Investing.com’s stocks of the week

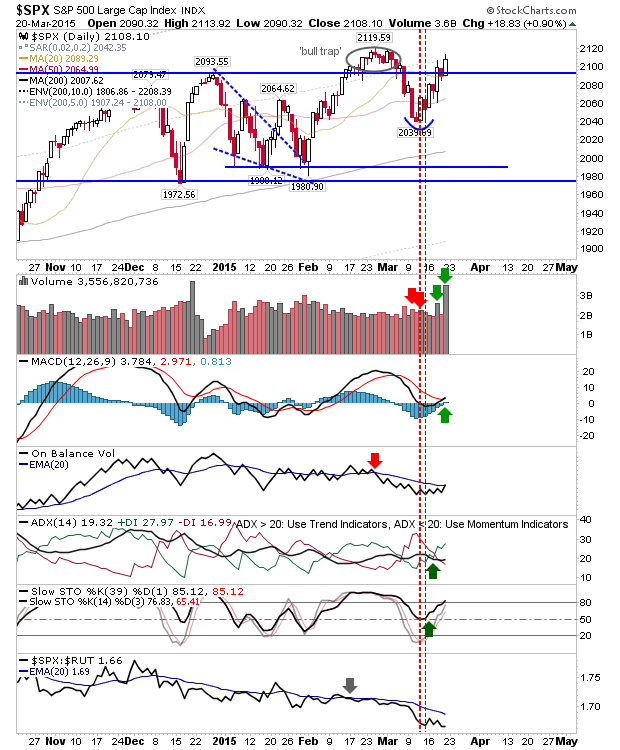

Friday's solid gains helped push both the Dow Jones and S&P 500 into challenges of their respective 'Bull Traps'. The big volume surge also marked a strong accumulation day for both indices. In the case of the S&P 500, there was a MACD trigger 'buy', but not quite an On-Balance-Volume 'buy' trigger, with which to work with.

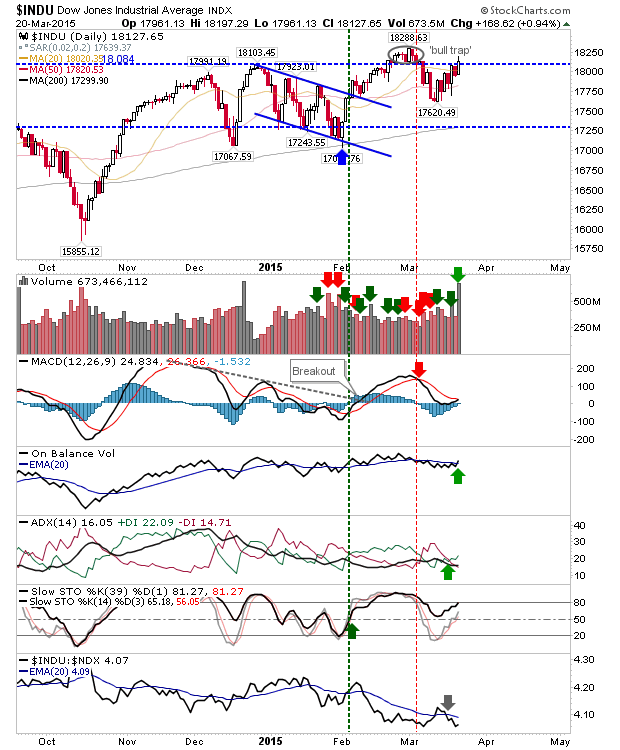

The Dow Jones Industrial Average hasn't quite generated a MACD trigger 'buy', but it did manage an On-Balance-Volume 'buy' signal.

