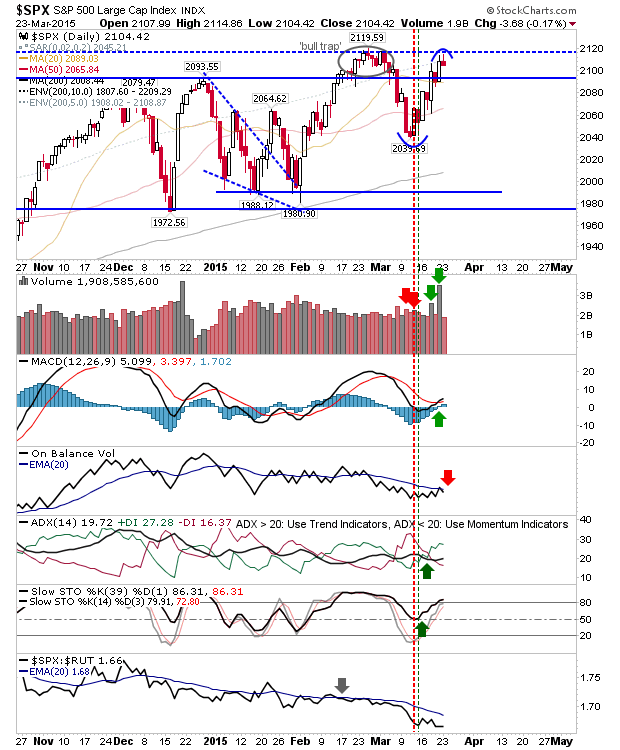

There was a small loss in the indices yesterday as Friday's gains consolidated. The S&P closed with a tweezer top, which is a reasonable marker for a bearish (and potentially trade-worthy) reversal. There are zones of support which will stall any decline, but for today, look for follow-through losses.

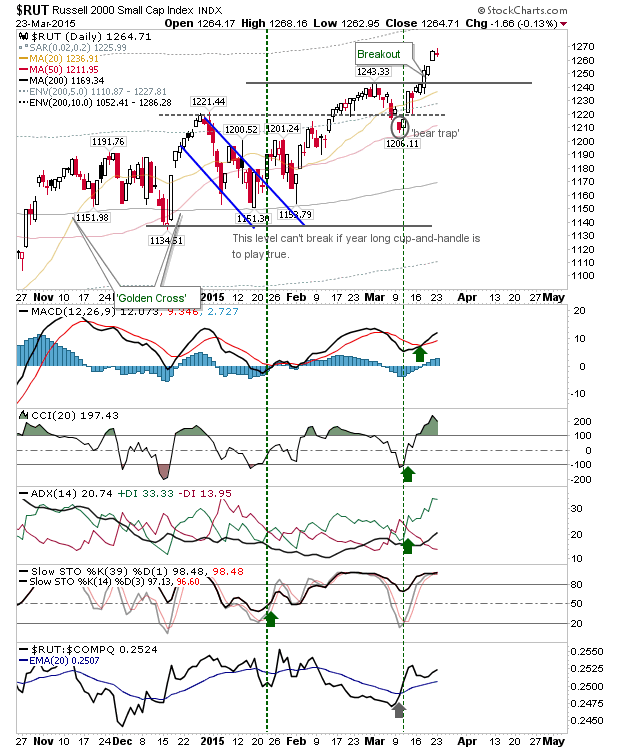

The Russell 2000 closed with a bearish harami cross yesterday which, given what's gone before, is a reasonable marker for a near term top. There are no guarantees on this, but the risk:reward is good for a move to retest 1243.

