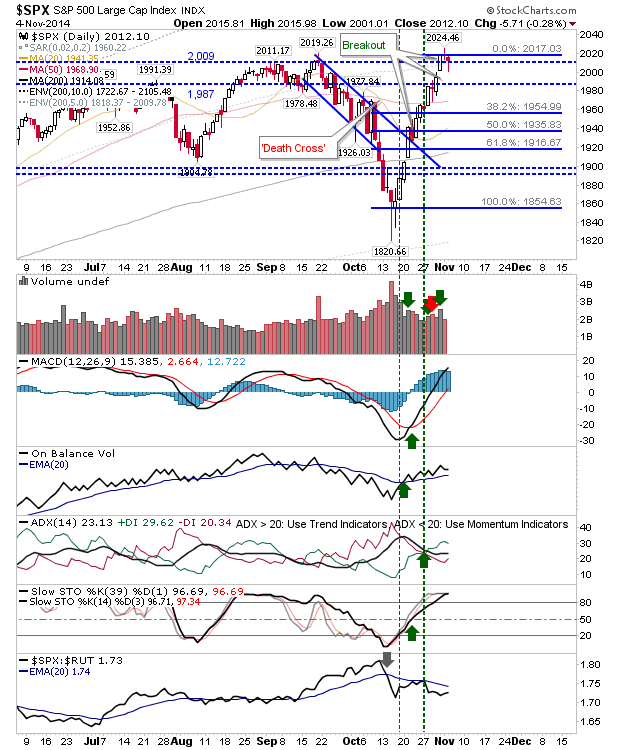

Yesterday looked a lot more bearish on an intraday chart than it did on the daily chart. For example, the daily chart in the S&P 500 closed with a bullish hammer, but as with any candlestick, a bullish candlestick is considered bullish in an oversold candle - and this is not an oversold market. However, the rally did enough to maintain a close above 2,009.

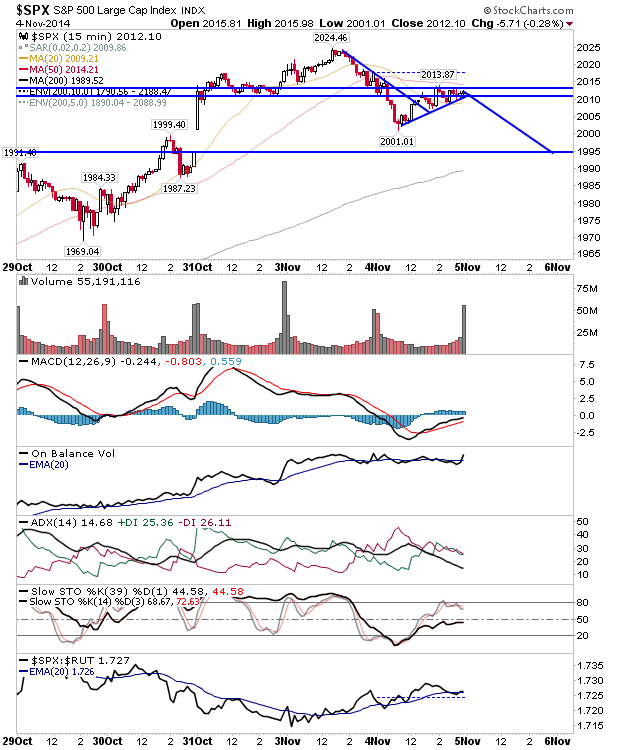

On the intraday S&P chart, there was a rejection of the 2,010-2,012 level and 20-period MA, but there was support at the 50-period MA: these two MAs are converging and will resolve one way or the other today. A measured move down takes it back to 1,995.