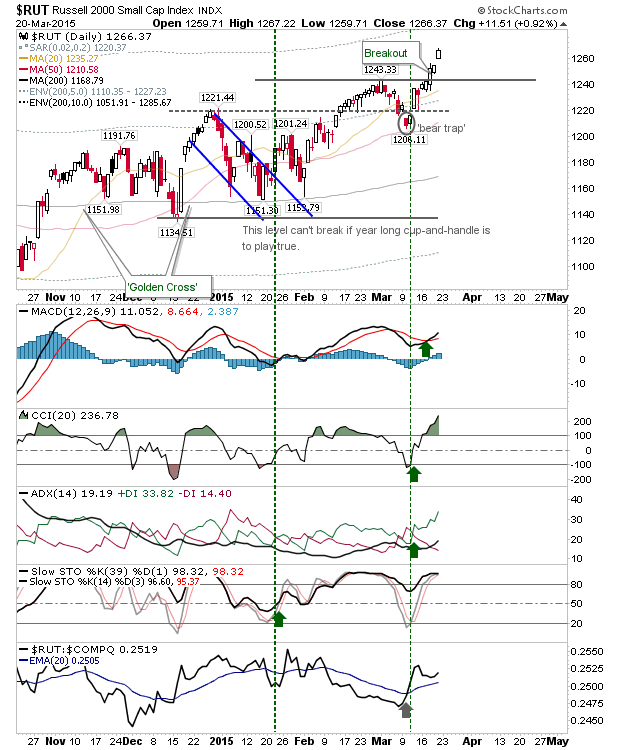

The Russell 2000 isn't having any such worries. Small Caps gapped higher and closed near highs. The index has plenty of wiggle room to nearest support.

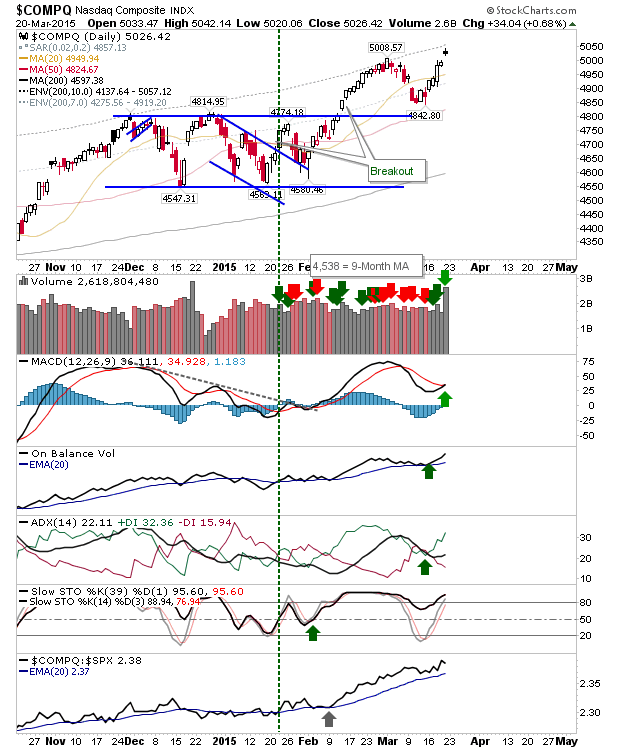

The NASDAQ Composite gapped higher and finished at a new high. However, it wasn't able to build off the opening gap, although it's coming close to tagging the 10% envelope (from the 200-day MA) and technicals returned net bullish.

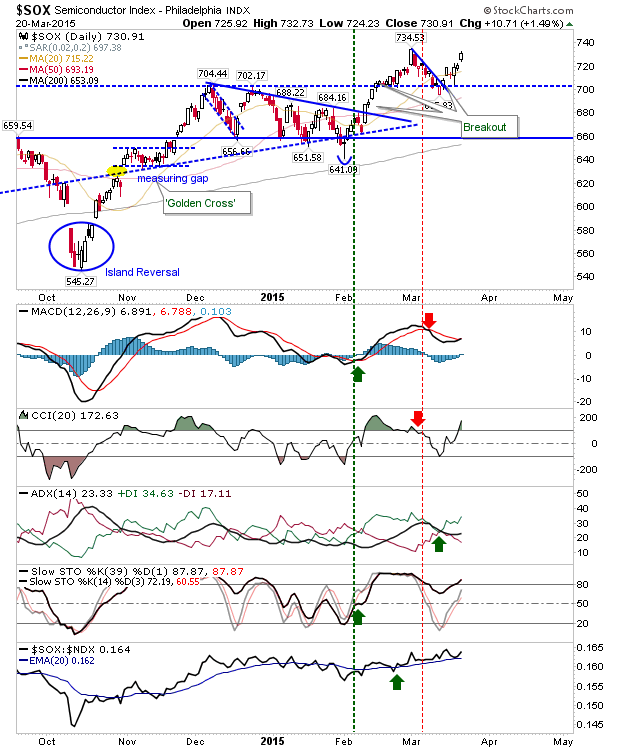

The Semiconductor Index was able to do a little better, although it finished just shy of a new high. Aside from the Russell 2000, this has been (for me) one of the star performers over the last 6 months.

This week is likely to be about consolidation for the Russell 2000 and breakouts for the S&P 500 and Dow. Tech indices are caught a little in the middle, so it will likely take a few days to determine what may be next in store for them.