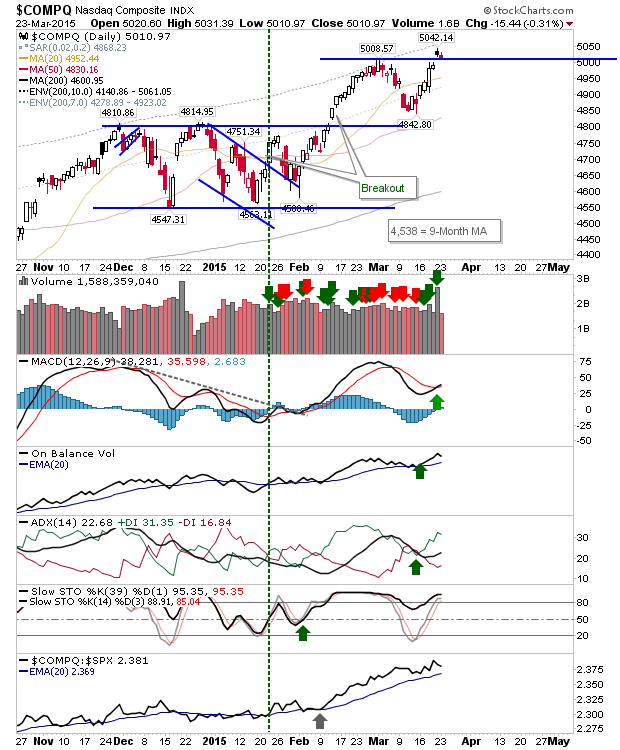

The NASDAQ closed lower, but has managed to find support at 5008, which was the last swing high. There is also a MACD trigger 'strong buy' to work with too.

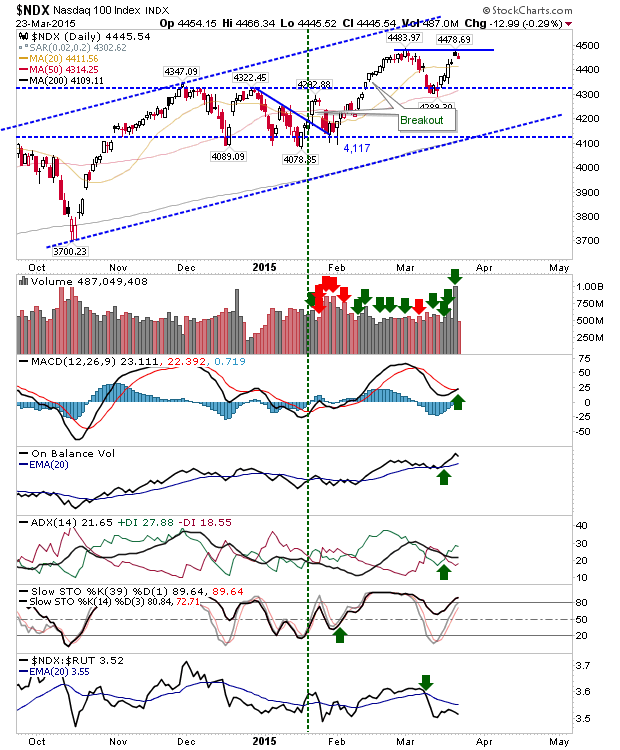

The Nasdaq 100 finished below the past swing high, but did manage a MACD trigger 'strong buy'. A move back to 4340 would appear preferable at this point, and there is a risk of a double top.

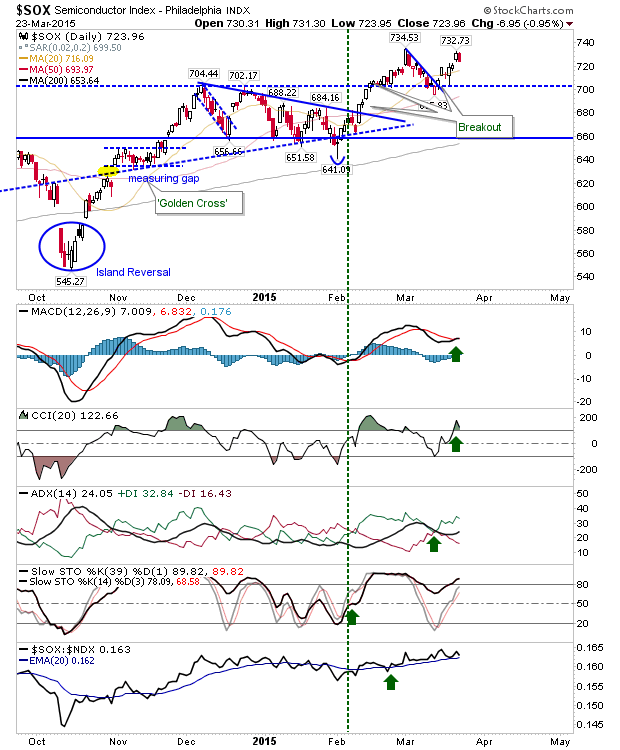

The Semiconductor Index also edged a MACD trigger 'buy', but is at risk of a double top.

For today, look for expansion on yesterday's weakness across indices, but any decline will quickly encounter support.