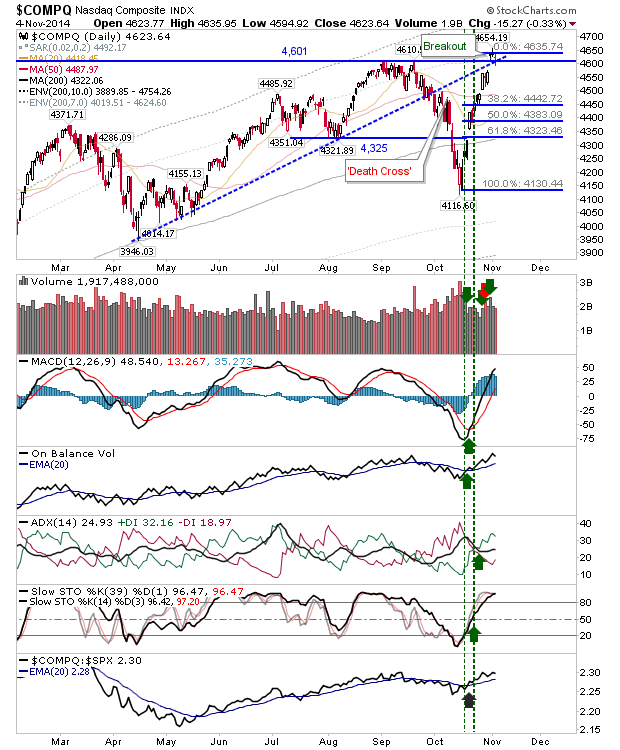

The NASDAQ is also holding breakout support of 4,623. However, my preference is still toward a pullback into fib retracements.

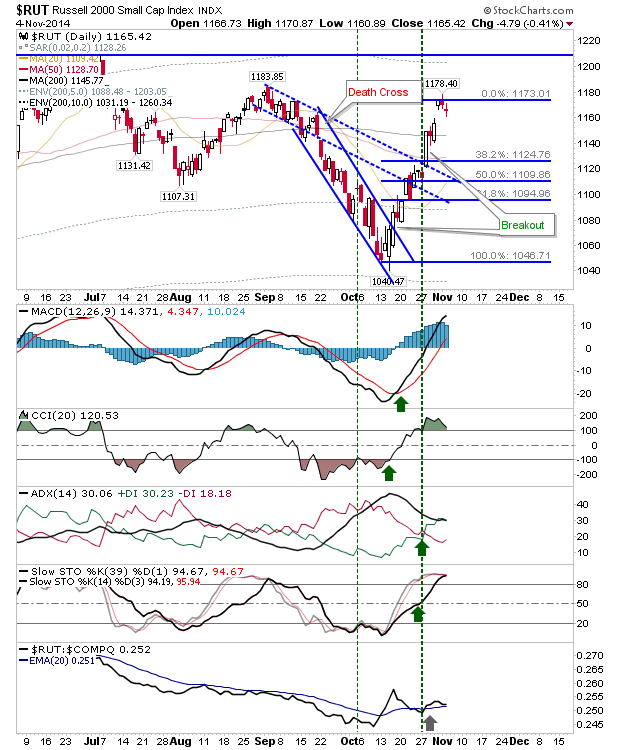

The Russell 2000 hasn't a breakout to protect, but it will have the 200-day MA to lean on. What makes it more difficult is a flat-line in the 200-day MA, which lacks the direction to help determine direction of the next move.

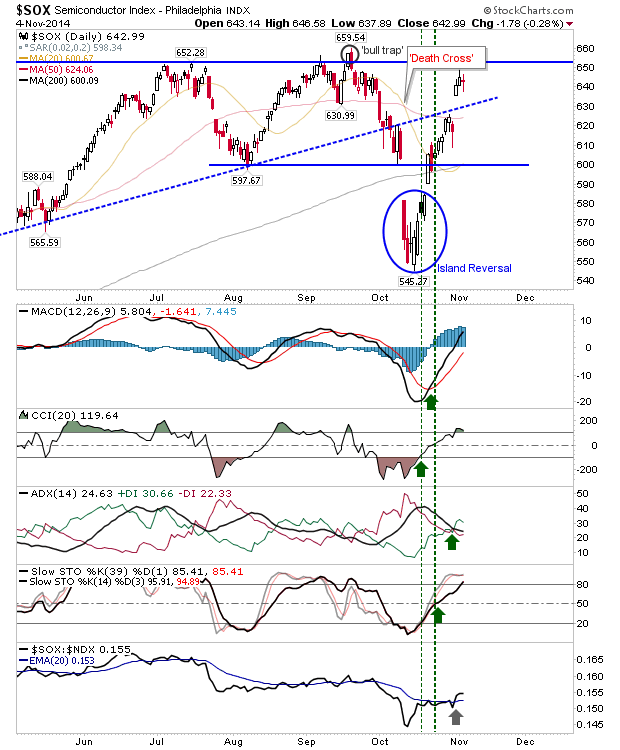

The Semiconductor Index is also working towards resistance and a challenge of the 'bull trap'. If it can do this it will help the NASDAQ with its rally.

For today, look for bearish action in the first hour. However, if buyers make an early appearance it could turn into a very good day for bulls given the lack of overhead resistance.