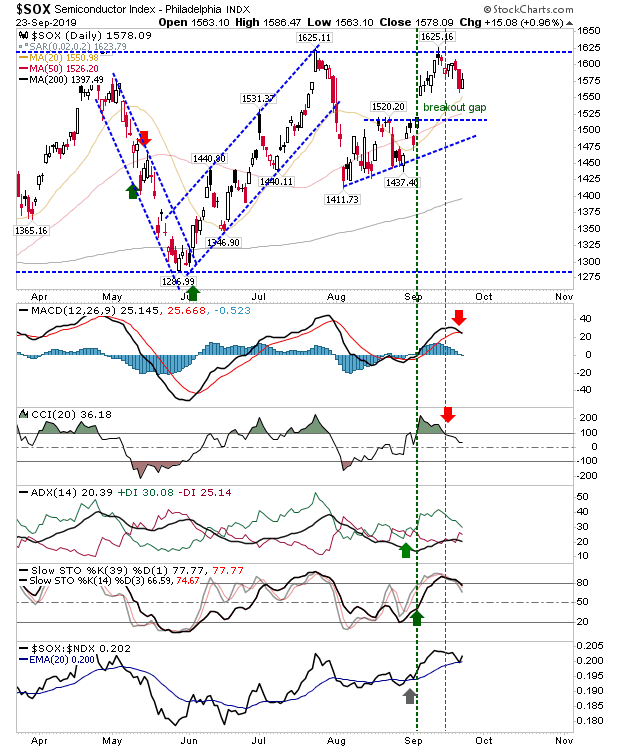

However, the Semiconductor Index looks ready to help in the short term. A new MACD trigger 'sell' adds another tick in the bear column, but price action looks like it's setting up for an upside breakout.

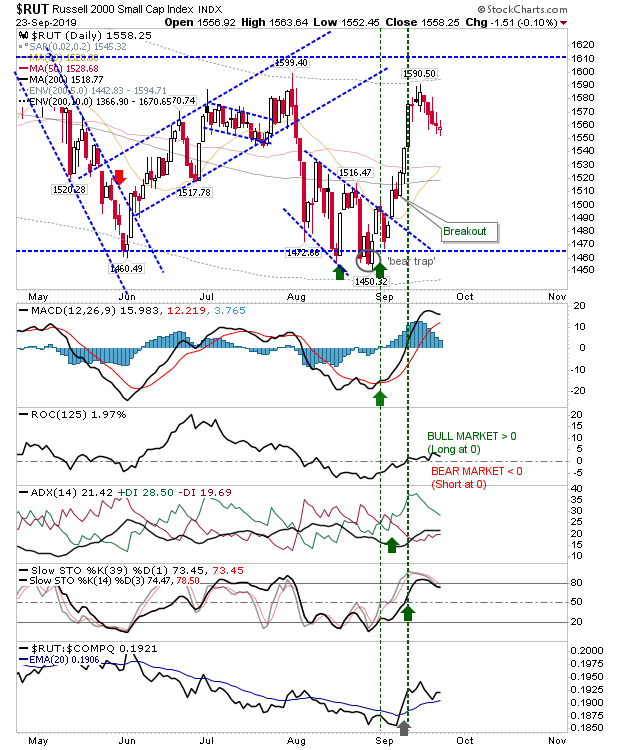

The Russell 2000 experienced a fifth day of losses in a row but it's all very narrow and the majority of gains were retained.

For today, we won't want to see big losses, but if there aren't gains then volume should be light. Looking for positive action but no need to read too much into it.