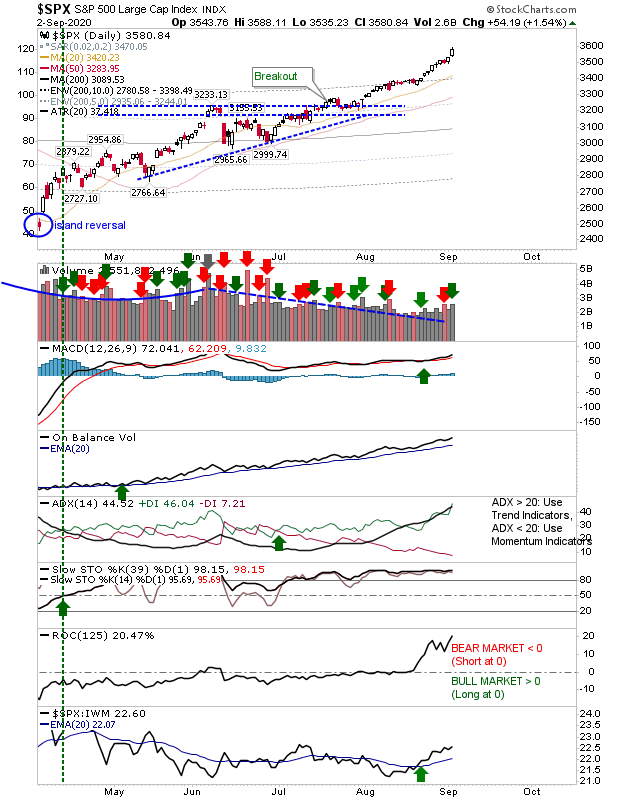

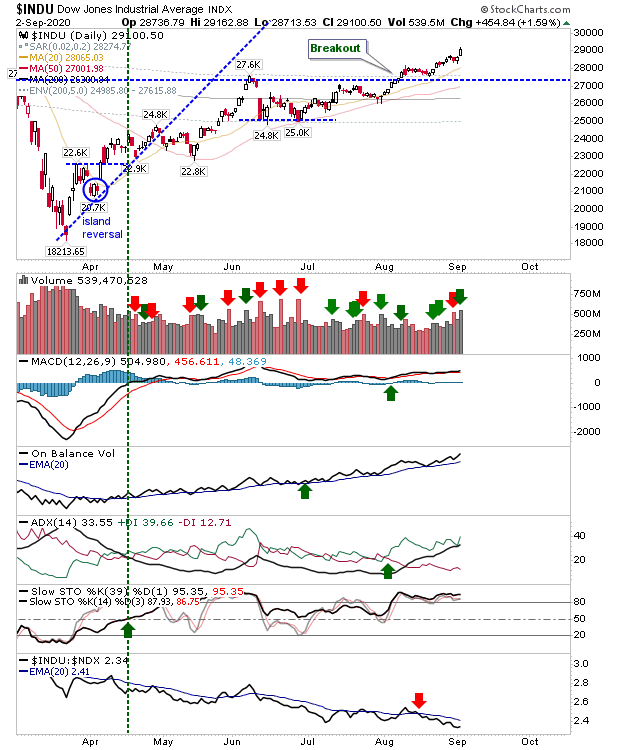

After weeks of small gains it was Large Caps in the form of the S&P and Dow Jones Industrials which both posted stronger gains. Large Caps posted gains on higher volume accumulation with strong relative performance against Small Caps.

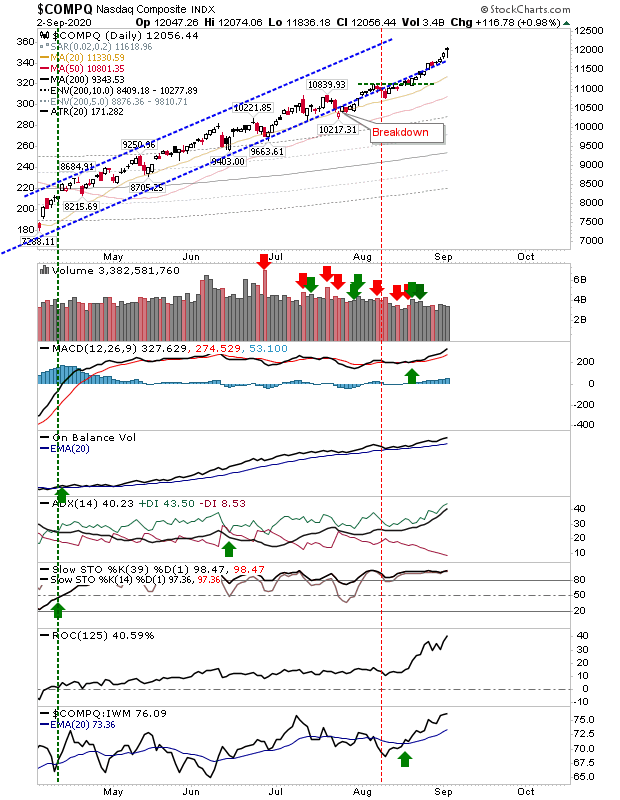

The NASDAQ had been the lead index in recent weeks, but it took a step back yesterday compared to its peers. As a result, there was no supporting accumulation to go with Wednesday's gain. In addition, the doji finish marked a balance between buyers and sellers—which after an extended rally is bearish.

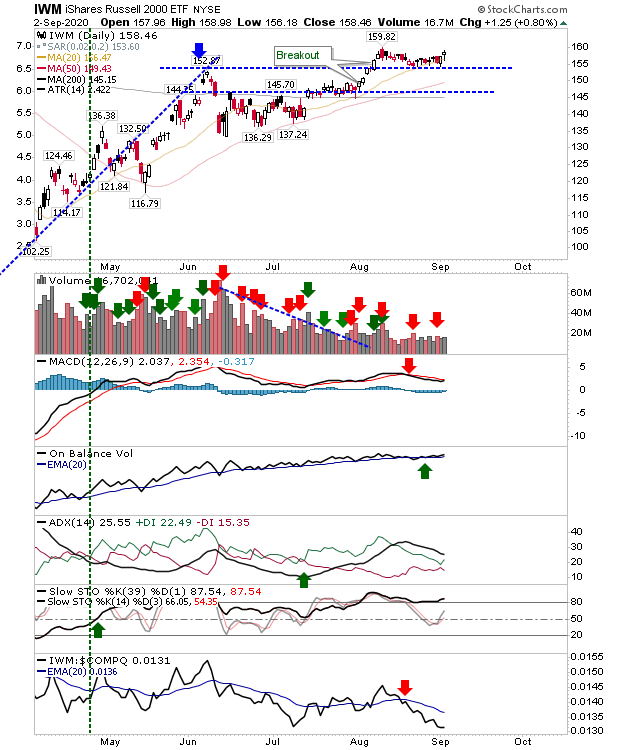

The Russell 2000 (via IWM) hasn't quite kicked on in the same way as other indices as appetite for Small Cap stocks dropped (light volume), but it has maintained a support level and despite relative performance weakness it offers the best risk:reward of the lead indices for buyers.

With yesterday's gains in Large Caps, the S&P now sits at 15.8% above its 200-day MA, which means it's now at the 5% zone of historic price action, joining the NASDAQ in a similar situation. Historically, when an index has outperformed 95% of historic action it is ready for a new downleg. If not this month or next, then by November (election result?), we could be looking at a next major move down. Buyer beware.