It is easy to sit here in middle America and think about foreign markets without distinction. The German market, the Japanese market, the Brazilian market. There are ETF’s to trade each of them and many other countries. In the US we get a lot more granular. There are 4 major indices used to carve up the market into sectors. the Dow Jones is the large cap industrials. The S&P 500 is the broad large caps. The Nasdaq 100 the technology and leading edge healthcare stocks, and the Russell 2000 the small caps.

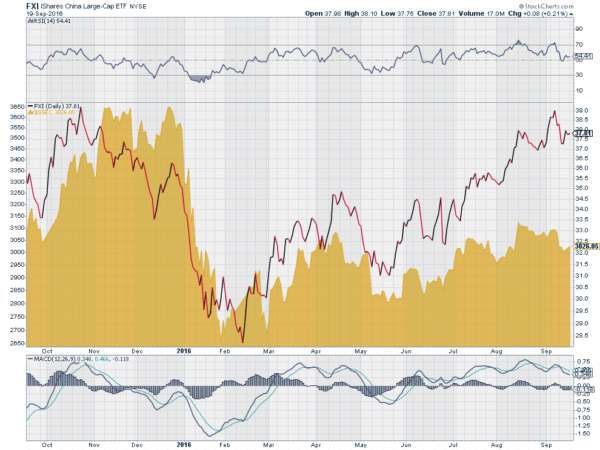

So why is it that there is not this kind of segmentation in the foreign markets? Well of course there is. It is just not visible to the outsider looking at the biggest broadest index. One market does give us that distinction. The Chinese market. For a US investor there is an ETF that mirrors the broad based Shanghai Composite (Deutsche X-trackers Harvest CSI 300 China A-Shares (NYSE:ASHR)) and another ETF that looks at the large cap Chinese stocks (iShares China Large-Cap (NYSE:FXI)). The chart below compares them.

The chart shows the large Cap FXI as the red and black line and the Shanghai Composite as the yellow area. You can see they are highly correlated, as you would suspect. But taking a closer look at the recent move higher in the FXI since May shows a break in the correlation, or rather an out-performance, of the large Caps. The FXI is up over 22% from the May 19 low. The Shanghai Composite is up only 7%. Large Caps are leading the Chinese market back up off of there lows.

As the Chinese market made new highs in 2015 the opposite was true, the broad market lead the large Caps. Will this continue? Does this make the Chinese market recovery more sustainable? Time will tell.

One thing to consider is that these large Cap companies are the ones tied most to the government in support and funding. For a country that is said from the outside to be in need of an economic recovery that is where one would expect to see leadership. When that changes the all clear signal may sound.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.